In the Draft Law on Personal Income Tax (amended), the Ministry of Finance proposed to add a number of activities that are exempted from or reduced from tax, including trading in open-end fund certificates. Data from the State Securities Commission shows that currently, there are over 80 public open-end funds with a revenue of about VND90,000 billion, which is very small compared to the market demand. Currently, there are about 10 million investor accounts, of which 99.9% are individual investor accounts.

Investors trading open-end fund certificates will be exempt from personal income tax.

PHOTO: DAO NGOC THACH

According to statistics from 20 fund management companies, the personal income tax is about 20-30 billion VND/year. Fund management companies can track the time investors hold fund certificates through accounting methods. The Ministry of Finance proposed to supplement the regulation on tax exemption for income from transferring open-end fund certificates held for 2 years or more from the date of purchase; supplement the regulation on reducing 50% of personal income tax rate (currently 5%) for the profits of individual investors divided from securities investment funds, real estate investment funds established under the Securities Law within the time limit prescribed by the Government .

At the same time, the law stipulates that the Government shall specify in detail the above-mentioned tax-exempt and tax-reduced income items to ensure consistency with actual occurrences, and to ensure that tax exemption and reduction are applied to the right subjects and appropriately.

Explaining the above proposal, the Ministry of Finance cited the legal basis that Resolution 68 of the Politburo on private economic development stipulates: Review and improve tax policies, facilitate capital investment activities of investment funds in enterprises; facilitate capital investment activities in enterprises; increase the investment limit in long-term assets or capital financing in the capital structure of enterprises; establish a mechanism to mobilize medium and long-term capital for investment funds.

Previously, in Decision No. 1726/2023 of the Prime Minister on Approving the Strategy for Stock Market Development to 2030, the goal of focusing on developing institutional investors and professional investors was set. To achieve this goal, one of the proposed solutions is to focus on developing types of securities investment funds towards a reasonable structure between individual investors and institutional investors; diversifying fund certificate distribution channels; encouraging investor participation in the stock market through types of investment funds; researching and proposing support mechanisms for securities investment funds to ensure the consistency and uniformity of the legal system; regulations on investors participating in privately offered corporate bond transactions. Therefore, the above proposed tax exemption and reduction aims to encourage the development of these funds in accordance with the orientation of the Party and the State.

Source: https://thanhnien.vn/nha-dau-tu-mua-ban-chung-chi-quy-mo-se-duoc-mien-thue-thu-nhap-ca-nhan-185250908081033437.htm

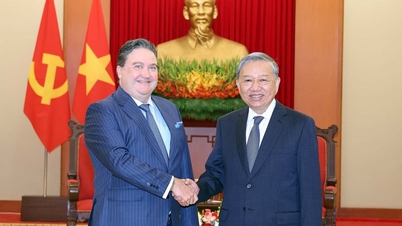

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)