Which generation has the hardest time buying a house?

You could call them an unlucky generation. Just as they were entering the property market hoping to buy their first home, inflation was rising, mortgage rates were at an all-time high, and house prices were up more than 60% in four years.

Many people think this is what Generation Y is going through. But it is the situation that Baby Boomers – those born between 1946 and 1964 during the post- World War II baby boom – faced.

That was in the 1980s, when US mortgage interest rates exceeded 16% per year and the average monthly loan payment relative to income rose to 34% after just one year.

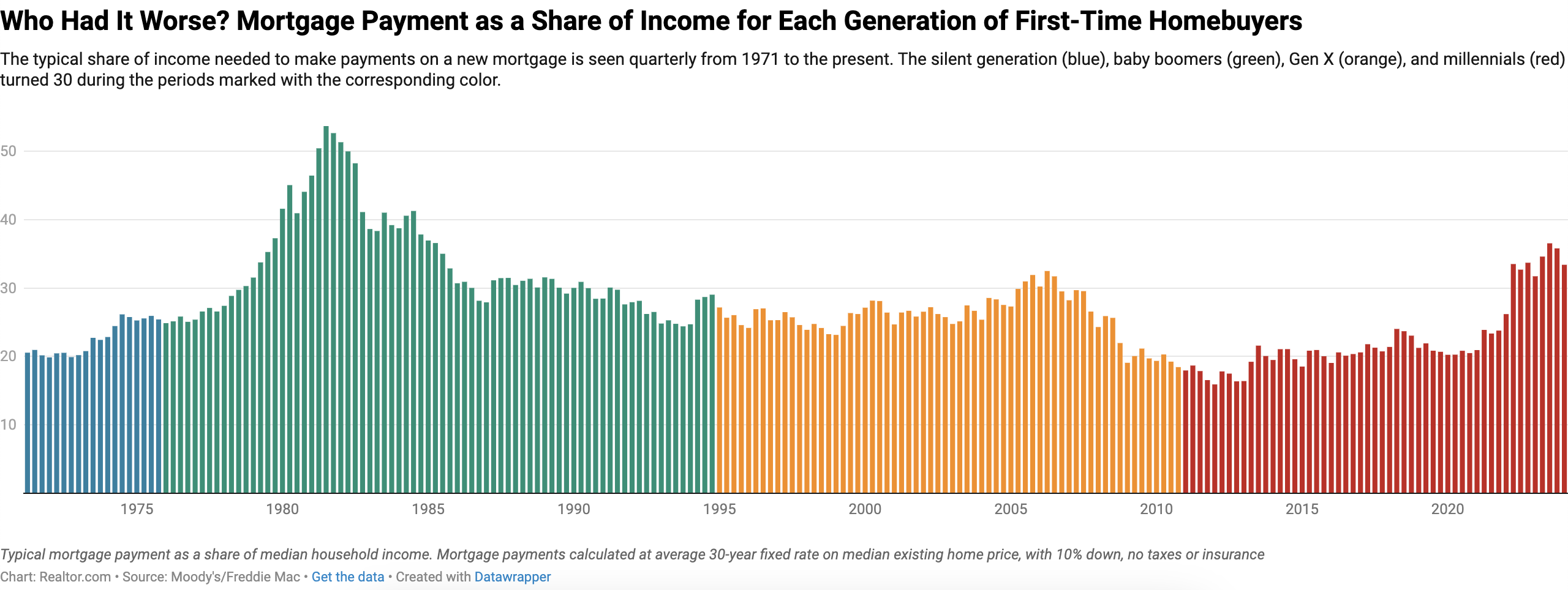

This statistic comes from an analysis of historical home prices, incomes and mortgage rates by America's largest real estate platform, Realtor .

Millennials (born between 1981 and 1996) often complain that the 2007 global financial crisis made it harder for them to buy a home. But the data shows that the Baby Boomer generation has faced even greater challenges.

Realtors analyzing historical data say Baby Boomers may have faced the toughest housing market in history for first-time buyers. When they turned 20, the average mortgage payment as a percentage of household income was 33.2%.

In contrast, millennials are not burdened with mortgages due to extremely low interest rates post -recession . The average mortgage is just 22.5% of a millennial household's income. This is lower than the average of 25.8% for Gen X (those born between 1965 and 1980).

Of course, in every generation there are periods when leverage exceeds 30% of income, as has happened over the past two years in the US.

Baby Boomers (green) have the highest mortgage-to-income ratios (Chart: Realtor).

Millennials’ complaints aren’t unreasonable, says Hannah Jones, senior economic analyst at Realtor.com, who says the current housing market isn’t the most illiquid in history, but it is the worst in 40 years and severely undersupplied.

Today’s homebuyers face high prices, high mortgage rates and a shortage of affordable housing, making first-time homebuyers extremely difficult.

When buying a home is no longer the best option

Realtor data shows that home prices in the U.S. have consistently risen faster than inflation. This year’s median home price, adjusted for inflation using the Consumer Price Index, was $227,737 for Baby Boomers, $279,843 for Gen Xers and $319,804 for Millennials.

Inflation-adjusted home prices have increased 18% for Baby Boomers compared to previous generations, 23% for Gen X and 14% for Gen Y.

But mortgage rates for millennials before 2022 are at historic lows.

Despite the price and interest advantages, it is interesting to note that many millennials did not buy their first home at the same age as their parents. According to the National Association of Realtors, the median age of first-home buyers will be 35 in 2023, compared to 31 in 2013 and 29 in 1981.

The question is why Generation Y has it easier, why don't many people decide to buy a house early?

Many millennials in the US buy their first home around the age of 35 (Photo: Realtor).

According to the Berkeley Economic Review , 45% of Baby Boomers were able to buy their first home between the ages of 25 and 34. As of 2019, research shows that only 37% of millennials in the same age group owned homes.

For millennials, the ultra-low interest rates that came with turning 30 after the last recession created strong incentives not to buy a home, says Professor David Clark of Marquette University.

For them, this was the worst time, coming out of the recession, the labor market was weak but they were burdened with a large amount of student debt. In addition, after the financial crisis of 2007, home prices in the US continued to fall until early 2012.

Therefore, the decision not to buy a house for Gen Y is considered a smart move.

Another economist, Ken H. Johnson, told Realtor that millennials are delaying home buying because it's not the most effective way to build wealth.

The vice dean of the Florida Atlantic University School of Business believes that Gen Y is better at building wealth by investing in stocks, bonds, and other instruments than buying real estate and renting like previous generations. For them, access to the investment market has become easier than for their parents thanks to the development of financial technology.

In addition, Gen Y easily finds jobs that require frequent travel between cities and even countries. Therefore, they often choose to rent a house in places with the best promotion opportunities instead of buying a permanent house. Therefore, Ken H. Johnson believes that it is not too surprising that the average age of first-time home buyers is increasing.

Source: https://dantri.com.vn/bat-dong-san/he-lo-bat-ngo-ve-the-he-kho-mua-duoc-can-nha-dau-tien-nhat-trong-lich-su-20240621162244257.htm

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

Comment (0)