SGGP

In the context of the corporate bond market facing many challenges, businesses have difficulty mobilizing new capital, while the burden of maturing bonds is large, the upcoming launch of the corporate bond trading "market" is expected to be a boost for this market in the near future.

|

| Transaction at a bank in Ho Chi Minh City. Photo: HOANG HUNG |

More than 130,000 billion VND matures by the end of the year

After a period of "freezing", in 2023 the market recorded successful corporate bond issuances. Statistics from the Vietnam Bond Market Association (VBMA) as of early June 2023, the total value of corporate bond issuance was about VND 35,513 billion with 7 public issuances and 19 private issuances worth VND 29,992 billion.

In general, the corporate bond market has shown positive signs thanks to policies that have been continuously issued in recent times. In particular, Decree 08 of the Government issued from March 2023, amending and supplementing a number of provisions of decrees on individual corporate bonds, aiming to resolve temporary difficulties and hopes to restore confidence in the corporate bond market. Accordingly, not only have enterprises successfully issued new batches of corporate bonds, but they also have a legal basis to restructure, extend corporate bonds or pay corporate bonds with other assets within 2 years.

Statistics from the Vietnam Stock Exchange (VNX) show that many businesses have successfully negotiated with investors to extend and convert into assets, including some large issuers such as Bulova Real Estate Group, Hung Thinh Land Joint Stock Company... Most recently, in June 2023, Novaland Real Estate Investment Group also negotiated with bondholders and successfully extended 2 bond lots with a total issuance value of VND 2,300 billion, with a repayment term until 2025. Along with that, businesses also continue to buy back corporate bonds before maturity, with a cumulative amount from the beginning of the year to date reaching VND 99,041 billion, an increase of nearly 51% over the same period in 2022.

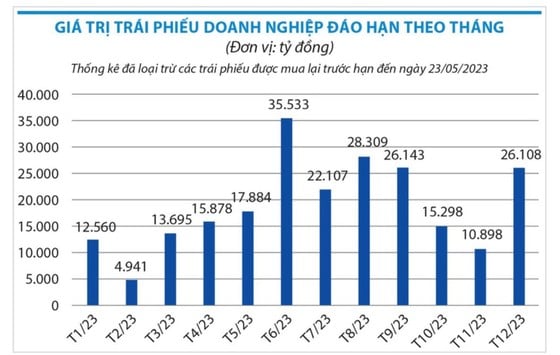

However, according to calculations by securities companies, in the remaining 6 months, the total value of corporate bonds that will mature is more than 130,000 billion VND, most of which belongs to the real estate group with 87,846 billion VND (accounting for 52%) and then the banking group with 30,261 billion VND (accounting for 17.8%). Statistics from Finn Group show that, to date, the market has recorded more than 100 issuers that are slow to fulfill their corporate bond debt obligations with a total value of hundreds of thousands of billion VND. According to calculations by HSC Securities Company, in the base scenario, the volume of corporate bonds that are slow to pay could reach 77.4 trillion VND by the end of this year.

|

Listing of individual bonds on the stock exchange

In addition to the convenience of extending bonds in the past time, a new boost is expected: the birth of a bond trading floor. According to the Ministry of Finance , it is expected that the corporate bond trading floor will be put into operation this July. Putting the corporate bond market with a scale of more than 1.1 million billion VND (accounting for 11.6% of GDP in 2022) into official trading is expected to increase liquidity for the secondary individual bond market, making transactions more convenient, while increasing the transparency and standardization of this market, thereby regaining investors' confidence in the corporate bond market.

Vietnam Securities Depository (VSD) is currently coordinating with Hanoi Stock Exchange (HNX) to build the HNX's individual bond trading system and the VSD's individual bond trading registration, depository, and payment system with a mechanism to connect and synchronize information and investor accounts registered for trading to strengthen management, ensuring that investors in individual bond trading are the right subjects according to the provisions of law. Individual bonds are traded by negotiation with a transaction scale that is often quite large, so the transaction payment will be carried out by VSD according to the instant payment mechanism for each transaction, with a T+0 payment cycle. The draft regulations on registration, depository, and payment of individual bond transactions will be issued in the near future. In addition, VSD's preparations are basically completed, ensuring that the registration, depository, and payment system for individual bond transactions is ready to go into operation.

According to financial experts, opening a private bond trading floor will help bondholders have more opportunities to sell corporate bonds themselves if they find buyers, and thereby help businesses reduce some of the debt collection pressure from bondholders. “Many investors holding corporate bonds place their hopes on the supervision and sanctioning capacity of the State Securities Commission. Once a secondary transaction is formed, both parties must comply with the agreements with each other and have a competent authority to monitor that compliance. If one party violates the commitment, there will be sanctions to avoid widespread risks and investors losing confidence as is happening now,” said the leader of Bao Viet Securities Company.

Mr. NGUYEN QUANG THUAN, General Director of FinnGroup: "Investors need to know that, in fact, through banks and securities companies... the buyer and seller have agreed with each other, listing is to legalize the transaction of both parties. Corporate bonds are not as liquid as stocks, but listing corporate bonds is to make information transparent, contribute to verifying the status of transparent bondholders, and limit disputes"

Source

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)