Vietnam Maritime Commercial Joint Stock Bank (MSB) has just announced the results of bond issuance on November 22, 2023. Specifically, MSB successfully issued 1,500 bonds coded MSBL2326003 on November 22, 2023 with a face value of VND 1 million/bond. Equivalent to a total issuance value of VND 1,500 billion.

The bond has a term of 3 years, expected to mature on November 22, 2026. According to information from the Hanoi Stock Exchange (HNX), the bond has an issuance interest rate of 5.8%/year.

The early redemption of bonds must comply with the terms and conditions of the bonds, in accordance with the provisions of current laws.

The repurchase price for a bond is equal to the total face value plus accrued but unpaid interest, including but not including the early repurchase date in accordance with the terms and conditions of the bond, unless otherwise agreed by the issuer and the bondholder.

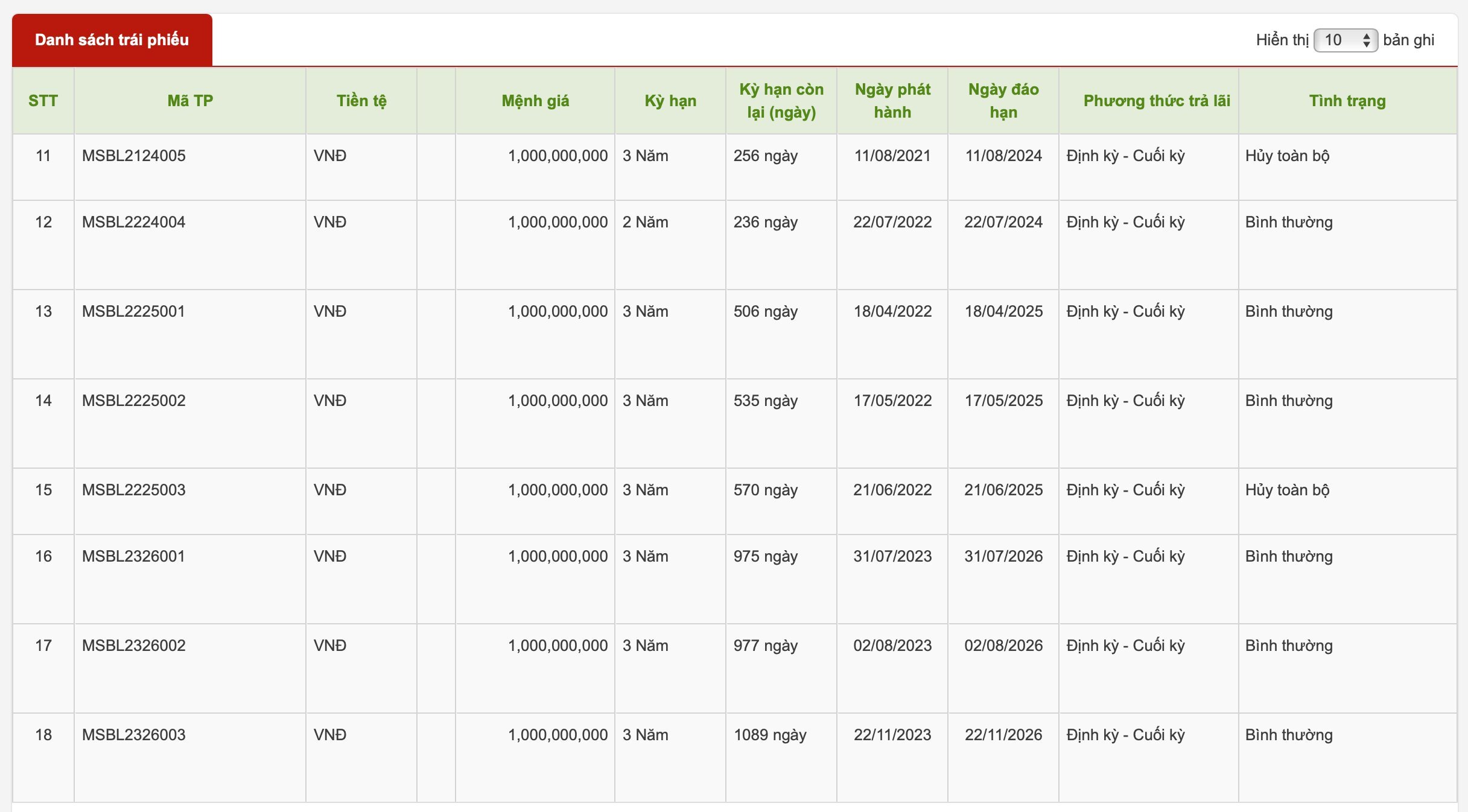

MSB's outstanding bond lots.

This is the third batch of bonds issued by MSB this year. Previously, in July and August, MSB consecutively issued two batches of bonds with an interest rate of 7.5%/year.

Of which, bond lot MSBL2326001 was issued on July 31, 2023, with a term of 3 years and maturity date of July 31, 2026. Bond lot MSBL2326002 was issued on August 2, 2023, with a term of 3 years and expected maturity date of August 2, 2026.

Both of the above bond lots have an issuance volume of 1,000 bonds with a face value of 1 billion VND/bond, the total issuance value is 1,000 billion VND. Thus, up to now, MSB has successfully mobilized a total of 3,500 billion VND from bonds.

According to HNX, MSB has mobilized a total of 18 bond lots from 2018 to present. However, there are only 6 bond lots in normal circulation: MSBL2326003, MSBL2326002, MSBL2326001, MSBL2225002, MSBL2225001 and MSBL2224004. In the first half of 203, MSB spent about 286 billion VND to pay bond interest and 5,000 billion VND of bond principal .

Thu Huong

Source

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)