Only 54.5% of the estimate was collected in 9 months.

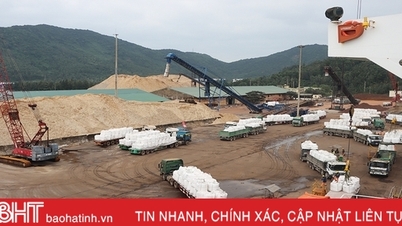

Vung Ang – Son Duong port cluster is one of the key national seaports and an important revenue source for Ha Tinh province. Each year, this area contributes more than 80% of the total import-export tax revenue of the whole province.

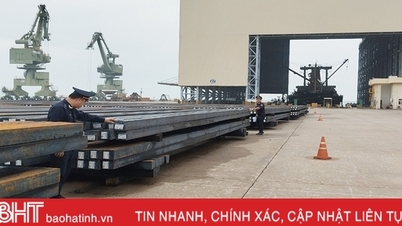

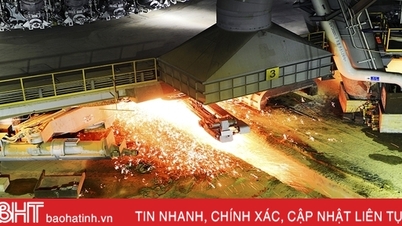

Mr. Nguyen Dinh Binh, Deputy Head of Vung Ang Port Customs, said: “Although there are many potential advantages, the infrastructure and logistics services around the Vung Ang - Son Duong port cluster have not yet developed synchronously, affecting the attractiveness of businesses and causing difficulties in budget collection. Currently, the unit's import and export tax revenue mainly depends on Formosa Ha Tinh Steel Corporation. When this enterprise adjusts its import plan or reduces production output, it will directly affect the budget revenue. In addition, many items are exempted or reduced from tax according to preferential policies and international commitments, reducing the unit's revenue.”

In order to increase budget revenue, in recent times, Vung Ang Port Customs has made efforts to facilitate import and export activities to attract businesses to open declarations. In the first 9 months of the year, the unit has called for 6 more businesses to conduct import and export activities, increasing the cumulative number of businesses operating in the area to 74 units. Of which, there are 5 typical businesses contributing large import and export tax revenues: Hung Nghiep Formosa Ha Tinh Iron and Steel Company Limited; Vung Ang II Thermal Power Company Limited; VG High-Tech Energy Solutions Company Limited; East Sunpply Project Company Limited; Giang Nam Petroleum Company Limited...

Up to now, Vung Ang Port Customs has opened 3,820 declarations (up 10% over the same period in 2024) with a total import-export turnover of more than 2,716 million USD. Thereby, the unit collected nearly 4,700 billion VND in budget revenue, reaching 54.5% of the assigned estimate for 2025 and down 25% over the same period in 2024.

Although the number of declarations increased, the turnover and budget revenue still decreased, showing that the structure of import and export goods tends to shift towards price reduction; many items are subject to tax exemption and reduction. This reflects the heavy dependence on a few key enterprises and shows that the stability of revenue sources is not high. With the current results, Vung Ang Port Customs is facing the risk of not completing the budget revenue target in 2025.

Sprint break

Facing the pressure of budget collection in the last 3 months of the year, Vung Ang Port Customs has proactively coordinated with related units such as the Provincial Economic Zone Management Board, the Department of Finance, Ha Tinh Provincial Tax... to grasp the implementation situation of new projects in the area to call on businesses to open declarations.

The unit also works specifically with large enterprises operating in the area to proactively grasp production and business plans and promptly remove difficulties and problems arising during customs clearance.

Mr. Tran Xuan Hau - Representative of SAS Vung Ang Logistics Co., Ltd. said: "On average, the company completes customs clearance procedures from 15 to 20 declarations per day. Previously, when businesses completed declarations on the electronic system, they had to wait for customs leaders to assign staff to process, so the time was longer. However, now, with the smart automatic customs clearance process, this administrative step has been reduced, helping our businesses shorten time and save costs."

At this time, Vung Ang Port Customs always arranges 24/24 hours of staff and civil servants on duty to carry out customs clearance procedures for businesses, ensuring that goods are processed quickly and are not left behind, especially during peak periods. Along with that, the unit synchronously deploys solutions to collect tax debts, ensuring that all revenue sources must be collected correctly, fully and promptly into the State budget; focusing on preventing revenue loss through checking taxable values, classifying and applying tax rates, especially for goods with high tax rates and large import-export turnover; strengthening inter-sectoral coordination mechanisms to prevent, inspect and detect acts of trade fraud; focusing on drastically implementing anti-smuggling topics.

From now until the end of the year, on average, each month, Vung Ang Port Customs must collect more than 1,300 billion VND. This is truly an extremely difficult and challenging task. Each month, the unit makes a detailed plan to ensure the progress is on schedule. In particular, the key solution that the unit focuses on promoting is to contact, support, promptly resolve difficulties and obstacles and remove them appropriately for each enterprise. With high political determination, Vung Ang Port Customs will synchronously deploy solutions to strive to complete the task at the highest level.

Mr. Le Dung - Captain of Vung Ang Port Customs

Source: https://baohatinh.vn/giai-phap-then-chot-nang-cao-hieu-qua-thu-ngan-sach-tai-vung-ang-post296677.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)