At the end of the session on June 19, the VN-Index only increased by 0.29 points (+0.02%), closing at 1,279 points.

Although the market opened in the green, it quickly returned to a cautious and tentative state. At times, the VN-Index fell to near the 1,270-point mark. The market was only supported and gradually recovered in the afternoon session of June 19.

At the end of the session, the VN-Index increased by only 0.29 points (+0.02%), closing at 1,279 points. Liquidity on the HoSE floor reached 1 billion shares, equivalent to a value of VND25,741 billion.

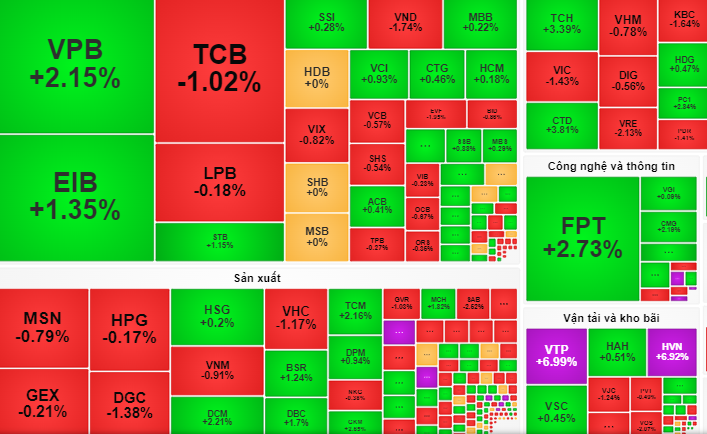

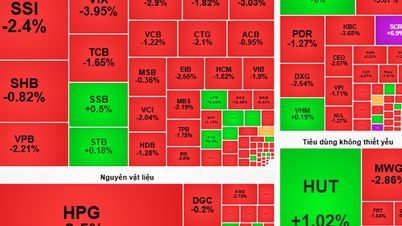

Among the 30 large stocks (VN30), 14 codes increased in price, such asFPT (+2.7%), VPB (+2.2%), MWG (+1.8%), PLX (+1.2%), STB (+1.1%)... On the contrary, 14 codes decreased in price such as SAB (-2.5%), VRE (-2.1%), VIC (-1.4%), VJC (-1.2%), TCB (-1%)...

This session, foreign investors continued to net sell on HoSE with a value of 1,511 billion VND. In particular, they sold heavily at FPT (-221.7 billion VND), VNM (-170.4 billion VND), VPB (-129 billion VND), VHM (-97.5 billion VND). Therefore, many domestic investors are worried that the "dumping" move of foreign investors may take place in the next session.

According to VDSC, liquidity on June 19 increased compared to the previous session, showing that cash flow is trying to support the market when the supply of stocks increases. It is expected that the VN-Index will continue to fluctuate to probe the supply and demand of stocks in the 1,275 - 1,285 point range in the next trading session.

"However, the recent cautious signals may still pose risks in the short term. Therefore, investors should avoid falling into an overbought state" - VDSC recommends.

VCBS Securities Company also recommends that investors consider buying small amounts of stocks that are moving sideways in the technology, electricity, and seafood industries...

Source: https://nld.com.vn/chung-khoan-ngay-mai-20-6-khoi-ngoai-co-the-con-xa-hang-196240619181657204.htm

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)