The American Enterprise Institute (AEI) has just published an analysis by economist Desmond Lachman, former Deputy Director of the Policy Development and Assessment Department of the International Monetary Fund (IMF) and Chief Strategist for Emerging Markets at Salomon Smith Barney, on the risk of Italy facing a public debt crisis. In the article, the author stated that Italy has very little prospect of reducing the size of its current public debt mountain.

According to the author, markets have not been quick to predict economic crises in Europe. In late 2009, before the sovereign debt crisis broke out in Greece, its government bonds were trading at yields only slightly higher than those of German government bonds.

A year later, the Greek debt crisis rocked global financial markets and Greece eventually defaulted on its debt. It was the largest government default ever.

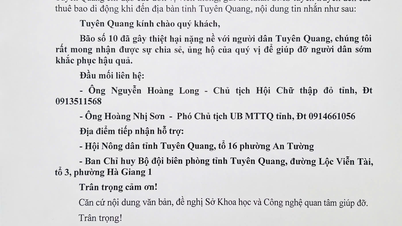

|

| Another Italian debt crisis is the last thing the world economy wants at a time when growth across economies is slowing down. (Source: Getty) |

The looming public debt crisis

Now, another Italian debt crisis is something the world economy absolutely does not want at a time when growth is slowing across the board. Italy’s economy is 10 times the size of Greece’s and has a $3 trillion government bond market.

If the 2010 Greek debt crisis shook world financial markets, how much more so will today's Italian debt crisis?

The main reason the world is bracing for another debt crisis in Italy is that all the factors that could allow Rome to ease its debt burden are now against it. This is especially worrying given that Italy’s public debt-to-GDP ratio is over 145%, about 15% higher than when the Italian debt crisis began in 2012.

In pure arithmetic terms, the three factors that can improve a country's public debt burden are a healthy primary budget surplus (a balanced budget after interest payments), lower interest rates at which the government can borrow, and higher economic growth.

Unfortunately, in Italy's current case, all three of these factors are moving in the opposite direction.

Instead of seeking to achieve a primary budget surplus, the mid-European country's disappointing budget presented by Prime Minister Giorgia Meloni's government this week implies a significant primary budget deficit.

Meanwhile, amid tightening monetary policy by the European Central Bank (ECB) and investor doubts about the current government's economic policy direction, the yield on Italy's 10-year government bonds has risen from below 1% in 2021 to around 4.75% currently. This is the highest level since the Italian debt crisis in 2012, but only about 1.8% higher than its German counterpart.

Meanwhile, rather than enjoying high economic growth, Italy’s economy appears to be on the brink of a recession. This is the fallout from the ECB’s monetary tightening aimed at controlling inflation. A recession, if it occurs, would make it difficult to believe in Italy’s ability to grow under the mountain of debt caused by its economic stagnation.

Will Italy fall into a technical recession?

At current government bond yields, the prospect of Italy being able to escape its debt burden seems to have diminished. This is especially true given the country’s dismal economic growth record. Since joining the Eurozone in 1999, Italy’s per capita income has barely budged.

Until recently, the Italian government had little difficulty financing itself on relatively favorable terms despite its high public debt. This was largely due to the fact that under its aggressive quantitative easing program, the ECB met almost all of the Italian government’s net borrowing needs.

However, the ECB has ended its bond-buying program since July 2023, leaving Rome heavily reliant on financial markets to meet its borrowing needs. It seems likely that Italy will soon follow Germany into a technical recession due to the ECB's tightening monetary policy.

With public finances in serious trouble, it is particularly important that the Italian government reassure investors that it is capable of managing a very difficult economic situation. For this reason, it is regrettable that the current government has failed to deliver on its economic promises.

Among its more disappointing missteps were a surprise tax on bank profits and a projected 5.3% budget deficit, which put the country on a collision course with the European Commission. This did little to inspire market confidence in the Italian government’s ability to boost economic growth or tackle a looming debt crisis.

In recent days, market attention has focused on Italy's shaky public finances, pushing the yield spread between Italian and German government bonds to its highest level since the start of the year.

The Italian government should pay attention to market fluctuations in difficult times and change its economic direction soon if it wants to avoid a full-blown debt crisis next year.

None of this means a full-blown Italian debt crisis is imminent. However, the ECB needs to be careful not to overdo monetary policy in an effort to control inflation.

Italy and Europe do not want to fall into a recession and higher interest rates will only worsen the country's public finances.

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)