|

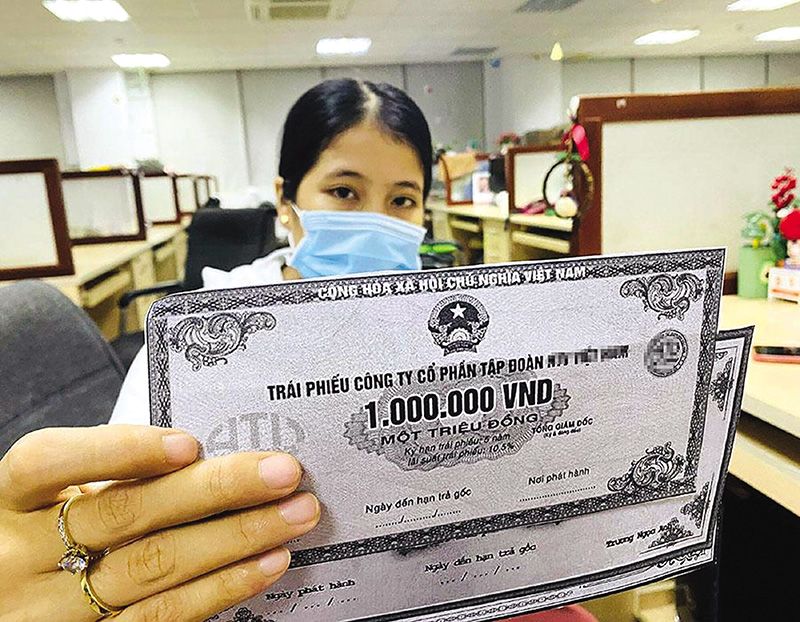

| The issuance of corporate bonds to the public will be tightened to increase safety. |

Bond issuance heats up

According to statistics from the Vietnam Bond Market Association (VBMA), August 2025 recorded public issuance activities reaching VND 6,332 billion, coming from 6 issuances of 4 organizations, including 3 banks and 1 infrastructure development company.

Specifically, Bac A Commercial Joint Stock Bank issued 2 tranches on August 25, 2025, with a total value of VND 1,500 billion; Ho Chi Minh City Development Joint Stock Commercial Bank issued 2 tranches, with a total mobilized value of more than VND 2,531 billion on August 20, 2025. Previously, on August 13, 2025, Viet A Commercial Joint Stock Bank issued VND 300 billion in bonds to the public.

The only non-financial enterprise participating in August is Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII) with a mobilized value of VND 2,000 billion, implemented on August 19, 2025. This is a bond convertible into common shares, without collateral, without warrants.

With the issuance value in August, the total value of bonds issued to the public in the first 8 months of 2025 has reached more than 47,800 billion VND, an increase of 30% compared to the whole year of 2024. This is also the highest issuance level in recent years.

Besides the recovering individual corporate bond market, the public issuance channel has been chosen by many organizations in recent times and tends to continue to increase.

After the August mobilization, on September 12, 2025, CII continued to approve the plan to offer convertible bonds to the public with a maximum total value of VND 2,500 billion.

Ba Ria - Vung Tau Housing Development Corporation (Hodeco, code HDC) has also approved a plan to raise VND500 billion through public bonds to restructure debt. These are unsecured bonds, without warrants, but are designed to be converted into common shares and only offered to existing shareholders.

Previously, Coteccons Construction Joint Stock Company (code CTD) had planned to issue bonds in 2025 with the intention of issuing to the public with a maximum face value of VND 1,400 billion. The company will finalize the list and collect shareholders' written opinions on this matter.

On the credit institution side, in early September, Viet A Bank decided to continue offering bonds to the public in the second round with a value of 300 billion VND.

Enterprises can raise capital through two forms: private offering and public offering. Unlike private offering which is only for professional investors, public offering is aimed at all investors in the market, so the requirements for the issuing organization are higher.

Tighten regulations

Recently, the Ministry of Finance has focused on perfecting the legal framework to create a foundation for businesses to mobilize capital openly and transparently, while supporting production and business development to serve the goal of economic growth.

Recently, the Government issued Decree No. 245/2025/ND-CP (Decree 245) dated September 11, 2025, amending and supplementing a number of articles of Decree No. 155/2020/ND-CP. In particular, a number of conditions related to the issuance of corporate bonds to the public were added to overcome existing shortcomings and limitations.

According to the provisions of Article 19 of the previous Decree 155/2020/ND-CP, in order to offer bonds to the public, the issuer or the bond registered for offering must have a credit rating if the total mobilized value in 12 months is greater than VND 500 billion and greater than 50% of equity, or the total outstanding bond debt is greater than 100% of equity. In addition, there are no other restrictions on the debt-to-equity ratio. This causes many businesses to issue bonds but do not ensure payment capacity, causing risks for investors.

To overcome this limitation, Decree 245 amended Clause 2, Article 19, requiring the issuer or the bond registered for offering to be credit rated by an independent credit rating organization, except for bonds of credit institutions or guaranteed for payment of all principal and interest by a credit institution, foreign bank branch, or international financial institution. The credit rating organization must also not be related to the issuer.

At the same time, the new Decree supplements the financial conditions of the issuing organization: liabilities (including the value of bonds expected to be issued) must not exceed 5 times the equity according to the most recent audited financial report, except for special cases such as state-owned enterprises, credit institutions, insurance companies, securities companies, fund management companies, etc.

In case of issuing bonds to the public to restructure debt, the enterprise is not allowed to change the purpose of capital use. If issued in multiple batches, the value of each bond at par value must not be greater than the owner's equity.

The improvement of the quality of corporate bonds issued to the public is clearly shown in Decree 245 with many new regulations. Previously, in June 2025, in the private bond market, the debt/equity ratio not exceeding 5 times was also stipulated in the Enterprise Law (amended). These "boundaries" are to ensure the financial capacity of the issuing organization and limit risks for investors.

The requirement for credit rating by an independent organization is considered an important new point, improving the quality of products for the market. Not only does it help businesses get used to the culture of credit rating, but it also increases the openness and transparency in public bond offering activities.

The third Vietnam Financial Advisors Summit 2025 (VWAS 2025), organized by the Finance - Investment Newspaper on Thursday, September 25, 2025 at Pullman Hotel (Hanoi), will gather leading domestic and international experts, focusing on in-depth discussions on the impact of new institutions and new dynamics on the economy and financial markets. The forum will also analyze in detail the breakthrough growth points of traditional investment asset classes as well as opportunities with crypto assets.

The forum includes activities:

The main workshop with 2 sessions presenting and discussing the topics "Support for market resilience"; "Finding breakthroughs for asset classes".

Honoring typical financial products/services in 2025 in the fields of banking, insurance, real estate, fund management, securities and financial technology.

Details: wwa.vir.com.vn

Source: https://baodautu.vn/phat-hanh-trai-phieu-doanh-nghiep-ra-cong-chung-them-luat-choi-moi-tang-do-an-toan-d386486.html

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)