SGGPO

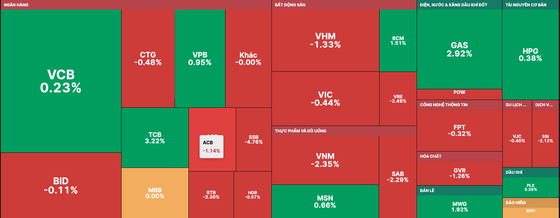

Although the VN-Index closed the session with a significant decrease compared to the highest decrease of more than 16 points in the session, it was still considered an unsuccessful recovery session.

|

| VN-Index failed to recover in the trading session on September 28 |

The Vietnamese stock market fluctuated strongly on September 28th, as selling pressure remained high after a fairly good recovery session before. Investors' sentiment remained cautious, causing liquidity to continue to decline sharply.

Notably, after the previous 3 net buying sessions, foreign investors returned to sell with a total net selling value on the HOSE floor of nearly 509 billion VND, contributing to putting pressure on the market's recovery.

There is a strong differentiation within the main stock groups in the market. Real estate stocks are also differentiated but the number of stocks that decreased is greater. The Vingroup trio all decreased with VHM down 1.33%, VRE down 2.49% and VIC down 0.44%.

Similarly, the group of banking stocks had TCB increase by 3.22%, LPB increase by 2.64%, TPB increase by 1.4% but SSB decrease by 4.76%, EIB decrease by 3.86%, STB decrease by 3.3%...

Energy and retail stocks in particular mostly increased positively. Of which, oil and gas stocks had POS increasing by 12.9%, BSR increasing by 6.16%, PTV increasing by 5.68%, PVS increasing by 5.61%, OIL increasing by 4.85%, PVC increasing by 4.65%, PVD increasing by 3.77%, PLX increasing by 3.28%, GAS also increasing by 2.92%. Retail stocks had MWG increasing by 1.92%, FRT increasing by 0.24%...

At the end of the trading session, VN-Index decreased by 1.42 points to 1,152.43 points (0.12%) with 211 stocks increasing in price, 282 stocks decreasing in price and 59 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also decreased by 1.34 points (0.57%) with 91 stocks decreasing, 80 stocks increasing and 73 stocks remaining unchanged. Liquidity decreased sharply with the total trading value in the whole market being only nearly 18,300 billion VND, of which liquidity on the HOSE floor was about 15,900 billion VND.

Source

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)