At the end of the session on August 18, the VN-Index closed at 1,636 points, up 6 points, equivalent to 0.39%.

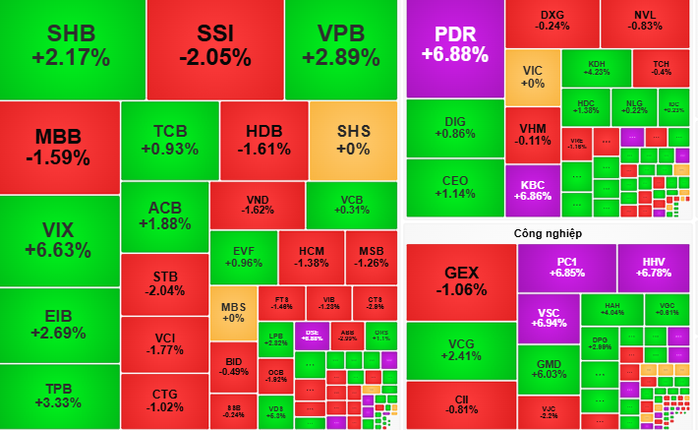

The stock market opened on August 18 with a positive signal, when the VN-Index increased by 10 points at the beginning of the session. The increase was led by strong demand from banking stocks (SHB , VPB), oil and gas (GAS, PVD) and steel (HPG, NKG). However, the adjustment pressure from large-cap stocks such as VJC, HVN and Vingroup group (VIC, VHM, VRE) caused the index to fluctuate in the morning session, temporarily stopping at 1633.67 points.

In the afternoon session, the market continued to fluctuate around 1,630 points, reflecting the cautious sentiment of investors. Bottom-fishing demand reappeared in Vingroup stocks in the middle of the session, helping to narrow the decline and support the VN-Index to regain green. At the end of the session, cash flow spread strongly to real estate groups (PDR, HDG, KBC hit the ceiling), maritime transport (VSC, HAH, GMD) and maintained the upward momentum in public investment groups (HHV hit the ceiling, FCN +5.61%) as well as food (ANV, HAG, BAF).

Foreign investors continued to sell strongly with a net value of VND 1,946.97 billion, focusing on codes such as SHB, VPB andFPT .

At the end of the session, the VN-Index closed at 1,636 points, up 6 points, equivalent to 0.39%.

According to Vietcombank Securities Company (VCBS), bottom-fishing demand appeared when VN-Index retreated to its lowest level in the session of August 18, showing a fierce tug-of-war between buyers and sellers. The decrease in liquidity shows the cautious sentiment of investors after the period of hot market growth. VCBS recommends that investors should realize profits with stocks that have increased sharply, while maintaining a safe margin ratio. New disbursement opportunities can focus on mid- and small-cap stocks with good business potential.

According to Dragon Capital Securities Company (VDSC), the decrease in liquidity compared to the previous session shows that supply has temporarily cooled down. VDSC forecasts that the market will continue to recover, aiming to challenge the resistance zone of 1,650-1,660 points in the coming sessions.

In the context of the market being clearly differentiated between industry groups, some securities companies advise investors to make appropriate decisions. Stock codes in the real estate, public investment, maritime transport and food groups are attracting cash flow thanks to their growth potential and good fundamentals. However, with reduced liquidity and net selling pressure from foreign investors, investors should avoid chasing the hot growth trend and consider investing in small and medium-sized stocks with long-term prospects.

Source: https://nld.com.vn/chung-khoan-ngay-19-8-co-phieu-quy-mo-vua-va-nho-se-hut-dong-tien-196250818172942649.htm

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

Comment (0)