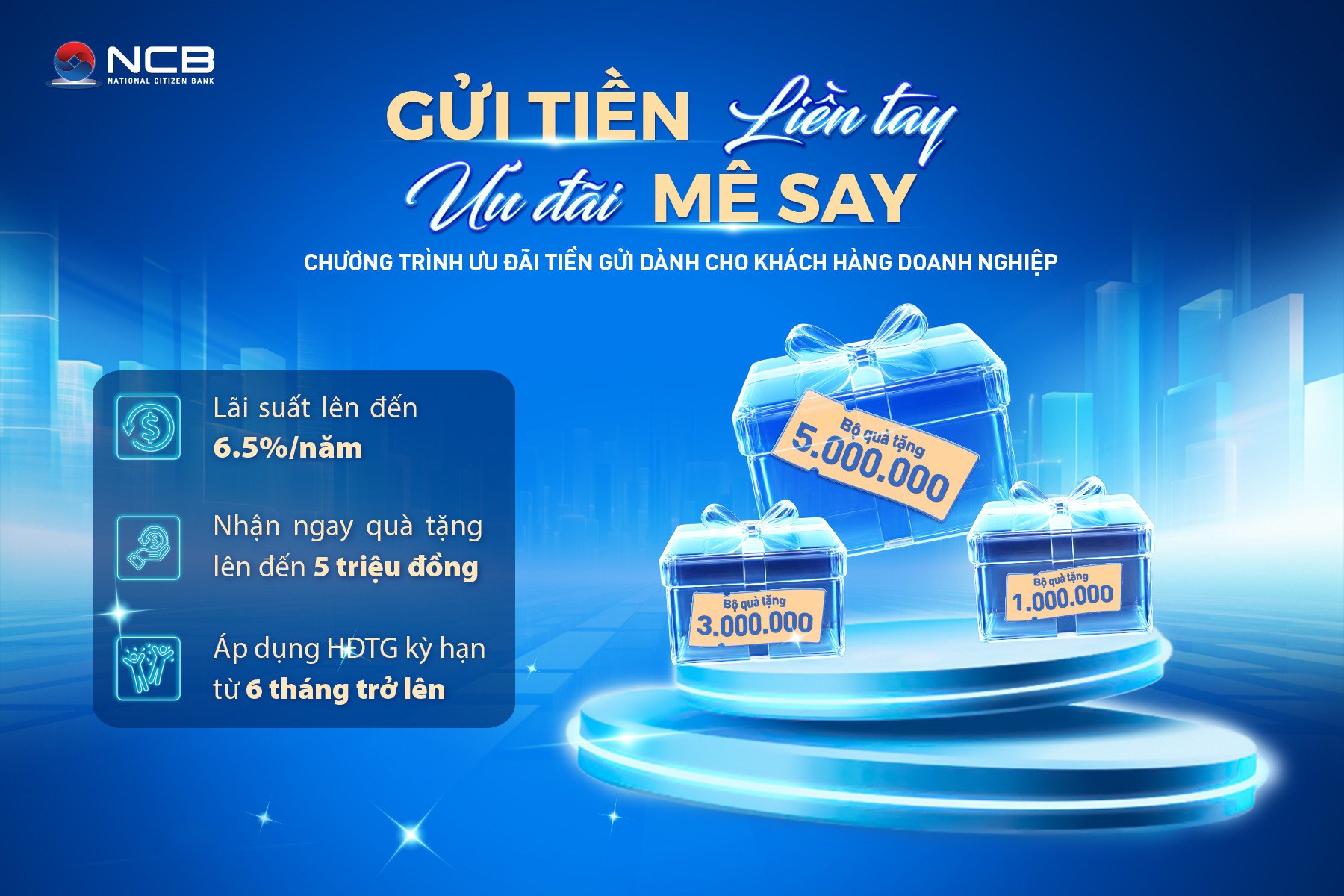

Optimize idle cash flow - receive luxurious gifts with NCB

According to the latest data from the State Bank, corporate deposits at credit institutions increased again in May 2025, after many months of decline. In the first 5 months of the year, the total balance of corporate deposits at credit institutions reached more than 7.7 million billion VND, an increase of 0.97% compared to the end of 2024. This development clearly reflects the trend of businesses shifting to safe investment channels, prioritizing capital preservation in the context of market fluctuations.

In fact, for small and medium-sized enterprises, optimizing idle cash flow is always a priority. Instead of risking investment in high-profit but potentially risky channels, many enterprises choose to deposit money for a term at the bank - a financial solution with stability, reasonable interest rates, flexible liquidity, suitable for medium and long-term plans.

Grasping the market demand, many commercial banks have launched incentive programs specifically for corporate customers opening deposit contracts. In particular, National Citizen Commercial Joint Stock Bank (NCB) offers flexible deposit solutions with competitive interest rates and high-class gifts, suitable for each business scale.

Specifically, from August 1, 2025, businesses depositing money for a 6-month term at NCB will enjoy an attractive interest rate of 6.12%/year. With a longer term, the interest rate is even more attractive: 6.5%/year for a term of 12 months or more. This is a stable profit level, helping businesses proactively manage capital while still ensuring investment efficiency.

In particular, NCB offers practical, highly aesthetic gifts as a thank you to businesses. Accordingly, when opening a deposit contract of 3 billion VND, with a term of 6 months or more (or 180 days for flexible date deposit products), businesses will immediately receive a high-class suitcase gift worth 1 million VND, suitable for short business trips. With a contract value of 5 billion VND, NCB gives businesses a high-class tea set worth 3 million VND, elegantly designed for important receptions.

In particular, businesses that deposit 10 billion VND or more will immediately own a Chu Dau ceramic fortune vase with hibiscus motifs and sophisticated gold painting worth 5 million VND. The gift carries deep cultural and aesthetic values, not only creating a subtle highlight for the office space but also symbolizing luck and prosperity for the business.

Sustainable companionship with Vietnamese enterprises

The term deposit incentive program is one of the efforts that NCB has implemented to accompany businesses in financial management and effective operations.

With an innovative, creative mindset and a spirit of continuous improvement, in recent years, NCB has continuously invested in upgrading infrastructure, technology solutions and promoting digital transformation to optimize customer experience. NCB has upgraded the NCB iziBankbiz digital banking platform exclusively for institutional customers, with two flexible versions: Internet Banking on browser and iziMobiz application on phone, focusing on optimizing user experience, enhancing security and efficiency of financial operations for businesses.

The bank also promotes credit development in a specialized direction: from financing products for distributors in the fast-moving consumer goods (FMCG) sector, unsecured loans up to 10 billion VND; credit solutions for enterprises implementing bidding packages with capital from the state budget/ODA with a guarantee deposit rate of only 0%, to granting credit to enterprises in industrial zones based on property rights from land lease contracts. Each solution is optimized in a flexible and practical direction, to support enterprises to proactively manage capital flows at each stage of development.

With flexible solutions, closely following practical needs and long-term commitment, NCB is affirming its role as a reliable partner of Vietnamese enterprises. At the same time, it contributes to bringing the Government and banking sector's policies to support production and business into life, promoting the development of the economy , creating a foundation for more stable and sustainable growth in the future.

For more information about NCB products and services, contact:

NCB transaction offices/branches nationwide

Hotline (028) 38 216 216 - 1800 6166.

Le Thanh

Source: https://vietnamnet.vn/doanh-nghiep-toi-uu-tai-chinh-voi-uu-dai-gui-tien-tu-ncb-2439164.html

![[Photo] Colorful Mid-Autumn Festival in Hanoi's Old Quarter](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/08ab35901a8f4a41af7f1ba1ef35380e)

Comment (0)