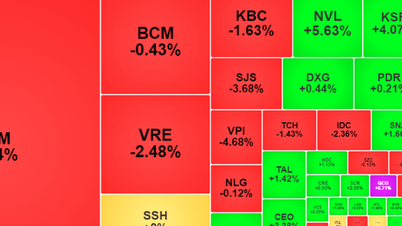

NDO - On December 26, after the ups and downs in the morning session, selling pressure increased in the afternoon session, causing the market to diverge and turn down; stocks in many industries such as telecommunications, transportation, securities, information technology, etc. were in red. At the end of the session, VN-Index decreased by 1.17 points, down to 1,272.87 points.

Market liquidity this session decreased sharply compared to the previous session, with total trading volume on the three floors reaching more than 730.96 million shares, equivalent to a total trading value of more than VND 15,828.70 billion.

After two consecutive net buying sessions, foreign investors returned to net selling more than 375.60 billion VND this session, focusing on VCB (more than 149 billion VND),FPT (more than 67 billion VND), VNM (more than 49 billion VND), STB (more than 44 billion VND), NLG (more than 32 billion VND)...

On the contrary, the stocks with the most net purchases in this session included SSI (over 43 billion VND), CTG (over 39 billion VND), VHM (over 26 billion VND), PDR (over 22 billion VND), MCH (over 16 billion VND)...

On the HoSE floor, the matched order value this session decreased sharply compared to the previous session, reaching more than VND 10,640.39 billion.

In this session, the codes that contributed positively to the VN-Index increasing by more than 3.01 points included: MBB, BID, VIB, STB, PGV, HDB, HVN,ACB , BCM, TPB.

On the contrary, the stocks that negatively impacted the VN-Index by more than 2.36 points included: VCB, FPT, MWG, SSB, HPG, LPB, GVR, BVH, TCB, DGC.

In terms of industry groups, the group of telecommunications service stocks with the strongest decrease this session (-1.22%) mainly came from codes VGI, FOX, CTR...

Next is the group of transport stocks (-0.70%), mainly from codes ACV, MVN, VJC, VTP, PHB, PVT... ; On the contrary, the codes that increased include HVN, VSC, STG, DVP...

Consumer service stocks decreased by 0.68%, mainly from DSP, VNG , DAH, PDC, VLA... Some codes increased including DSN, BTV, EIN...

In this session, the energy stocks group had the strongest increase (0.98%), mainly from codes BSR, PVD, TMB, CST, TVD, AAH... Declining direction included codes PVS, POS...

The second strongest increase was in the group of specialized service and trade stocks (0.84%), mainly from codes VEF, ODE... Declining codes include TV2, TV4, USD...

The group of utility service stocks also performed quite positively with an increase of 0.46%, mainly from codes GAS, PGV, BWE, QTP, TDM, TMP, PPC, SHP... On the contrary, the codes that decreased included REE, HND, HNA, BWS, PGD, VPD, PGS...

* The Vietnam stock market index reversed to decrease at the end of the morning session today and remained red until the end of trading time. VNXALL-Index closed down 2.97 points (-0.14%), down to 2,118.64 points. Liquidity with a trading volume of more than 577.17 million units, equivalent to a trading value of more than VND 13,882.12 billion. In the whole market, there were 178 stocks increasing in price, 91 stocks remaining unchanged and 200 stocks decreasing in price.

* At the Hanoi Stock Exchange, the HNX-Index closed at 229.90 points, up 0.09 points (+0.04%). Liquidity reached a total of more than 71.24 million shares transferred, with a corresponding trading value of more than VND 1,152.52 billion. In the whole market, there were 81 stocks increasing in price, 71 stocks remaining unchanged and 72 stocks decreasing in price.

The HNX30 index closed up 0.44 points (+0.09%) to 485.74 points. Trading volume reached over 17.81 million units, equivalent to over VND442.43 billion. In the whole market, there were 9 stocks increasing in price, 8 stocks remaining unchanged and 13 stocks decreasing in price.

On the UPCoM market, the UPCoM-Index closed at 94.41 points, down 0.18 points (-0.19%). Market liquidity, total trading volume reached over 64.51 million shares, corresponding trading value reached over 964.17 billion VND. In the whole market, there were 166 stocks increasing in price, 95 stocks remaining unchanged and 124 stocks decreasing in price.

* At the Ho Chi Minh City Stock Exchange, the VN-Index closed down 1.17 points (-0.09%) to 1,272.87 points. Liquidity reached over 595.21 million units, equivalent to a trading value of VND13,712.01 billion. The entire floor had 186 stocks increasing, 70 stocks remaining unchanged and 227 stocks decreasing.

The VN30 Index increased by 0.20 points (+0.01%) and stopped at 1,342.68 points. Liquidity reached more than 208.59 million units, equivalent to a trading value of more than VND6,817.49. The VN30 group of stocks ended the trading day with 12 stocks increasing, 4 stocks remaining unchanged and 14 stocks decreasing.

The 5 stocks with the highest trading volume are VIB (over 21.86 million units), MBB (over 19.90 million units), BCG (over 16.55 million units), STB (over 16.44 million units), DXG (over 20.26 million units).

The 5 stocks with the highest price increase are PGV (+6.99), TDH (+6.92%), TMT (+6.91%), LGL (+6.91%), BMC (+6.90%).

The 5 stocks with the biggest price decrease were YEG (-6.90%), TNC (-6.84%), TEG (-6.29%), TDW (-6.08%), CCI (-6.07%).

* Today's derivatives market had 115,175 contracts traded, worth more than VND 15,543.65 billion.

Source: https://nhandan.vn/giao-dich-tram-lang-vn-index-quay-dau-giam-nhe-post852662.html

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

Comment (0)