Many banks "finish" first

On the afternoon of June 16, the State Bank announced a reduction in operating interest rates. This is the fourth consecutive reduction since mid-March 2023. In particular, the ceiling on deposit interest rates is one of the most concerned contents in the market.

Accordingly, from June 19, the maximum interest rate applied to non-term deposits and deposits with terms of less than 1 month remains at 0.5%/year; the maximum interest rate applied to deposits with terms from 1 month to less than 6 months decreases from 5.0%/year to 4.75%/year, while the maximum interest rate for deposits in VND at People's Credit Funds and Microfinance Institutions decreases from 5.5%/year to 5.25%/year; the interest rate for deposits with terms of 6 months or more is determined by credit institutions based on the supply and demand of capital in the market.

It can be seen that the ceiling interest rate for deposits with terms from 1 month to less than 6 months has decreased from 5.0%/year to 4.75%/year. Currently, many banks have "reached the finish line" early with the "ceiling" of 4.75%/year.

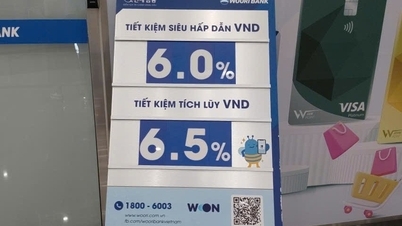

From June 19, the ceiling interest rate for deposits with terms of less than 6 months will be reduced to only 4.75%/year. Therefore, banks that are applying high interest rates for short terms are of interest. Illustrative photo

The Big 4 group (including Vietnam Joint Stock Commercial Bank for Foreign Trade - Vietcombank, Vietnam Joint Stock Commercial Bank for Investment and Development - BIDV, Vietnam Joint Stock Commercial Bank for Industry and Trade - VietinBank and Vietnam Bank for Agriculture and Rural Development - Agribank ) all apply an interest rate of 4.6%/year for a 3-month term and 4.1%/year for a 1-month term.

Some joint stock commercial banks also finished early, such as Southeast Asia Commercial Joint Stock Bank - SeaBank (4.7%/year), Vietnam Public Commercial Joint Stock Bank - PvcomBank (4.5%/year), DongA Commercial Joint Stock Bank - DongA Bank (4.5%/year). The applicable terms are 3 months and 1 month.

Not only does DongA Bank have low short-term interest rates, it has also pushed long-term interest rates down to below 7% per year. Specifically, the interest rates for 6-month and 12-month contracts at DongA Bank are 6.59% per year and 6.94% per year.

Find the bank with the highest interest rate

While the difference in long-term interest rates between banks is very high, the difference in short-term interest rates (less than 6 months) is quite modest. Currently, there are still quite a few banks listing short-term interest rates higher than 4.75%/year. However, the “higher” level is quite modest.

5%/year is the highest rate applied by many banks for 1-month and 3-month terms. Some names that can be mentioned are Vietnam Technological and Commercial Joint Stock Bank – Techcombank, Vietnam Prosperity Joint Stock Commercial Bank – VPBank, Asia Commercial Joint Stock Bank –ACB ,…

At a rate lower than 4.8%/year (1-month and 3-month terms) applied by some banks such as VietA Bank, Lien Viet Post Joint Stock Commercial Bank - LPBank.

Meanwhile, many banks apply 4.8%/year for 1-month term but maintain higher policy (from 4.9%/year to 5%/year) for 3-month term. These are Military Commercial Joint Stock Bank – MB (4.9%/year), Orient Commercial Joint Stock Bank – OCB (4.95%/year), Saigon Thuong Tin Commercial Joint Stock Bank – Sacombank (5%/year).

It can be seen that from June 19, this list will have many fluctuations and the highest rate applied will only be 4.75%/year.

The interest rate differential between short and long terms is very high.

The interest rate ceiling does not apply to long terms. However, adjustments show that short-term interest rates decrease, so do long-term interest rates. Previously, at some banks, 6-month and 12-month interest rates were listed at over 9%/year, but before “G-hour”, this rate was only slightly above 8%/year.

“Closing” this week, the highest 6-month term interest rate is 8.2% at An Binh Commercial Joint Stock Bank (ABBank) and 8.1%/year at Global Petroleum Commercial Joint Stock Bank (GPBank).

For 12-month term, the highest rate is 8.3%/year applied by GPBank and ABBank. PVComBank listed the interest rate at 8.2%/year.

For long term, Big 4 group applies the lowest rate, only 5.5%/year (6 months) and 6.8%/year (12 months).

Terms under 6 months have much lower interest rates than long terms but are still chosen by many businesses because they need to ensure a large enough cash flow to finance debt repayment and liquidity activities.

Source

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)