The Vietnamese stock market started the new trading week (July 7) with a flourishing performance. Green covered all indices during the entire trading period. The focus of today's session was the strong breakthrough of large-cap stocks. The VN-Index surpassed the psychological mark of 1,400 points for the first time since April 2022. The VN30-Index also officially surpassed the 1,500 point mark.

At the end of the session, VN-Index increased by 15.09 points (+1.09%) to 1,402.06 points. VN30-Index increased by 19.89 points (+1.34%) to 1,508.66 points. On the Hanoi Stock Exchange, HNX-Index and HNX30 also increased by 3.39 points and 8.3 points, respectively. Market liquidity was vibrant with the transaction value of all three exchanges reaching nearly VND28,800 billion. Of which, the VN30 group alone contributed more than VND14,250 billion. The entire market had about 500 stocks increasing in price, double the number of stocks decreasing, showing a wide spread.

Cash flow entered the market strongly from the morning session, focusing mainly on banking, securities and steel groups. Vietinbank (CTG) contributed 2.19 points, contributing the most to the index's increase. Followed by BID, VPB, VIC,SHB and VHM.

SHB shares were the focus of cash flow today when attracting strong demand. The trading value during the session was a record high with 6% of the outstanding shares "changing hands". In addition to becoming the most liquid stocks in the whole market with a trading value of 3,377 billion VND, SHB shares increased sharply from 2:00 p.m.

|

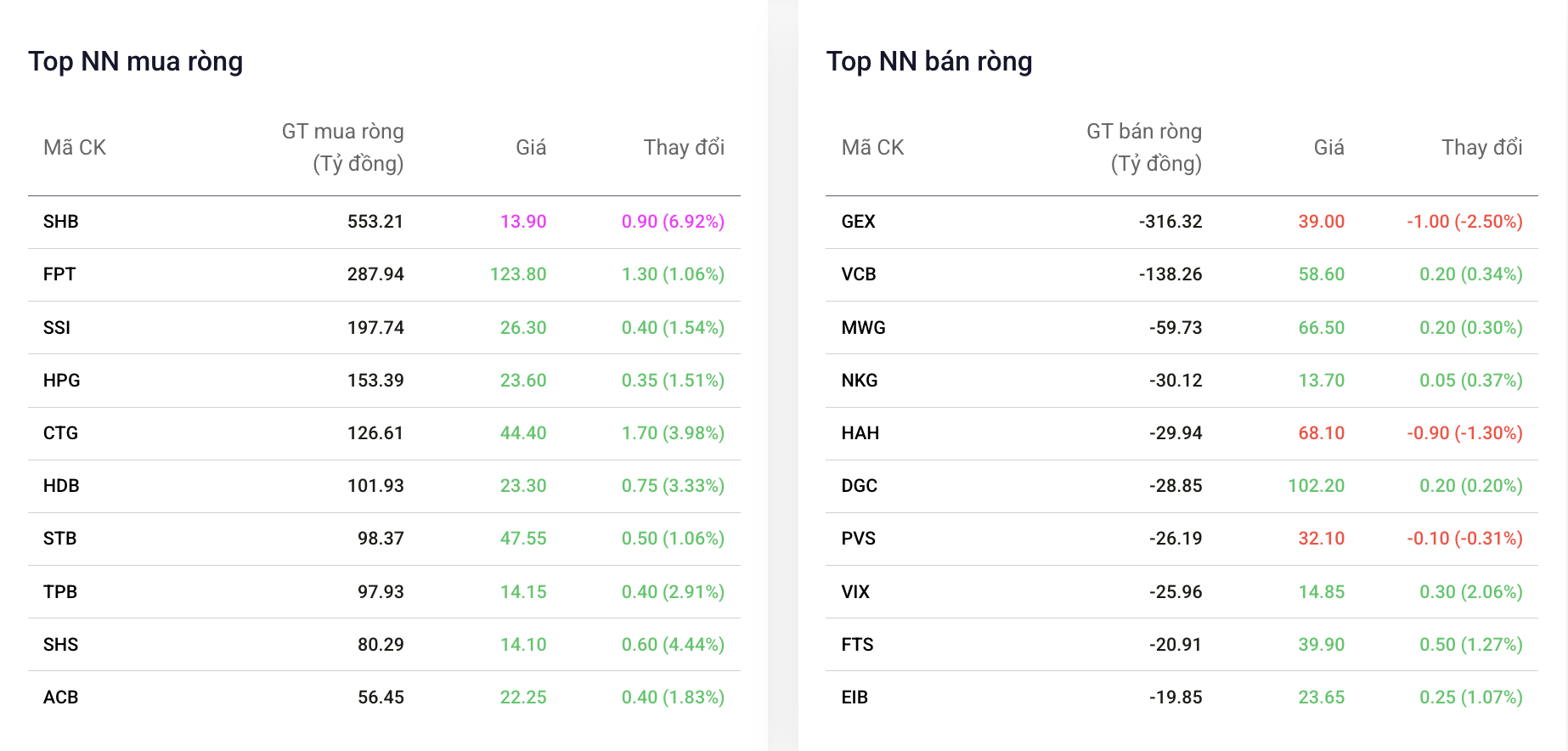

| Top stocks traded by foreign investors. |

Steel industry stocks increased positively after the official announcement of anti-dumping tax. Specifically, after the investigation, the Ministry of Industry and Trade has just issued an official decision to impose anti-dumping tax on some hot-rolled steel (HRC) products imported from China from July 6. According to the decision, the anti-dumping tax on some Chinese hot-rolled steel products ranges from 23.1% to 27.83%, applied from July 6 and lasting for 5 years, unless extended, changed or canceled according to regulations. Hoa Phat shares increased by 350 VND/share, closing at 23,600 VND/share.

Foreign investors maintained a streak of 4 consecutive net buying sessions, with a total value of VND1,257 billion today on all 3 exchanges. Since the beginning of July, foreign capital has net bought nearly VND5,900 billion. Leading the list of net buying is still the stock in focus of the session (SHB). Foreign investors spent VND553 billion to collect more SHB shares.

Many other stocks also received hundreds of billions of VND in disbursements, such as FPT (287 billion), SSI (197 billion), HPG (153 billion), CTG (127 billion), HDB (102 billion). The stocks in the top net buying list of foreign investors all increased positively in price. On the contrary, GEX was the most net sold (316 billion VND), followed by VCB, MWG and some mid-cap stocks. Gelex shares fell 2.5% today. Meanwhile, despite being net sold nearly 140 billion VND, VCB shares still increased slightly by 0.34%.

According to the analysis team of Vietcombank Securities Company (VCBS), the fact that VN-Index surpassed the 1,400-point mark is a positive sign, showing that the current uptrend is still being maintained by large-cap stocks.

“We recommend that investors continue to hold stocks in an uptrend, but should limit buying when stocks have increased sharply. The market is still in the main uptrend, however, investors still need to maintain a stable mentality, be patient, and only disburse when the market fluctuates,” experts from VCBS recommended.

VCBS also advised investors to keep an eye on the banking, securities and retail sectors. These are sectors expected to continue attracting cash flow in the second half of the year.

Source: https://baodautu.vn/vn-index-lan-dau-vuot-1400-diem-sau-hon-ba-nam-bung-no-giao-dich-co-phieu-shb-d325144.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)