Maternity benefits are only for compulsory social insurance participants (Illustration: Son Nguyen).

Ms. Binh is scheduled to give birth in December 2024, but because she is worried about the fetus, she decided to quit her job early. Therefore, she knows for sure that in the 12 months before giving birth, she will not have paid the required 6 months of social insurance.

Ms. Binh asked: "If I pay voluntary social insurance now, will I be entitled to maternity benefits in December?"

Mr. Diep had paid compulsory social insurance from 2017 to 2021. After that, Diep quit his job and started paying voluntary social insurance from April 2023 to present. Mr. Diep's wife is pregnant and is due in June 2024.

Mr. Diep asked: "In this case, am I entitled to maternity benefits for a husband whose wife gives birth?"

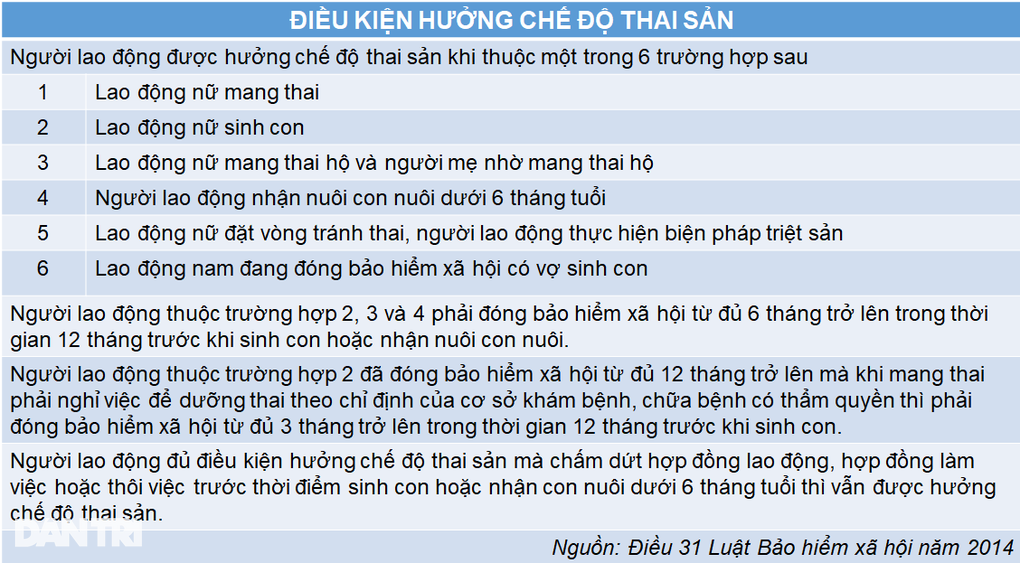

According to Vietnam Social Security, the conditions for enjoying maternity benefits are stipulated in Clauses 1 and 2, Article 31 of the Social Security Law 2014.

Based on the above regulations, Vietnam Social Security said that Ms. Binh's case is a voluntary social insurance participation so she is not entitled to maternity benefits.

"To enjoy maternity benefits, you need to participate in compulsory social insurance for at least 6 months in the 12 months before giving birth," Vietnam Social Security stated.

Regarding maternity benefits for male employees when their wives give birth, Vietnam Social Security said it is regulated in Clause 2, Article 34 of the Social Insurance Law 2014.

Accordingly, male employees who are paying social insurance when their wives give birth are entitled to take 5 working days off to enjoy maternity benefits.

In case the wife has to have a cesarean section or gives birth before 32 weeks, she is entitled to 7 working days of maternity leave.

In case of twin birth, the wife is entitled to 10 working days off, from triplets or more, for each additional child, the wife is entitled to 3 additional working days off.

In case the wife gives birth to twins or more and has to have surgery, she is entitled to 14 working days off.

Vietnam Social Security said: "Thus, according to the above regulations, male employees who are paying compulsory social insurance and whose wives give birth will be entitled to maternity benefits."

However, in Mr. Diep's case, at the time his wife gave birth (June 2024), he was participating in voluntary social insurance, so he was not eligible for maternity benefits.

Source: https://dantri.com.vn/an-sinh/moi-mang-thai-thi-nghi-viec-dong-bhxh-tu-nguyen-co-duoc-huong-thai-san-20240522151411471.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Video] Launch of 12 new works by Professor, Dr. Dinh Xuan Dung and colleagues](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/2b81342a9c2b482c901c8997ec7ad0ea)

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)