Supply pressure surrounds coffee market

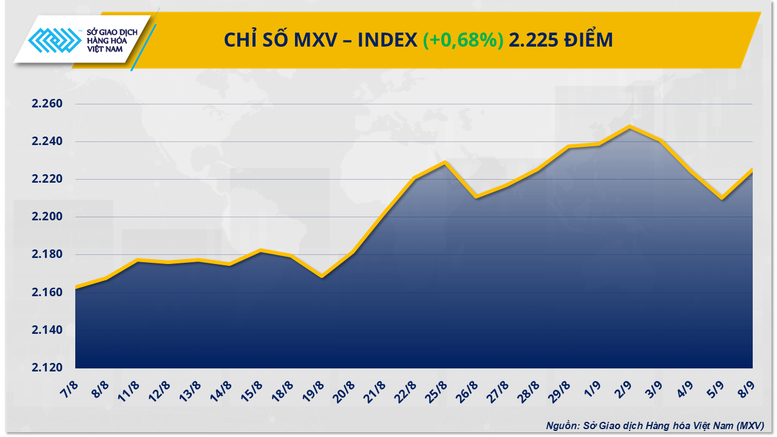

Closing yesterday's trading session, the industrial raw materials market witnessed strong buying power with 7/9 items increasing in price simultaneously. Of which, the price of Arabica coffee for December contract increased by 3% to 8,484 USD/ton while the price of Robusta coffee also recorded an increase of more than 2.8% to 4,430 USD/ton.

The world coffee market is facing a shortage of Arabica coffee in the 2025-2026 crop year. According to the latest report by Conab, the production of this type of coffee will decrease by more than 4 million bags (equivalent to 11.2%), down to more than 35 million bags. This decline is equivalent to 1/3 of the Arabica production of the second largest producer, Colombia, which was forecast by the US Department of Agriculture at 12.5 million bags. If this scenario becomes a reality, the market will face the reality that no country will be able to compensate for this supply gap in the global market.

In addition, the outlook for Brazil's coffee production in the 2026-2027 crop year is also raising concerns in the market, as the country has just experienced unusual weather phenomena not recorded in at least the past 4 years in its main growing regions. According to research by the Cerrado Coffee Exporters Cooperative (Expocacer), the frost that occurred on August 11 could reduce the production potential of the next crop by about 5.5%, equivalent to the loss of about 412,000 bags of coffee.

On the other hand, the rise in coffee prices has been somewhat restrained after US President Donald Trump recently signed an executive order reducing the reciprocal tax to 0% for many products that the US cannot produce, exploit or meet domestic demand. Accordingly, coffee is on the list of products proposed to be exempted from tax, contributing to somewhat limiting the rise of this product in the international market.

In the domestic market, Vietnam Customs reported that coffee exports in August increased by 11% compared to the same period last year, reaching 84,000 tons. However, the cumulative amount of coffee exports in the first 11 months of the current coffee crop year (from October 2024 to September 2025) was recorded to be 45,500 tons lower than the same period last year, with a total volume of 1.3 million bags.

In addition, the General Statistics Office of Vietnam also said that the value of coffee export turnover in the first 8 months of 2025 reached about 6.50 billion USD, a sharp increase of 61.1% over the same period last year.

Regarding production, the new coffee harvest in the Central Highlands has just begun in some provinces with early harvests by the end of August, but the output is still very limited. The main crop is expected to start from the end of October and be harvested in November. End-of-season inventories are showing signs of tightening. Coffee transactions in the first week of the month were somewhat gloomy, with farmer agents temporarily suspending sales, waiting to see price developments, while warehouses had no clear buying activity.

Not outside the general market trend, the metal group also recorded green covering most of the key commodities in the group. Notably, iron ore prices continued to rise in yesterday's session, up 0.55% to 105.42 USD/ton - the highest level since late February, marking a series of 5 consecutive sessions of increase. The main driving force came from market expectations on the consumption prospect in China, when the country imported more than 105.2 million tons in August, a slight increase compared to July.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-chi-so-mxv-index-quay-dau-phuc-hoi-sau-ba-phien-suy-yeu-lien-tiep-102250909103341662.htm

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

Comment (0)