With an increase of about 0.5% for the week, this week's oil price has extended its upward trend to the 7th consecutive week. Brent crude oil price ended the week at 86.81 USD/barrel.

World oil prices

Oil prices ended the week up less than 50 cents after the International Energy Agency (IEA) forecast record global demand and tight supplies. Oil prices rose for the seventh consecutive week, the longest streak since 2022, according to Reuters.

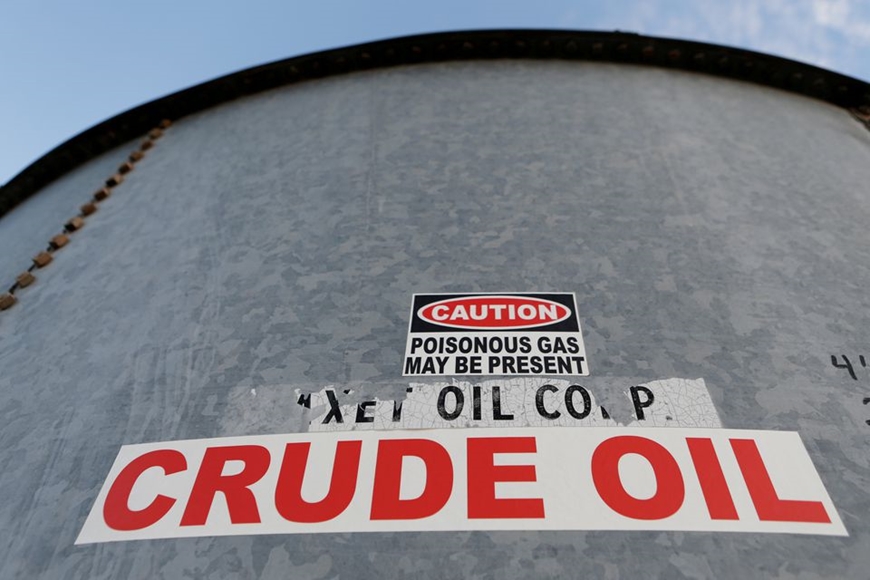

|

| The modest increase for the week still helped gasoline prices increase for the 7th consecutive week. Illustration photo: Vanguardngr |

Brent crude futures rose 41 cents, or 0.5%, to $86.81 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 37 cents, or 0.5%, to $83.19 a barrel. Both benchmarks rose about 0.5% for the week.

The IEA estimates global oil demand hit a record 103 million barrels per day in June and could hit a new peak this month, Reuters reported.

Meanwhile, voluntary production cuts by Saudi Arabia and Russia have set the stage for a sharp drawdown in inventories in the remaining months of 2023, which the IEA said could push oil prices higher.

OPEC said on August 10 that it expects global oil demand to grow by 2.44 million barrels per day this year, unchanged from its previous forecast. The oil market outlook also looks good for the second half of the year, OPEC said.

In addition, this week's US economic data also lifted market sentiment, fueling expectations that the US Federal Reserve (Fed) is about to end its aggressive rate hikes. Since March last year, the Fed has increased its benchmark overnight interest rate by 525 basis points to the current range of 5.25% - 5.5%.

Supply cuts and an improving economic outlook have created more optimism among oil investors, said OANDA analyst Craig Erlam. However, he noted signs of waning momentum after a prolonged rally. Brent crude hit its highest level since January on August 10, a day after WTI hit its highest price this year.

After falling for eight straight weeks, the number of active US oil rigs, an early indicator of future output, held steady at 525 this week, energy services firm Baker Hughes said.

|

| The weekly increase in gasoline prices has not been broken yet. Illustration photo: Reuters |

Eric Freedman, chief investment officer at US Bank Asset Management, said the steady rig count shows that US producers are maintaining discipline in drilling and exploration. Freedman noted that although oil prices continue to rise, not many companies are looking for oil.

This week, economic data from China showed that crude oil imports rose year-on-year in July, while China's total exports fell 14.5%, but monthly crude oil imports fell from a near-record high in June to their lowest since January.

Domestic gasoline prices

Domestic retail prices of gasoline on August 12 are as follows:

E5 RON 92 gasoline is not more than 22,822 VND/liter. RON 95 gasoline is not more than 23,993 VND/liter. Diesel oil not more than 22,425 VND/liter. Kerosene not more than 21,889 VND/liter. Fuel oil not exceeding 17,668 VND/kg. |

The above domestic retail price of gasoline and oil was adjusted by the Ministry of Finance and the Ministry of Industry and Trade in the price management session on the afternoon of August 11, with gasoline prices increasing by more than 30 VND/liter, and the highest oil price increase was 1,813 VND/liter.

In this price management period, the joint ministries decided: Not to set up the Price Stabilization Fund for all petroleum products and continue not to spend the Price Stabilization Fund for the two petroleum products, stop spending the Price Stabilization Fund for kerosene and diesel, and spend the Price Stabilization Fund for fuel oil.

MAI HUONG

* Please visit the Economics section to see related news and articles.

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)