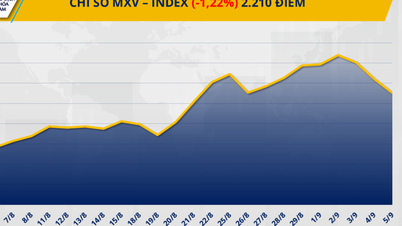

| Commodity market today September 11: After a positive session, world raw material prices continue to reverse Commodity market today September 12: Strong buying power returns to the market, pulling the MXV-Index back to recovery |

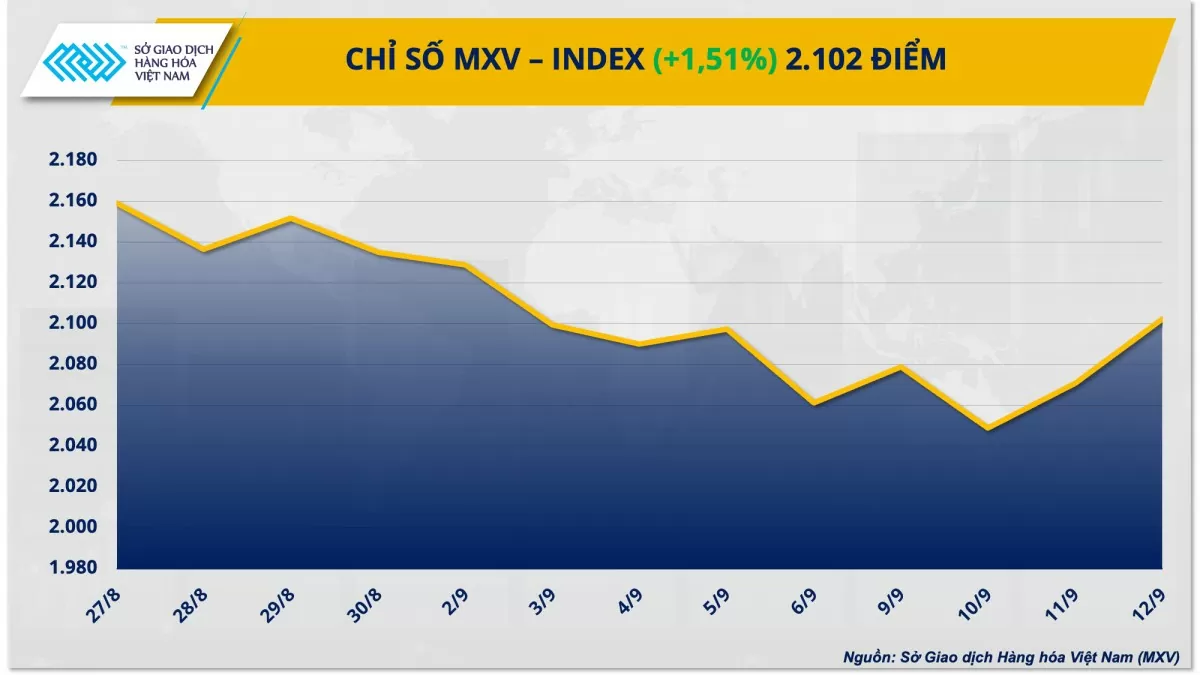

At the close of the session on September 12, the MXV-Index increased by 1.5% to 2,102 points. Notably, the price list of the energy and metal groups was bright green. In particular, the world oil price extended its increase to the second session in the context of production activities in the US Gulf of Mexico region being heavily affected by Hurricane Francine. Silver price also had the strongest increase since mid-June this year when it broke out more than 4% to a record high in the past two months.

|

| MXV-Index |

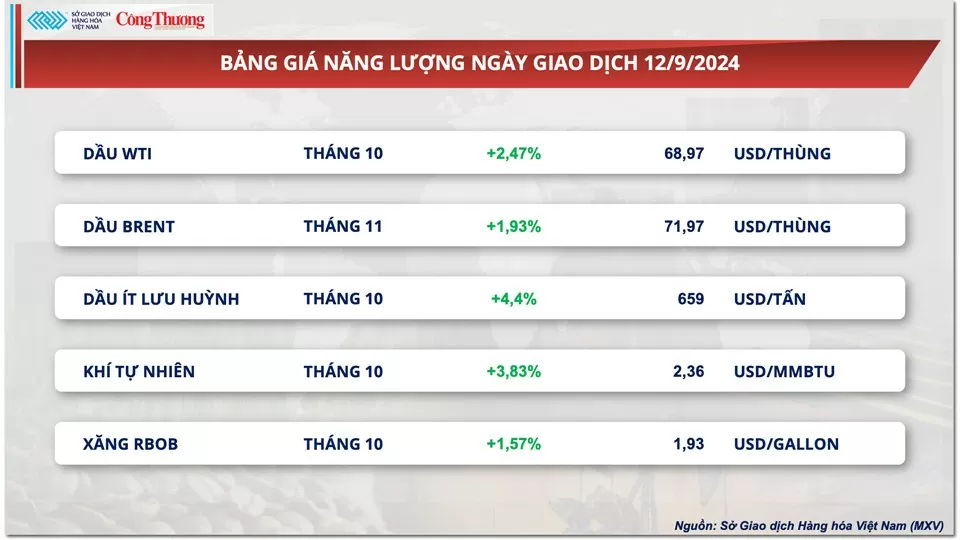

World oil prices continue to rise due to the impact of hurricane Francine

World oil prices extended their recovery into the second session as crude oil production in the US Gulf of Mexico continued to be heavily affected by Hurricane Francine. At the end of the trading session on September 12, WTI crude oil increased by 1.66 USD, equivalent to 2.5%, closing at 68.97 USD/barrel. Brent crude oil prices increased by 1.9% to 71.97 USD/barrel.

|

| Energy price list |

According to the US Bureau of Safety and Environmental Enforcement, the total supply affected in the US Gulf of Mexico after Hurricane Francine made landfall in this area has reached 730,000 barrels/day, accounting for about 42% of the total crude oil production in the region. UBS analysts estimate that the average production from the Gulf of Mexico this month will decrease by about 50,000 barrels/day. However, the impact of Hurricane Francine is likely to be short-lived, with production in this area soon restored.

Meanwhile, the dispute in Libya has not been resolved despite previous efforts, raising concerns that supplies in the country will be further halted. The UN mission to Libya said that Libyan factions have failed to reach a final agreement in talks to resolve the central bank crisis that has cut oil production and exports. Libyan oil exports fell by 81% last week as the National Oil Corporation canceled shipments, according to Kpler data.

The green color in the market also received support from the decision to cut interest rates by the European Central Bank (ECB). Specifically, the ECB decided to lower interest rates by 25 basis points, bringing the Eurozone deposit base rate down to 3.5%. The ECB's move made the market believe in a similar decision from the US Federal Reserve (FED) at the meeting taking place next week.

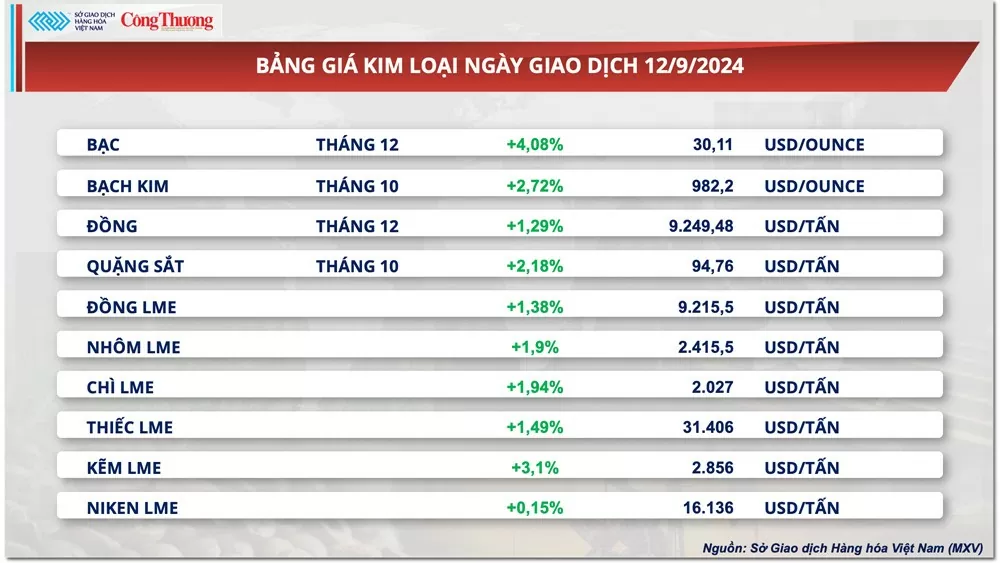

Silver prices have the strongest increase since June

According to MXV, the strong cash flow into the metal market continues to support all commodities to increase in price. At the close yesterday, the metal market had its second consecutive positive session. For precious metals, silver prices jumped more than 4% to 30.1 USD/ounce, the highest level in the past two months. This is also the strongest increase in silver prices since mid-June this year. Platinum prices increased more modestly, increasing 2.72% to 982.2 USD/ounce, the highest level in a month and a half.

|

| Metal price list |

Precious metal prices continued to be supported after the US released economic data that reinforced the case for a rate cut next week. Specifically, according to the US Department of Labor's Bureau of Labor Statistics, the US producer price index (PPI) and core PPI increased 1.7% and 2.4% year-on-year in August. Both figures were 0.1 percentage points lower than forecast, reflecting faster-than-expected factory inflation. In addition, the US Department of Labor also said that the number of unemployment claims last week increased by 2,000 to 230,000, surpassing the market forecast of 227,000.

Adding to the support, yesterday the European Central Bank (ECB) decided to lower interest rates to 3.5% from 3.75%, marking the second consecutive rate cut by the bank. This move by the ECB has increased confidence that the FED will make a similar move at its important meeting next week.

For base metals, all commodities recorded a steady increase of 1-2%. Of which, COMEX copper prices increased for two consecutive sessions with an increase of 1.29% to 9,249 USD/ton, the highest level in two weeks. Iron ore prices also increased to the highest level in more than a week thanks to a 2.18% increase to 94.76 USD/ton. The prices of these two commodities have been recovering in recent sessions mainly due to expectations of increased consumption as China enters its peak consumption season. September - October is considered the peak period for metal consumption in this country, as this is the "golden time" for year-end construction activities.

In addition, the recent sharp decline in prices of these two commodities has further prompted downstream factories to accelerate stockpiling activities, especially to serve production during the upcoming Mid-Autumn Festival and National Day holidays.

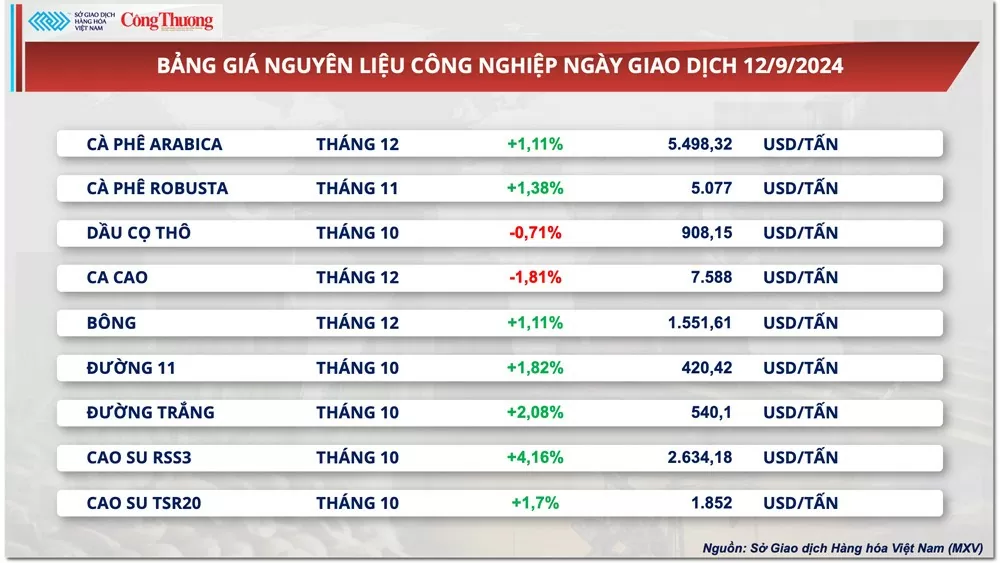

Prices of some other goods

|

| Agricultural product price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-139-dong-tien-dau-tu-chay-manh-vao-thi-truong-nang-luong-va-kim-loai-345593.html

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)