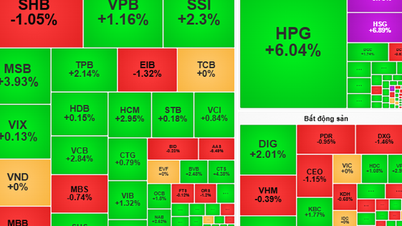

VN-Index increased by 4 points in the session on September 26, to 1,291 points and at one point approached 1,300 points thanks to foreign money actively pouring into large-cap stocks.

Following the increase in the previous two sessions, VN-Index opened the trading session on September 26 in green and maintained this state throughout the session.

The index representing the Ho Chi Minh City Stock Exchange increased by more than 11 points compared to the reference point at one point, approaching 1,300 points. Before closing, selling pressure at high prices appeared and caused the index to narrow its increase range. The VN-Index closed at 1,291.49 points, accumulating 4 points compared to yesterday's session.

Previously, some experts said that investors should continue to maintain their account proportion and limit buying to chase the strong increase. Investors can take advantage of the fluctuations to increase the proportion of industries that are attracting good cash flow, such as securities, banking, and steel.

These are also the groups that increased strongly in today's session. Specifically, banking stocks traded enthusiastically when most of them closed above the reference price. In the list of 10 stocks that positively impacted the VN-Index, there are 7 representatives in this group.

Specifically, HDB led the list when accumulating 3.85% to 28,300 VND. Next, TPB increased to the full range to 16,650 VND and closed with no sell side, CTG increased 1.11% to 36,400 VND, TCB increased 1.26% to 24,100 VND, MSB increased 5.44% to 12,600 VND, VPB increased 0.77% to 19,600 VND and SSB increased 2.1% to 17,000 VND.

The momentum for growth also came from pillar codes of many other industries such as real estate, securities, oil and gas... Specifically, in the real estate group, LDG hit the ceiling at 2,160 VND and closed the session in a state of no selling. Next, KHG and NVL both increased by 1.3%, to 5,370 VND and 11,550 VND respectively, IJC increased by 1.1% to 13,700 VND.

On the other hand, VCB lost 0.32% to VND92,500 and became the main factor holding back the market's increase in today's session. Next, HVN decreased 2.07% to VND21,250, HPG decreased 0.57% to VND26,050,ACB decreased 0.76% to VND26,000, FPT decreased 0.37% to VND134,300. The remaining stocks in the list of stocks negatively affecting the general index are MWG, BCM, PDR, DCM and SIP.

Today, the Ho Chi Minh City Stock Exchange had 209 stocks increasing, overwhelming the number of stocks decreasing with 177 codes. The VN30 basket contributed positively to the excitement when 18 codes closed above the reference, double the number of stocks decreasing.

The trading volume for the whole session was approximately 957 million shares, down 36 million units compared to yesterday's session. The trading value accordingly decreased by VND987 billion, down to VND21,804 billion.

Domestic investors focused on buying bank stocks when VPB topped the matched value with over VND1,080 billion (equivalent to 55.1 million shares). The next positions were TPB with VND992 billion, STB with over VND853 billion, CTG with over VND821 billion and MBB with over VND680 billion.

Foreign investors maintained their net buying status for the second consecutive session. Specifically, foreign investors disbursed nearly VND2,567 billion to buy 82.7 million shares, while only selling 54.9 million shares, equivalent to VND1,606 billion. The net buying value accordingly reached VND960 billion, nearly double yesterday's session and the highest in the past month.

Foreign investors strongly bought TPB with a net value of approximately 129 billion VND. VNM ranked next in terms of attracting foreign cash flow with a net purchase value of nearly 115 billion VND. Meanwhile, foreign investors strongly sold HPG shares with a net value of 68.6 billion VND.

Source: https://baodautu.vn/vn-index-tang-phien-thu-ba-lien-tiep-vuot-1290-diem-d225919.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)