Late payment of bond principal and interest

On July 31, 2024, Big Gain Investment Company Limited sent a document to the Hanoi Stock Exchange (HNX) announcing unusual information about the delay in principal and interest payments for the bond lot coded BGICH2124002. This bond lot was issued by Big Gain Investment on July 30, 2021 and has a term of 3 years, the maturity date is July 30, 2024 and the planned payment date is also July 30, 2024.

Illustration photo (Photo: TL)

The company will have to pay off the bonds to the bondholders with the interest of 108.3 billion VND and the principal of 1,000 billion VND. However, the company has only paid nearly 58.6 billion VND in bond interest and 561.9 billion VND in bond principal. The remaining amount for bond interest is 49.7 billion VND and the principal of the bond is 438 billion VND.

The reason given by Big Gain Investment for the delay in payment of principal and interest of bond lot BGICH2124002 is that the Company has not yet arranged a payment source. Currently, the enterprise is in the process of negotiating with investors about the schedule for payment of principal and interest.

According to data from HNX, in 2021, Big Gain Investment issued 4 bonds with a total value of VND 3,900 billion, term of 3 - 4 years, interest rate of 11%/year for the first interest period and the following periods interest rate equal to the sum of 4.5%/year and the average of the highest savings interest rate for individual customers.

All 4 bonds are individual bonds, non-convertible, without warrants and are all custodians of KS Securities JSC. A total of 3,900 billion VND of issued bonds were used by Big Gain to fulfill its payment obligations to the Group Corporation in Ho Chi Minh City under the general contract for design, consultancy and construction of the project dated January 9, 2019.

The collateral for all four bond issuances is the assets and property rights at the Phu Thuan Ward High-rise Housing Project, District 7, Ho Chi Minh City (implemented with the current investor of the project) and all property rights of the issuer arising from or related to the general contract and its appendices.

The above-mentioned collateral is also used to secure bonds offered privately by Xuan Dinh Construction Investment Joint Stock Company with a total face value of VND 3,300 billion in the first and second quarters of 2021 and bonds offered privately by a Housing Trading Joint Stock Company with a total face value of VND 3,300 billion in the second quarter of 2021.

How does Big Gain Investment work?

Big Gain Investment Company Limited was established in 2017, with its head office located at Commercial Area No. S1.A2.01.03, 1st Floor, Tower S1, No. 23 Phu Thuan, Tan Phu Ward, District 7, Ho Chi Minh City. The company operates in the field of real estate business, land use rights owned, used or rented.

Big Gain is led by Mr. Le Van Dung as General Director and legal representative. In addition to Big Gain, Mr. Le Van Dung is also the legal representative of Great Point Joint Stock Company and Forseti Real Estate Construction Joint Stock Company. Both companies are headquartered in Ho Chi Minh City and operate in the construction sector.

Big Gain had an initial registered charter capital of 150 billion VND but increased its capital rapidly afterwards. By July 2021, this real estate company increased its charter capital to 7,700 billion VND, which is 51 times more in just about 4 years. Despite the huge capital increase, the business results of this company are not commensurate.

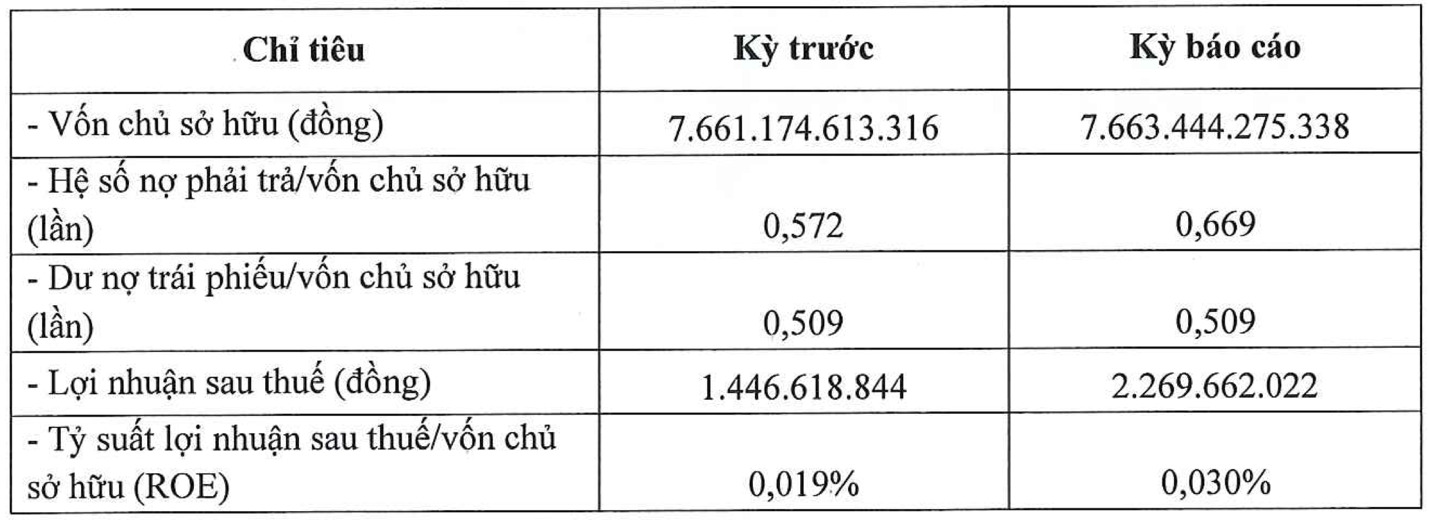

In recent years, Big Gain has only made a profit of a few billion VND. In 2023, this enterprise recorded a profit after tax of only nearly 2.27 billion VND, corresponding to a very low profit margin on equity of only 0.03%. In 2022, Big Gain's pre-tax profit was only over 1.44 billion VND. This figure in 2021 was nearly 1.6 billion VND.

By the end of 2023, Big Gain's total assets were VND 12,790 billion, up 6% compared to the beginning of the year. The increase was mainly financed by debt capital. Total liabilities at the end of 2023 were at VND 5,127 billion, an increase of nearly VND 745 billion compared to the beginning of the year and accounting for more than 36% of total capital. The bond debt/equity ratio is 0.509 times, meaning Big Gain has VND 3,900 billion in bond debt.

Source: https://www.congluan.vn/dau-tu-big-gain-tang-von-than-toc-nhung-lai-let-det-cung-khoan-cham-thanh-toan-goc-lai-trai-phieu-post308732.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)