Agribank unexpectedly adjusted interest rates up for some terms. About a month ago, this “big guy” was also the only bank in the big 4 group to increase deposit interest rates.

Accordingly, the interest rate for 1-2 month term deposits increased by 0.2%/year to 2%/year. The interest rate for 3-5 month term online deposits increased by 0.3%/year to 2.5%/year. The interest rate for 6-9 month term banks was adjusted up slightly by 0.1%/year to 3.3%/year.

GPBank also increased the interest rates for 1-9 month terms by 0.2% per year. The 1-month term increased to 3.2% per year, the 2-month term to 3.7% per year, the 3-month term to 3.72% per year, the 4-month term to 3.74% per year, the 5-month term to 3.75% per year, the 6-month term to 5.05% per year, the 7-month term to 5.15% per year, the 8-month term to 5.3% per year and the 9-month term to 5.4% per year.

VietBank has also continued to increase short-term deposit interest rates. Accordingly, online deposit interest rates for 1-4 month terms increased by 0.2%/year. Currently, the 1-month deposit interest rate at this bank is 3.8%/year, 2-month term 3.9%/year, 3-month term 4%/year, 4-month term 4.1%/year.

Thus, from the beginning of September until now, the market has recorded 5 banks increasing interest rates: Agribank, GPBank, VietBank, OceanBank and Dong A Bank.

Previously, in August, the market recorded 17 banks increasing savings interest rates, including: Eximbank, ACB, Agribank, Sacombank, Saigonbank, VietBank, TPBank, CBBank, VIB, Dong A Bank, VPBank, Techcombank,SHB , VietBank, PVCombank, Nam A Bank, HDBank.

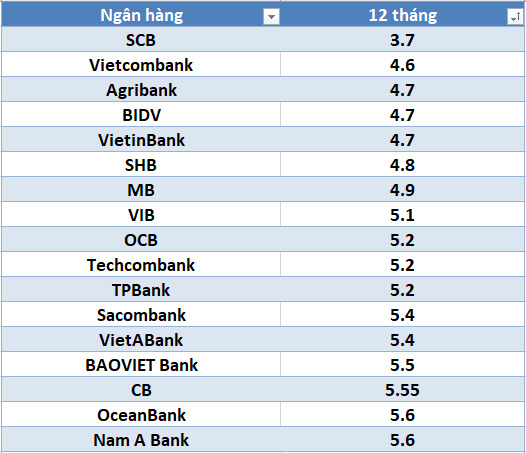

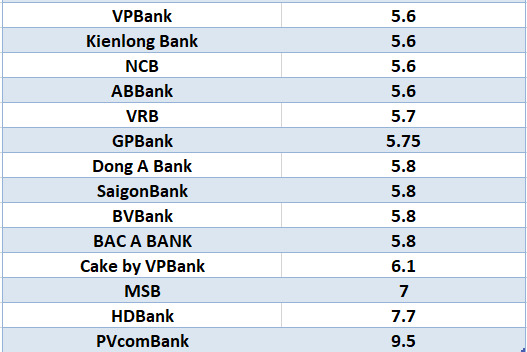

Currently, PvcomBank's interest rate is at its highest level, up to 9.5% for a 12-month term, with conditions applied to a minimum deposit of VND2,000 billion.

Next is HDBank with a fairly high interest rate, 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB also applies quite high interest rates with interest rates at bank counters up to 8%/year for 13-month term and 7% for 12-month term. The applicable conditions are new savings books or savings books opened from January 1, 2018 automatically renewed with a term of 12 months, 13 months and deposit amount from 500 billion VND.

Dong A Bank has a deposit interest rate, term of 13 months or more, end-of-term interest with deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

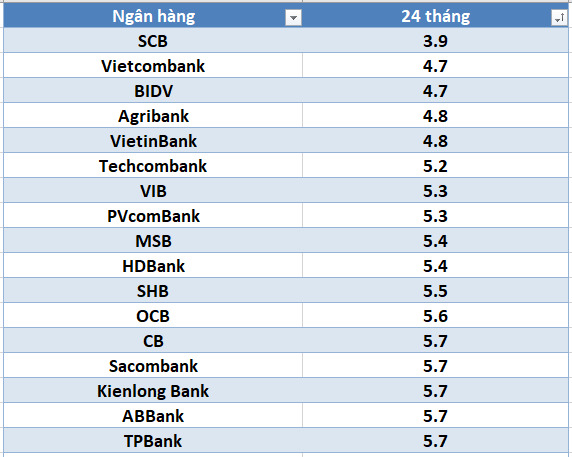

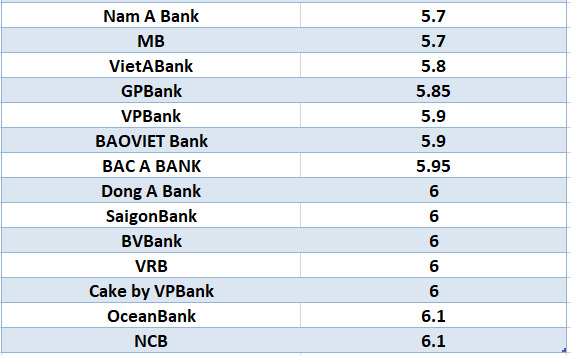

Cake by VPBank applies an interest rate of 6.1% for a 12-month term; NCB and OceanBank apply an interest rate of 6.1% for a 24-month term.

BVBank and Cake by VPBank also apply 6% interest rate for 24-month and 12-month terms; VRB and Dong A Bank apply 6% interest rate for 24-month terms; SaigonBank applies 6% interest rate for 13, 18 and 24-month terms, 6.1% for 36-month terms.

Statistics of banks with the highest savings interest rates today:

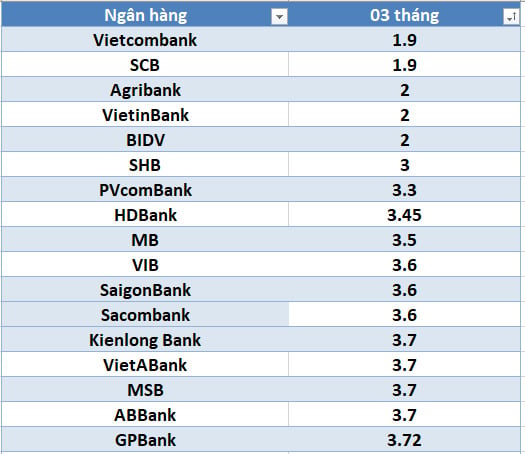

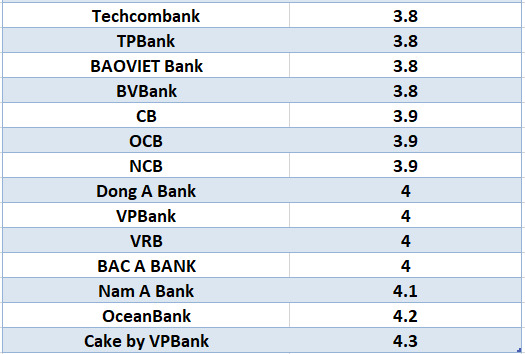

Compare the highest bank interest rates for 3-month terms

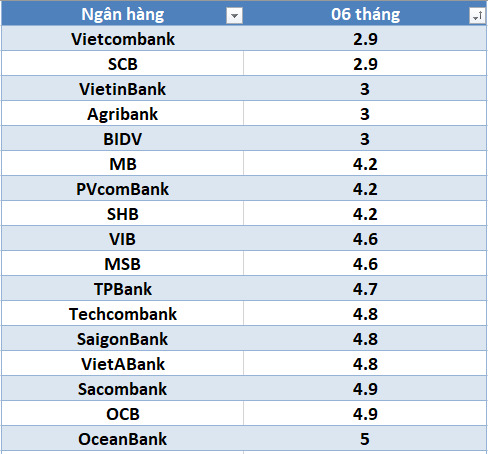

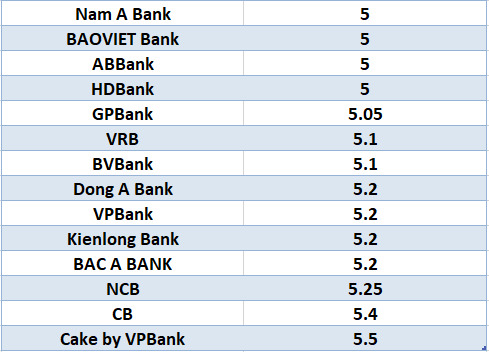

Interest rates on 6-month savings deposits at banks

Want to save for 12 months, which bank has the highest interest rate?

Latest update of Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.

Source: https://laodong.vn/kinh-doanh/lai-suat-ngan-hang-hom-nay-119-ong-lon-lien-tuc-tang-lai-1392304.ldo

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)