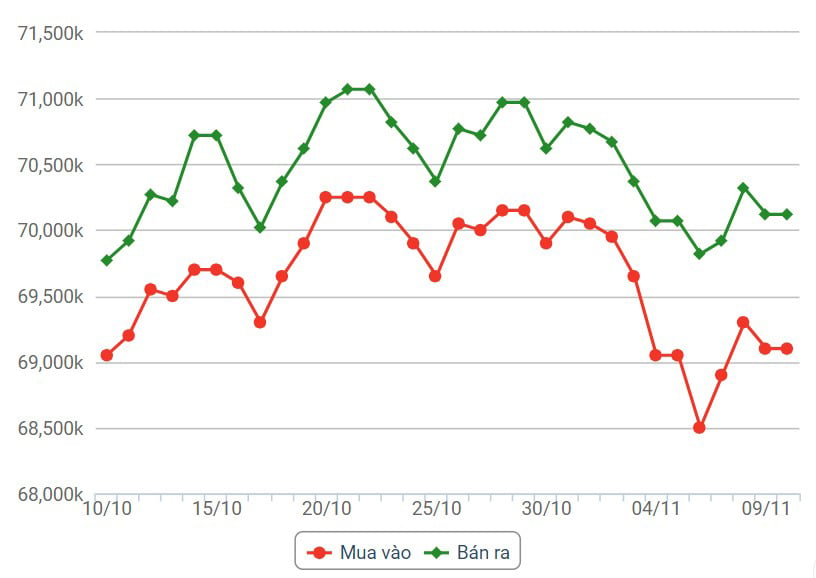

Domestic gold price

Domestic gold price developments

World gold price developments

World gold prices increased slightly in the context of the USD's decline. At 5:50 p.m., the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 105.695 points (down 0.06%).

World gold is heading for a second consecutive week of decline as the US dollar and US Treasury bond yields rose sharply following comments on interest rates from US Federal Reserve (FED) Chairman Jerome Powell.

Fed officials, including Chairman Powell, said on Thursday (November 9) that it was still uncertain whether interest rates were high enough to end the inflation “war.” After Powell’s comments, the yield on the benchmark 10-year US Treasury note rose from its lowest in more than a month, making non-yielding gold less attractive to investors.

Oil prices, which are closely related to gold, are also rising. Brent crude for January 2024 delivery rose 40 cents (0.5%) to $80.41 a barrel at 2:29 p.m. Vietnam time, while US West Texas Intermediate (WTI) for December 2023 delivery rose 30 cents (0.4%) to $76.04 a barrel.

For the week, Brent futures fell 5.7% while WTI fell 5.9% from the previous week. The three-week decline is the longest for both benchmarks since a four-week slump from mid-April to early May 2023.

As gold and oil prices rose, stock markets fell. Notably, Asian stocks fell to a one-week low in the trading session on November 10.

During this trading session, the Shanghai Composite Index of the Shanghai Stock Exchange (China) decreased by 14.31 points (0.47%) to 3,038.97 points and the Shenzhen Composite Index on the Shenzhen Stock Exchange (China) decreased by 8.10 points (0.42%) to 1,903.80 points; the Hang Seng Index of the Hong Kong Stock Exchange (China) decreased by 308.03 points (1.76%) to 17,203.26 points...

Forecasting gold prices, Jim Wyckoff - senior analyst at gold market website Kitco Metals, said there are no major unexpected developments from the conflict in the Middle East that will reduce the attractiveness of buying gold to preserve investors' assets.

Daniel Ghali, commodity strategist at TD Securities, said the market is looking at economic data and the Fed's next move. Gold will react to whatever data is released. Without a significant decline in the reported figures, gold prices will have little momentum.

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)