USD exchange rate today (June 25): Early morning of June 25, the State Bank announced the central exchange rate of Vietnamese Dong to USD increased by 21 VND, currently at: 23,732 VND.

USD exchange rate in the world last week

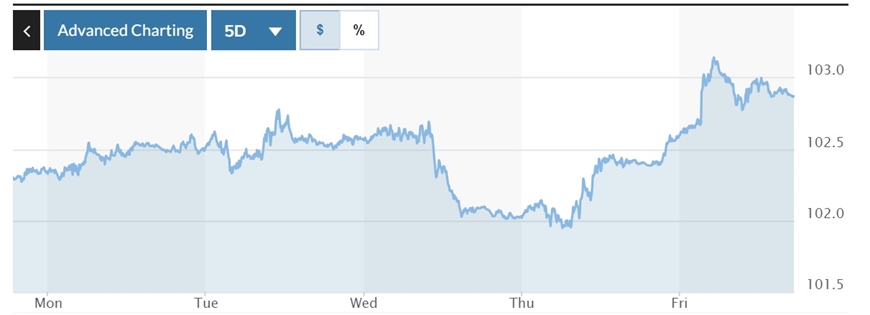

The USD Index (DXY), which measures the greenback's movements against six major currencies, stood at 102.87, up 0.61%.

|

| DXY Index volatility chart over the past week. Photo: Marketwatch. |

The US dollar continued its gains from the previous weekend, rising 0.25% to 102.49. Currency market moves have been dominated by efforts by central banks around the world to curb high inflation, with the DXY index posting its biggest weekly decline since January last week after the US Federal Reserve (Fed) skipped a rate hike in June.

The greenback edged up against the euro on June 21 after new data showed U.S. home sales began to rise, as traders awaited testimony from Fed Chairman Jerome Powell for more clarity on the outlook for monetary policy.

However, on June 22, the DXY index reversed and fell 0.46% to 102.08, after comments from Chairman Jerome Powell on the central bank's fight against inflation did not meet market expectations. Accordingly, the head of the Fed shared that the fight against inflation is still "a long way ahead", and although recent interest rate hikes have been paused, borrowing costs may need to rise further. He also emphasized that although inflation is still far from the Fed's target, the Fed may still need to raise interest rates at a more moderate pace.

The greenback recovered its gains in the final two trading days of the week (June 23 and 24), returning to near 103, after dismal business activity data from around the world boosted risk sentiment and as hawkish comments from central banks added pressure on riskier currencies. According to new data released on June 23, US business activity fell to a three-month low in June, as services growth fell for the first time this year and the contraction in the manufacturing sector deepened.

In contrast, the euro fell 0.57% to $1.08925, its lowest in three days against the dollar. Against the Japanese yen, the dollar rose 0.44% to 143.76 yen, its highest in more than seven months. The Japanese currency came under renewed pressure as the Bank of Japan (BOJ) maintained its ultra-dovish stance. Meanwhile, the pound fell 0.30% to $1.271.

|

| USD exchange rate today June 25: USD "swims against the current" to increase again. Illustration photo: Reuters. |

Domestic USD exchange rate today

In the domestic market, at the end of the trading session on June 23, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD unchanged, currently at: 23,732 VND.

* The reference exchange rate at the State Bank's buying and selling exchange center remains unchanged, currently at: 23,400 VND - 24,868 VND.

USD exchange rates at commercial banks for buying and selling are as follows:

USD exchange rate | Buy | Sell out |

23.30 VND | 23,690 VND | |

Vietinbank | 23,315 VND | 23,735 VND |

BIDV | 23,371 VND | 23,671 VND |

* The Euro exchange rate at the State Bank's buying and selling exchange center decreased slightly to: 24,698 VND - 27,298 VND.

Euro exchange rates at commercial banks for buying and selling are as follows:

Euro exchange rate | Buy | Sell out |

Vietcombank | 25,154 VND | 26,297 VND |

Vietinbank | 24,762 VND | 26,052 VND |

BIDV | 25,279 VND | 26,419 VND |

MINH ANH

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)