Stock investors start to suffer heavy losses

After leaving the 1,700-point peak, VN-Index continued to fluctuate within a narrow range for a week, mainly accumulating around the 1,660-point mark. At the end of the week, the index increased slightly by 0.13% to 1,660 points, maintaining above the psychological support zone of 1,600 points; VN30-Index decreased by 0.37% to 1,852 points, while HNX-Index decreased by around 276 points. The general movement showed a clear probing state: decreasing at the beginning of the week, recovering at the end of the week but with strong differentiation and low liquidity.

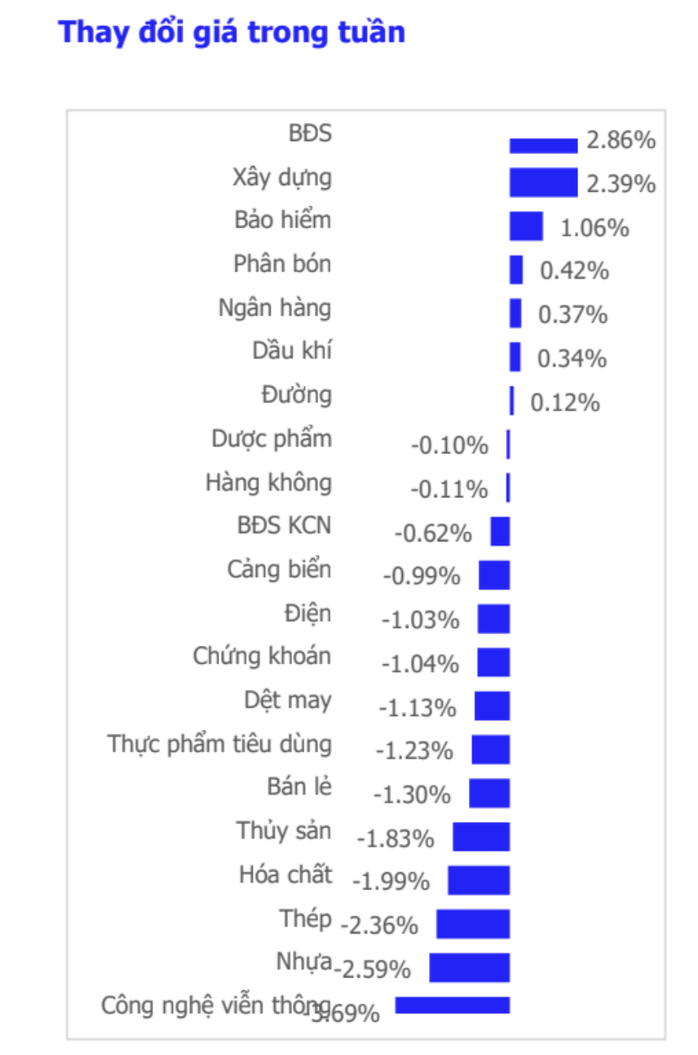

The developments by industry group are quite uneven. Construction increased positively; insurance, oil and gas and industrial zones recovered. On the contrary, technology - telecommunications, steel, retail, seaports, real estate, securities and fertilizers are under pressure to adjust.

Notably, the index closed the week in green, but the experience of many investors was mixed: their accounts were still down compared to the peak of 1,700 points because most stocks were weaker than the index.

VN-Index closed the week in green, but many investors' accounts are suffering heavy losses compared to the peak of 1,700 points.

According to SHS Securities Company, liquidity on the HoSE floor has decreased for the second consecutive week, with the average matched volume remaining at about 910 million units/session, significantly lower than the average of 1.67 billion units/session in August. The cautious cash flow is reflected in the fact that only a few large-cap stocks pulled up the score, while the rest were less active.

Foreign investors continued to sell net for the 10th consecutive week, this week alone withdrawing a net of VND7,355 billion; the cumulative net selling value of foreign investors since the beginning of the year has reached VND96,522 billion. The prolonged net selling pressure has made domestic sentiment more cautious, especially during the uptrends.

Although the VN-Index is only about 40 points away from its historical peak, many investor accounts have reported losses of 10-15%; for accounts with high margin lending rates, the decrease can be as high as 20-25%. Ms. Thanh Hoang (HCMC) said that her banking and securities portfolio has been flat for 2-3 weeks, with many stocks falling 10-15% after the correction from the 1,700-point zone, making capital turnover difficult as liquidity in the entire market has shrunk.

What should investors do?

Mr. Nguyen Thai Hoc, analyst of Pinetree Securities Company, commented that last week the market fluctuated in a state of “green on the outside, red on the inside”. In the last two sessions of the week, VIC and VHM alone contributed more than 14 points to the VN-Index, but the general index only increased by more than 3 points, showing weak market breadth.

“Low liquidity reflects that new investors are hesitant to participate, while holders do not want to sell at low prices. Real estate and public investment have shown signs of recovery, but the capitalization scale is not enough to create momentum for spreading,” he said.

According to Mr. Hoc, entering the new trading week, the basic market picture will not change much: narrow fluctuation range, declining liquidity, and undistributed cash flow. The tug-of-war scenario is still prioritized, with the possibility of re-testing support levels before forming a clearer trend. It is not excluded that the VN-Index will have a retreat to around 1,600 points, especially when foreign investors continue to maintain the net selling trend.

The positive point is that the banking group is showing signs of forming a short-term bottom; if it stabilizes again, this could be an "anchor" to help the index maintain its base and accumulate towards challenging the old peak in the coming time.

CSI Securities Company believes that the probability of an explosion next week is not high unless liquidity improves significantly. Therefore, investors should maintain a moderate stock proportion, prioritizing codes with a tight accumulation base, positive third-quarter business results, benefiting from public investment disbursement or private stories (industrial parks, construction, some oil and gas - utilities).

With a profitable portfolio, you can take advantage of technical corrections to increase but need to set a disciplined principle on the stop loss point. With a negative portfolio, limit the use of margin, focus on restructuring to stocks that show relative strength better than the market.

Stock price fluctuations by industry last week. Source: CSI

Source: https://nld.com.vn/vn-index-xanh-vo-do-long-nha-dau-tu-chung-khoan-bat-dau-lo-nang-196250927232118981.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)