Before October 1, 2025, all car owners in Vietnam must complete the conversion from toll collection accounts to traffic accounts linked to payment means, according to Decree 119/2024/ND-CP.

A traffic account is an identity account that is directly connected to the user's e-wallet, bank account or credit card. Thanks to that, transactions are processed quickly, limiting errors in depositing, increasing security and authenticating the owner. The need to deposit or withdraw money can be done immediately, instead of having to wait 15 - 20 days and needing support from the service provider as with previous toll accounts.

This is an important step to synchronize the non-stop toll collection system nationwide, while expanding the ability to pay for many other traffic services such as parking, gasoline or vehicle inspection.

For users, this conversion also helps customers not need to "set aside" a sum of money in their account to collect traffic fees. Instead, customers can pay each time such as shopping, ordering online through an e-wallet or payment card that they are already using.

However, non-stop toll collection requires a specific technology solution to achieve extremely fast payment processing speed for vehicles passing through the station, in about 0.2 seconds. This is also the reason why non-stop toll collection service providers previously required customers to set up a specialized toll collection account.

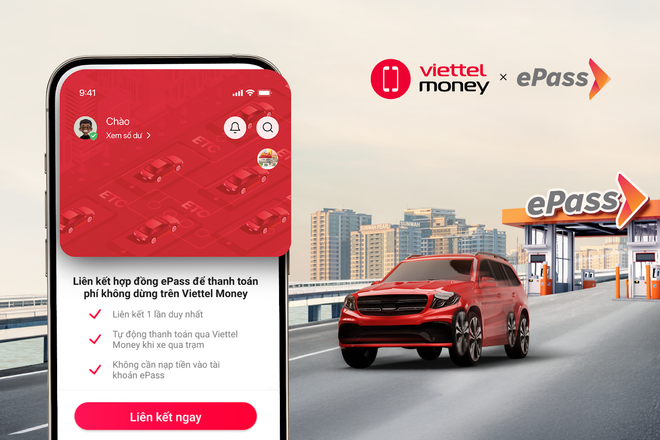

To facilitate the transition, ePass has collaborated with Viettel Money - a digital financial application in the Viettel ecosystem to build a payment solution that meets technical standards, meets the requirements for fee collection transaction processing speed and brings a seamless experience to users.

Linking to payment methods: Why do we need Viettel Money?

According to the explanation of the Vietnam Road Administration, the traffic account is the vehicle owner's identification account, which can be directly connected to an electronic wallet, bank account or credit card. Compared to the previous toll collection account (which was only an internal account managed by the non-stop toll collection provider), this is a more flexible solution for customers.

For example, customers will not need to estimate their usage needs in advance to “top up” their non-stop toll collection accounts. In addition, customers who are businesses providing transportation services will not have a large amount of money pre-loaded into their accounts. Instead, each traffic toll can be deducted directly from a customer’s existing payment account.

However, not all payment methods are ready for the transition. According to TCCS 44:2022/TCDBVN and Decision 2255/QD-BGTVT, each non-stop toll collection (ETC) transaction must be processed in less than 200 milliseconds to ensure that vehicles passing through the station are not interrupted.

Currently, Viettel Money is one of the first methods to meet this requirement, along with International Credit Cards. Meanwhile, most banks and other e-wallets are still upgrading their infrastructure to soon reach the standard of processing this transaction speed.

According to Ms. Nguyen Thuy Anh - Deputy Head of Payment Department ( State Bank of Vietnam ), the transaction processing speed of bank accounts currently only reaches about 50% of the performance requirements. Therefore, intermediary units such as Viettel Money are playing the role of an effective bridge, ensuring both the speed and reliability of the system.

In addition, this conversion also expands customers' payment services. If previously, money in the toll account could only pay for non-stop fees, now the traffic account will expand to pay for many other traffic services such as parking, gas stations, airports, inspections, etc.

How ePass and Viettel Money are solving the conversion problem

Currently, on ePass, customers can choose to link their transportation account with Viettel Money or an international credit card (Visa/MasterCard/JCB/Amex). These are two payment methods that have been recognized by the Ministry of Construction and the State Bank as meeting technical standards.

When the vehicle passes the station, the system will automatically recognize and deduct money immediately from Viettel Money, without the need for manual operation or delay. In addition, Viettel Money is free of charge for all steps of linking, depositing money (from bank accounts) and transacting through the station. Users can deposit from bank accounts or ATM cards of more than 40 domestic banks.

The use of Viettel Money is also guaranteed to be safe thanks to eKYC technology that meets international ISO standards, a data security system that strictly complies with the Law on Cyber Security and Decision 1813/QD-TTg in 2021 of the Prime Minister.

Notably, Viettel Money also provides a Postpaid Wallet feature, allowing ePass users to "buy first - pay later" in accordance with the direction of the Vietnam Road Administration. This helps reduce pressure on customers, providing better support for situations such as forgetting to top up the account or not having enough balance.

To support people who are not tech-savvy, ePass has deployed more than 1,400 direct support points nationwide, including toll stations, supermarkets, and Viettel stores. The 1900.9080 call center system also operates 24/7 to guide operations and answer questions during the conversion process./.

Source: https://www.vietnamplus.vn/giai-phap-cho-khach-hang-epass-chuyen-doi-tai-khoan-giao-thong-thuan-tien-hon-post1064025.vnp

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)