Customer feedback is at the heart of everything

One of the latest technological solutions that Manulife Vietnam has just deployed is the M-PS (Manulife Promoter System) customer feedback system, which helps businesses quickly grasp customer opinions and proactively and continuously improve service quality. After each transaction, customers will receive a survey link via Zalo or SMS from the M-PS system to evaluate the service quality. In cases where customers have a bad experience, Manulife Vietnam will respond within 48 hours.

Customers evaluate their service experience after the transaction. Photo: Manulife

M-PS not only acts as a channel to measure satisfaction, but also provides important data for decisions to adjust processes, products and services to suit the actual needs of customers. The company representative said that this platform is part of the company's commitment to constantly listen and act promptly to ensure maximum customer satisfaction.

Together with M-PS, Manulife continues to upgrade the insurance benefits settlement process by applying automation technology to shorten processing time, and at the same time launching an online document supplement portal, helping customers submit documents quickly, conveniently and safely.

Making insurance transparent with technology

Ms. Tina Nguyen - General Director of Manulife Vietnam emphasized that digitalizing operations is Manulife's top priority in its customer-centric strategy. "We always aim to digitalize operations to bring maximum benefits to customers. Our digital improvements over the past time have created positive effects in both user experience and internal operations." Ms. Tina also affirmed that Manulife will continue to launch new digital initiatives to maintain its pioneering position in transparency in the insurance industry in Vietnam.

The Canadian insurance company once created a “turning point” in the transparency of the insurance market when implementing the process of verifying and monitoring the issuance of insurance contracts (M-Pro process), helping customers fully understand and buy correctly. Through this process, customers perform electronic identification and confirm previously provided personal information, as well as check important information about the insurance contract such as benefits, payment information, notes on investment risks, etc. This initiative also allows businesses to independently evaluate the content of the agent's consultation with customers.

Manulife's M-Pro process helps customers understand correctly and buy enough. Photo: Manulife

Last year, the Insurance Company also successfully deployed a consulting recording system for its investment-linked insurance products. With a friendly interface and intuitive instructions, especially integrated with virtual assistant technology, customers can easily perform the recording process with consultants. This initiative not only meets the requirements of Circular 67 ( Ministry of Finance ), but also helps to increase transparency in consulting activities, as well as ensure the right to understand and make decisions of customers.

In the context of the insurance market shifting from traditional to digital solutions, the role of pioneers like Manulife is expected to contribute to raising the standards of the entire industry, especially the way businesses interact and accompany customers throughout the journey of personal financial protection. With a series of systematic initiatives, Manulife Vietnam has just been recognized by Global Business & Brands magazine as 'Best Life Insurance Company for Digital Transformation 2025'.

Ngoc Minh

Source: https://vietnamnet.vn/manulife-nang-cao-trai-nghiem-khach-hang-voi-loat-giai-phap-cong-nghe-moi-2394145.html

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

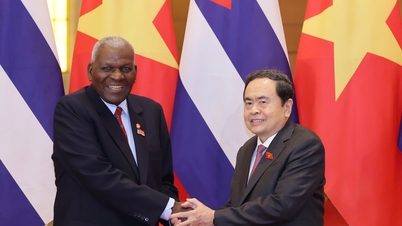

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)