Businesses benefit from 24/7 electronic tax payment

Previously, to complete tax obligations, businesses had to spend 1-2 days, depending on bank working hours, but now with just a few online steps, businesses can pay taxes at any time, even on holidays. In particular, expanding payment methods through third parties helps overcome system congestion during peak hours, ensuring a smooth tax payment process.

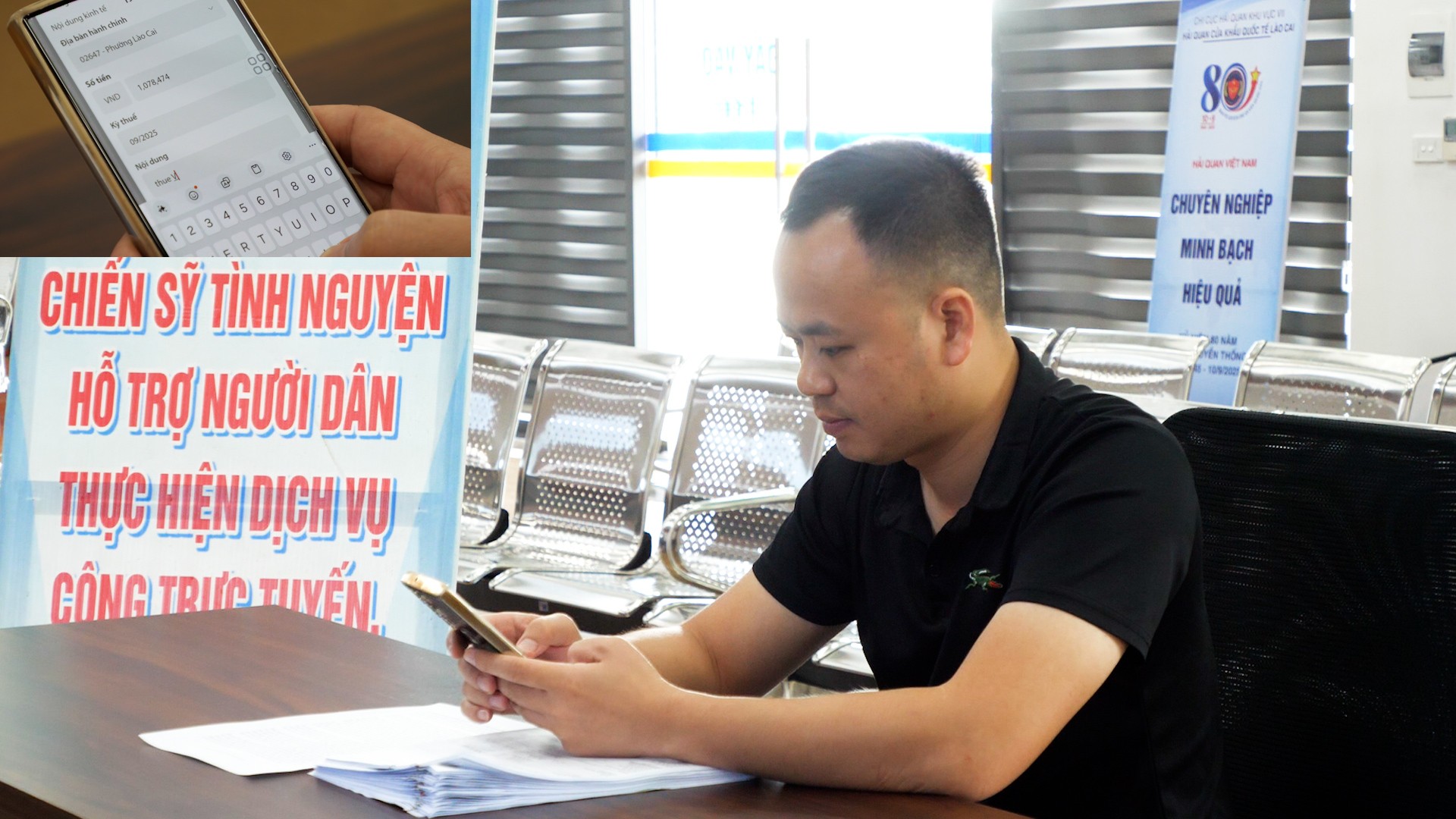

Mr. Ngo Tien Bang, representative of Long Hung Import Export Company, shared: We can pay taxes 24/7 on the Customs portal, or through banks, or through intermediary organizations with internet banking. The procedure is significantly shortened, helping businesses complete customs clearance documents quickly, without interrupting production and business progress.

After just over a month of implementation, over 99% of businesses have implemented electronic customs tax payments, directly connected to the commercial banking system and intermediary organizations, and processed continuously 24/7. This solution not only shortens customs clearance time, but also makes tax payments transparent, minimizing cash transactions.

Customs proactively transforms digitally, creating favorable conditions for businesses

According to Ms. Nguyen Thi Thanh Binh, Deputy Head of Lao Cai International Border Gate Customs: The new highlight is that businesses have many options for different channels and methods of tax payment. 24/7 electronic tax payment not only shortens the time but also improves accuracy and transparency in tax management.

According to the report of the Customs Branch of Region VII, up to now, there have been 670 enterprises participating in import and export. The total import and export turnover since the beginning of the year has reached more than 1.16 billion USD. The promotion of information technology application, especially in electronic tax management, has helped to strongly reform administrative procedures, creating maximum favorable conditions for enterprises.

Mr. Nguyen Minh Thanh, Deputy Head of the Customs Branch of Region VII, emphasized: The Customs Department will continue to promote procedural reform, especially focusing on digital transformation, ensuring strict management while still creating favorable conditions for businesses. This is the foundation for moving towards a digital - paperless customs model.

Synchronous benefits for the State, enterprises and banks

For customs authorities, the application of electronic tax helps shorten the steps in administrative procedures, reduce manual processing pressure, and improve management efficiency. At the same time, this is also an important solution to implement the non-cash payment project under the direction of the Prime Minister .

For businesses, the benefits are clearly shown in reducing customs clearance time, being more proactive in production and business planning, and limiting traffic congestion, especially at key border gates such as Lao Cai.

For banks and intermediary organizations, participating in the electronic tax system also creates opportunities to expand services, increase convenience for customers, and reduce paperwork and verification.

Towards a digital Customs model

The implementation of e-customs tax is an important step in the digital transformation roadmap of the Customs sector. This is also a concrete solution to realize the spirit of Resolutions No. 66-NQ/TW and 68-NQ/TW of the Politburo on administrative procedure reform, facilitating the development of the private economy.

In the coming time, the Customs authority will continue to expand the scope of connection, improve technical infrastructure, diversify payment channels, and tighten control to prevent trade fraud. The goal is to build a modern, transparent, professional e-Customs that meets the requirements of international integration.

E-customs tax not only helps businesses save time and costs but also contributes to improving competitiveness in import and export. More importantly, this is an inevitable step on the path of digital transformation of the Customs sector, towards a modern, transparent management system, accompanying the development of the business community.

Source: https://baolaocai.vn/thue-dien-tu-hai-quan-go-nut-that-cho-doanh-nghiep-xuat-nhap-khau-post882924.html

![[Photo] Prime Minister Pham Minh Chinh attends the groundbreaking ceremony of two key projects in Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/6adba56d5d94403093a074ac6496ec9d)

Comment (0)