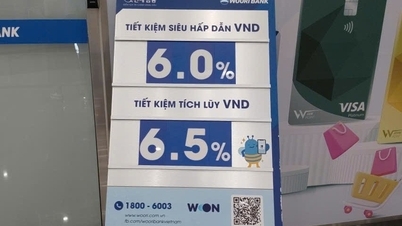

Eximbank no longer maintains the ceiling interest rate of 4.75%/year for deposits with terms of less than 6 months after the recent reduction in interest rates.

According to statistics on online deposit interest rates at domestic commercial banks today, the highest deposit interest rate applied for terms under 6 months is 4.6%/year, applied by Vietnam Export Import Commercial Joint Stock Bank (Eximbank) for terms of 4-5 months and by Orient Commercial Joint Stock Bank (OCB ) for terms of 5 months.

Behind Eximbank and OCB in terms of highest bank interest rates for terms under 6 months are Bao Viet Commercial Joint Stock Bank (BaoViet Bank) and Vietnam Thuong Tin Commercial Joint Stock Bank (VietBank).

Currently, the online deposit interest rate of 4.5%/year is applied by BaoViet Bank for a 5-month term, and by VietBank for a 4-5 month term.

For 3-month term savings interest rates, the highest rate is 4.4%/year listed by VietBank. BaoViet Bank, Vikki Digital Bank (Vikki Bank) and Vietcombank Digital Technology (VCBNeo) are also leading with interest rates of 3.35%/year for 3-month term deposits.

The highest bank interest rate for the 2-month term is 4.2%/year listed by Vikki Bank and Eximbank. Next is VCBNeo with 4.15%/year and a series of banks listed at 4.1%/year including: VietBank, Nam A Bank, NCB, OCB.

With an interest rate of 4.15%/year, Vikki Bank and VCBNeo are leading the market in terms of the highest interest rate for a 1-month term . Next is VietBank at 4.1%/year, followed by Eximbank, Nam A Bank, NCB, and OCB with an interest rate of 4%/year.

In general, the group of banks Eximbank, BaoViet Bank, VietBank, Vikki Bank, VCBNeo, OCB, NCB, Nam A Bank are the banks leading the market in terms of the highest interest rates for deposits with terms of less than 6 months.

After a sharp drop in deposit interest rates since late February, the number of banks maintaining interest rates above 4%/year for 1-5 month term deposits has also gradually decreased.

Currently, only 8 banks maintain the interest rate of 4%/year for online deposits with a term of 1 month. Meanwhile, 11 banks offer 2-month term; 14 banks offer 3-month term; 12 banks offer 4-month term and 15 banks offer 5-month term.

On the other hand, the Big 4 banking group is still maintaining the lowest interest rates in the market. Of which, Vietcombank is currently only maintaining an interest rate of 1.6%/year for 1-2 month term deposits; 1.9%/year for 3-5 month term deposits.

| INTEREST RATE FOR ONLINE DEPOSITS FOR 1-5 MONTHS TERM ON MARCH 29, 2025 (%/YEAR) | |||||

| BANK | 1 MONTH | 2 MONTHS | 3 MONTHS | 4 MONTHS | 5 MONTHS |

| VIETBANK | 4.1 | 4.1 | 4.4 | 4.5 | 4.5 |

| BAOVIETBANK | 3.5 | 3.6 | 4.35 | 4.4 | 4.5 |

| VCBNEO | 4.15 | 4.15 | 4.35 | 4.35 | 4.35 |

| VIKKI BANK | 4.15 | 4.2 | 4.35 | ||

| EXIMBANK | 4 | 4.2 | 4.3 | 4.6 | 4.6 |

| NCB | 4 | 4.1 | 4.2 | 4.3 | 4.4 |

| NAM A BANK | 4 | 4.1 | 4.2 | 4.2 | 4.2 |

| OCB | 4 | 4.1 | 4.2 | 4.2 | 4.6 |

| BVBANK | 3.95 | 4 | 4.15 | 4.2 | 4.25 |

| GPBANK | 3.5 | 4 | 4.02 | 4.04 | 4.05 |

| VIET A BANK | 3.7 | 3.9 | 4 | 4.1 | 4.1 |

| VPBANK | 3.8 | 4 | 4 | 4 | 4 |

| MB | 3.7 | 3.8 | 4 | 4 | 4 |

| HDBANK | 3.85 | 3.85 | 3.95 | 3.95 | 3.95 |

| MSB | 3.9 | 3.9 | 3.9 | 3.9 | 3.9 |

| LPBANK | 3.6 | 3.7 | 3.9 | 3.9 | 3.9 |

| ABBANK | 3.2 | 3.4 | 3.9 | 3.9 | 3.9 |

| BAC A BANK | 3.5 | 3.5 | 3.8 | 3.9 | 4 |

| VIB | 3.7 | 3.8 | 3.8 | 3.8 | 3.8 |

| SHB | 3.5 | 3.5 | 3.8 | 3.8 | 3.9 |

| TPBANK | 3.5 | 3.7 | 3.8 | ||

| PGBANK | 3.4 | 3.5 | 3.8 | ||

| KIENLONGBANK | 3.7 | 3.7 | 3.7 | 3.7 | 3.9 |

| PVCOMBANK | 3.3 | 3.4 | 3.6 | 3.7 | 3.8 |

| SACOMBANK | 3.3 | 3.5 | 3.6 | 3.6 | 3.6 |

| SAIGONBANK | 3.3 | 3.3 | 3.6 | 3.6 | 3.6 |

| TECHCOMBANK | 3.25 | 3.25 | 3.55 | 3.55 | 3.55 |

| ACB | 3.1 | 3.2 | 3.5 | 3.5 | 3.5 |

| SEABANK | 2.95 | 2.95 | 3.45 | 3.45 | 3.45 |

| AGRIBANK | 2.4 | 2.4 | 3 | 3 | 3 |

| BIDV | 2 | 2 | 2.3 | 2.3 | 2.3 |

| VIETINBANK | 2 | 2 | 2.3 | 2.3 | 2.3 |

| VIETCOMBANK | 1.6 | 1.6 | 1.9 | 1.9 | 1.9 |

| SCB | 1.6 | 1.6 | 1.9 | 1.9 | 1.9 |

Since the meeting on interest rates held by the State Bank with commercial banks on February 25, no domestic commercial bank has increased its deposit interest rates. On the contrary, 24 domestic commercial banks have reduced their deposit interest rates by 0.1-1.05% per year depending on the term.

In March, 20 domestic commercial banks reduced deposit interest rates from the beginning of the month, including: PGBank, Viet A Bank, Kienlongbank, Bac A Bank, Eximbank, LPBank, Nam A Bank, NCB, SHB, VCBNeo, VIB, Vikki Bank, MBV, BIDV, Techcombank, VietinBank, OCB, ABBank, BaoVietBank, BVBank.

Of which, Eximbank has reduced interest rates 4 times, Kienlongbank 3 times and PGBank twice since the beginning of the month.

Source: https://vietnamnet.vn/lai-suat-huy-dong-ky-han-duoi-6-thang-ngan-hang-nao-cao-nhat-2385580.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

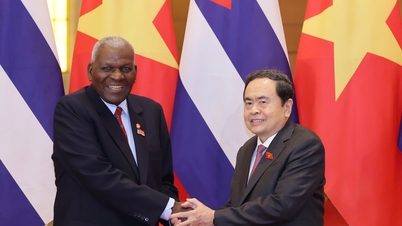

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)