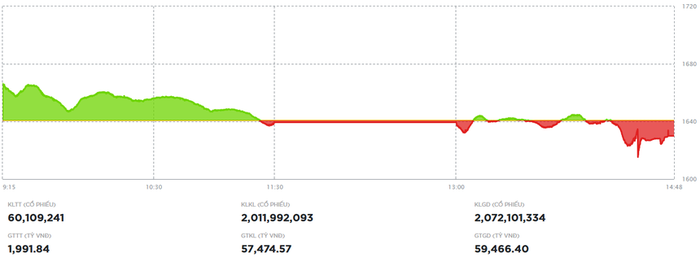

At the end of the trading session on August 15, VN-Index lost 10.69 points, equivalent to 0.65%, falling to 1,630 points. The entire HOSE floor recorded 84 stocks increasing and 261 stocks decreasing. Liquidity reached more than 2.07 billion units, with a trading value of VND59,466.4 billion, up 14% and 13% respectively compared to the previous session. Negotiated transactions alone contributed more than 59 million units, worth VND1,902 billion.

Overall for the week, VN-Index still increased by 45 points, equivalent to 2.84%.

Mixed developments

During the morning session, the index increased by more than 20 points at times thanks to support from some banking stocks and bluechips. However, red quickly dominated, causing the VN-Index to narrow its increase and reverse to decrease at the end of the session.

In the afternoon session, selling pressure spread, many large and small stocks fell simultaneously, causing the index to fall below 1,625 points at times. Although supply slowed down at the support zone, cautious sentiment prevented demand from increasing strongly, and the VN-Index struggled until closing.

Stock Highlights

In the banking group, MBB and VPB were the two most notable codes. VPB increased 1% to 31,100 VND with 64.8 million units matched; MBB increased 2.4% to 28,250 VND, setting a record of more than 117.4 million units matched.

In the bluechip group, VJC suddenly broke out, at times hitting the ceiling before closing the session +6.82% to 145,600 VND, becoming the biggest support pillar of the market.

On the contrary, many large stocks were under pressure to correct: TCB, DGC, GVR,FPT , CTG, STB, BID, LPB decreased from 2% to 3%. The real estate group was under strong selling pressure, NBB and DLG hit the floor, along with HPX, LGL, LDG, NHA, NLG, TCH, DC4, HHS, QCG lost 4-5%.

Some small and medium-sized stocks still maintained purple color such as VIX, ORS, DSC, VSC, BSR , VRC, MHC. In addition, codes CRE, PET, EIB, DCL, CII, HSL, TCO increased sharply from 3% to more than 6%.

Developments on HNX and UpCoM

On the HNX floor, the HNX-Index decreased by 2.81 points (-0.99%) to 282.34 points, with 50 stocks increasing and 133 stocks decreasing. The matched volume reached more than 210.9 million units, worth VND5,021.9 billion; negotiated transactions reached 10.9 million units, worth VND516.8 billion.

Some small stocks still surprised, such as IVS, IPA, GKM, LIG, which hit the ceiling; VFS increased by more than 5% to 20,600 VND. However, high-order codes such as CEO, IDJ, HUT decreased by 4-5%, APS lost 7.8% to 11,800 VND. SHS only decreased slightly by 1% to 25,300 VND but led the liquidity with 43.5 million units.

On UpCoM, UpCoM-Index decreased 0.34 points (-0.31%) to 109.61 points. Liquidity reached more than 129.5 million units, worth 1,484.3 billion VND. BGE shares were a rare bright spot, increasing 6.9% to 6,200 VND with 4.69 million units matched. HNG, ABB, BVB codes traded actively with more than 9-11.3 million units but all decreased 2-4%.

Derivatives and warrants market

In the derivatives market, 14I1F8000 futures contract decreased by 12 points (-0.67%) to 1,781 points, matched more than 332,000 units, open volume more than 56,200 units.

In the warrant market, red dominated. CHPG2406 led the liquidity with more than 7 million units, down 2.4% to 1,630 VND/unit. CMWG2511 followed with 5.4 million units, down 14% to 1,970 VND/unit.

The session on August 15 recorded a correction after a long increase, reflecting increased profit-taking pressure and cautious investor sentiment. Although the VN-Index fell more than 10 points, the index still maintained its gains for the week. Market developments show that money has not been withdrawn, but the possibility of fluctuations still exists, especially when pillar stocks such as banks and real estate show signs of strong differentiation.

Source: https://phunuvietnam.vn/vn-index-dieu-chinh-giam-diem-sau-chuoi-9-phien-tang-lien-tiep-20250815170808246.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)