Minister of Finance Nguyen Van Thang and his delegation worked with the London Stock Exchange (LSE) and FTSE Russell to discuss solutions to upgrade Vietnam's stock market, promote cooperation and promote it to international investors.

Vietnam is determined to reform, aiming to upgrade the market

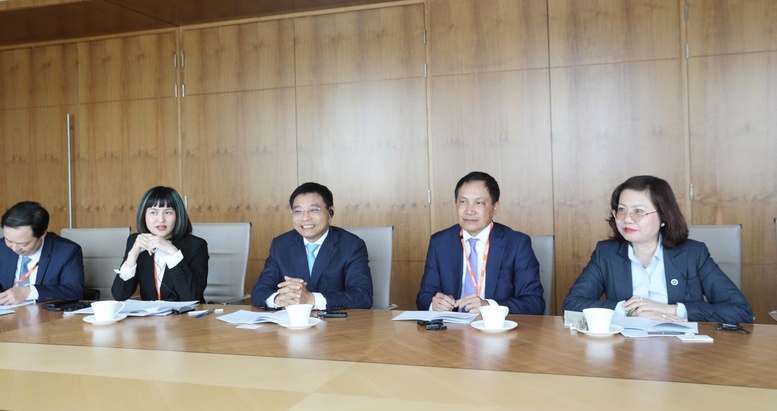

On September 15 (local time), in London (UK), Minister of Finance Nguyen Van Thang and a delegation from the Ministry of Finance worked with the London Stock Exchange (LSE).

On the Vietnamese side, there was the participation of Ambassador Extraordinary and Plenipotentiary of Vietnam to the United Kingdom of Great Britain and Northern Ireland and concurrently to Ireland Do Minh Hung; Ms. Vu Thi Chan Phuong - Chairwoman of the State Securities Commission (SSC) and leaders of relevant units.

On the UK side, there were Ms. Julia Hoggett – CEO of LSE; Mr. Gerald Toledano – Head of Global Equities FTSE Russell; Mr. David Sol – Head of Global Policy and Governance FTSE Russell; Mr. Tom Attenborough – Head of International Business Development LSE; Ms. Wanming Du – Head of Index Policy FTSE Russell Asia – Pacific ; and Mr. Thom Abbott – Director of Southeast Asia LSE.

Minister of Finance Nguyen Van Thang at the working session

Minister Nguyen Van Thang highly appreciated the close cooperation between LSE and FTSE Russell with the State Securities Commission in recent times, especially in reform efforts to meet the criteria for upgrading Vietnam's stock market. He thanked Ms. Julia Hoggett, Mr. David Sol and their colleagues for accompanying Vietnam.

The financial sector leader also informed that, within the framework of this working trip, Chairwoman of the State Securities Commission Vu Thi Chan Phuong will work directly with FTSE Russell to discuss in detail the upgrading criteria. At the same time, the Ministry of Finance will organize an Investment Promotion Conference in London on September 16, to provide the most complete information about the Vietnamese financial market to international investors.

Regarding the economic situation, the Minister said that in the first 8 months of 2025, Vietnam's economy continued to record many positive results. GDP growth in the second quarter reached 7.96%, the Government set a growth target for the whole year from 8.3% to 8.5%. Newly registered, adjusted and contributed FDI capital to buy shares reached nearly 26.1 billion USD, up 27.3% over the same period. Import-export turnover of goods reached 598 billion USD, up 16.3%.

For the stock market, by the end of August 2025, the total stock market capitalization will reach about 352 billion USD, equivalent to 79.5% of GDP in 2024. Market liquidity will increase significantly, with many trading sessions exceeding 3 billion USD. On average, the trading value will reach more than 1.1 billion USD/session, ranking among the most vibrant in ASEAN.

The Vietnamese Government has been focusing on synchronously implementing many solutions to meet upgrading requirements, creating more favorable conditions for international investors to participate in the stock market.

"Vietnam has issued many synchronous mechanisms and policies that take effect immediately, creating favorable conditions for foreign investment capital to participate in the stock market," Minister Nguyen Van Thang affirmed.

Ms. Julia Hoggett, General Director of LSE at the working session

Julia Hoggett, CEO of LSE, welcomed the positive news from the Minister. She shared about LSE's activities and highlighted the potential for cooperation in many areas, including the development of a joint index between VNX and FTSE Russell.

LSE – a "gateway" for integration of the Vietnamese stock market

Minister Nguyen Van Thang proposed many directions for cooperation in the coming time. First of all, enhancing the exchange of experiences in building legal frameworks, monitoring the market, applying international standards on corporate governance, information disclosure and promoting sustainable growth (ESG). At the same time, Vietnam wishes to learn from the experience of developing new financial products such as green bonds, sustainable bonds, and derivative securities.

In addition, the two sides can coordinate to promote investment and promote the image of Vietnamese enterprises to international investors, especially in the UK and Europe. Another priority is to train human resources in finance and securities, combined with the application of Fintech, AI, and Blockchain technology to improve market operation efficiency.

"With the support of LSE, the Vietnamese stock market will increasingly develop, contributing positively to the common prosperity of the two countries as well as the world," Minister Nguyen Van Thang expressed his confidence.

In response, Ms. Julia Hoggett affirmed that LSE will continue to support Vietnam in the process of upgrading to an emerging market, and at the same time act as a "gateway" to connect the Vietnamese market with the world.

At the end of the meeting, the two sides agreed to continue to strengthen cooperation in many aspects, thereby helping the Vietnamese stock market become more and more attractive to international investors. FTSE Russell also acknowledged the strong reforms that Vietnam has implemented in recent times.

Vietnam Stock Exchange (VNX) has signed a Memorandum of Understanding (MOU) with FTSE International Limited. This MOU officially establishes a strategic partnership to improve capital market infrastructure and promote Vietnam's international integration.

At the LSE headquarters, witnessed by Minister Nguyen Van Thang, Ambassador Do Minh Hung, Chairwoman of the State Securities Commission Vu Thi Chan Phuong, General Director of LSE Julia Hoggett and Global Policy Director of FTSE Russell David Sol, the Vietnam Stock Exchange (VNX) signed a Memorandum of Understanding (MOU) with FTSE International Limited. This MOU officially establishes a strategic partnership to improve capital market infrastructure and promote Vietnam's international integration.

The signing event, witnessed by the Minister of Finance, demonstrates Vietnam's strong commitment to developing the stock market and expanding international cooperation.

The London Stock Exchange (LSE) was founded in 1801 and is currently based at 10 Paternoster Square in central London, close to St. Paul's Cathedral. LSE is part of the London Stock Exchange Group (LSEG) and is one of the oldest stock exchanges in the world, with a history dating back to 1571 as the Royal Exchange.

FTSE Russell is a subsidiary of LSEG, providing index services, market data and analysis. FTSE Russell indices are widely used globally, covering 94 of the world's top 100 asset managers with nearly $16 trillion in assets under management. FTSE currently assesses 47 countries, covering 90% of global capital markets.

For Vietnam, FTSE Russell has index sets such as FTSE ASEAN Index Series, FTSE ASEAN Extended Index Series, FTSE Vietnam Index Series. To be upgraded from a frontier market to a secondary emerging market, Vietnam must meet 9 mandatory criteria and 2 reference criteria. These criteria are assessed based on practical experience and feedback from international investors.

Mr. Minh

Source: https://baochinhphu.vn/bo-truong-tai-chinh-lam-viec-voi-so-giao-dich-chung-khoan-london-thuc-day-hop-tac-nang-hang-thi-truong-viet-nam-102250916084543551.htm

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)