VN-Index conquers 1,450 points

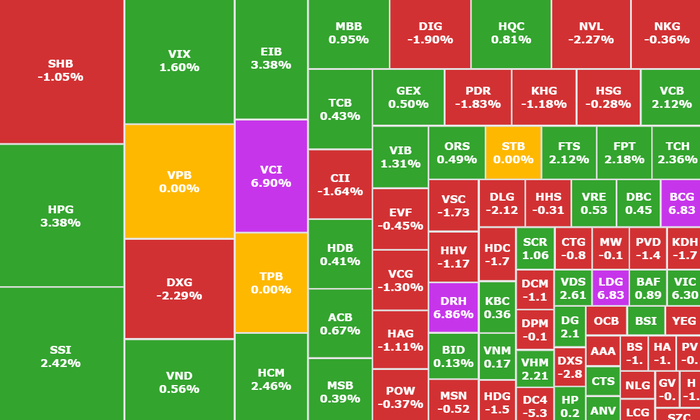

Last week, VN-Index maintained its explosive momentum, breaking out more than 70 points in a row and ending the week with a breakthrough when surpassing the resistance level of 1,450. Closing the week, VN-Index was at 1,457.76 points, up 70.79 points (+5.1%).

This is supported by the record liquidity of the stock market since its inception and 45.5% higher than the 20-week average. Specifically, accumulated to the end of the trading session, the average weekly liquidity on the HOSE floor reached 1,287 million shares (+35.76%), equivalent to a value of VND 30,415 billion (+30.42%).

The market leading group belongs to the "VN30 basket", breaking the all-time peak to the 1,600 point mark.

Regarding industry groups, "green" covered 17/21 industry groups that increased points: Real estate (+13.2%), Steel (+10.99%) and Securities (+8.37%).

Foreign investors also played a role in helping to promote the strong growth of the market last week, maintaining a strong net buying status with a value at the end of the week reaching 6,970 billion VND, the focus belonged to: SSI (SSI Securities, HOSE) reaching 2,018 billion VND,SHB (SHB, HOSE) reaching 1,007 billion VND and HPG (Hoa Phat Steel, HOSE) reaching 690 billion VND.

According to experts, investor sentiment last week became much more excited when a series of good news was released: Countries around the world were imposed by the US with higher reciprocal tariffs than Vietnam, US Bank JP Morgan recommended buying stocks in the Vietnamese market, the Prime Minister promoted the FTSE upgrade of the Vietnamese stock market in September this year,...

However, the market has a certain differentiation when cash flow only focuses on bluechip stocks while midcap stocks only move sideways or adjust slightly, leading to the situation that many investor accounts still only move sideways if they do not buy correctly.

Dozens of stocks increased by 40-250%

Since the beginning of the year, VN-Index has increased by about 188 points (+14.8%) from 1,269 to 1,457. In line with the general market trend, many stocks on HOSE have recorded impressive breakthroughs.

Leading the way is GEE ( Gelex Electricity, HOSE) , which jumped more than 250%. This stock has growth momentum in the context of the company recording pre-tax profit in the first quarter of 2025 reaching 608 billion VND, up 311% over the same period - the highest quarterly level in its history. Profit after tax reached 487.4 billion VND, 4.2 times higher than the same period last year.

GEE's market price has increased by more than 250% since the beginning of the year (Screenshot)

Next is VIC (Vingroup, HOSE) with an increase of 150%. VIC shares are likely to have established a long-term bottom in early 2025 and are currently entering the first medium-term increase phase. However, VIC is in the stage of expanding the increase range, not forming a safe buying price zone for medium-term investors. Therefore, the appropriate strategy at this time is to monitor and wait for the correction to disburse more effectively.

Ranked 3rd, 4th, 5th respectively are GEX (Gelex, HOSE), HHS (Hoang Huy Service, HOSE), VHM (Vinhomes, HOSE) with increases of 124%, 120% and 115% respectively. Particularly for Vinhomes stock.

In addition to the top 5 stocks, the remaining codes on the list such as SBT (TTC-BH, HOSE), VIX (VIX Securities, HOSE), VRE (Vincom Retail, HOSE), SHB (SHB, HOSE), TCH (Hoang Huy Finance, HOSE), DPG (Dat Phuong Group, HOSE), NVL (Novaland, HOSE), EVF (EVN Finance, HOSE) also recorded growth of tens of percent.

Many businesses offer millions of shares

Recently, Vietnam Airlines Corporation (HVN, HOSE) announced the closing of the shareholder list on July 22 to exercise the right to buy. The time to register to buy and pay for shares is from August 7 to September 8.

Previously, the State Securities Commission had decided to grant a certificate of registration for public offering of additional shares to Vietnam Airlines. The distribution period is within 90 days from the effective date of the certificate of registration for public offering, i.e. from July 3.

Vietnam Airlines plans to sell millions of shares

The offering is reserved for existing shareholders at a rate of 40.64%, meaning that shareholders owning 10,000 shares have the right to buy 4,064 new shares. With the expected number of shares issued at 900 million shares and the offering price of 10,000 VND/share, Vietnam Airlines plans to raise about 9,000 billion VND in this offering.

Vietnam Airlines said all the money raised will be used to pay off debt.

Similarly, Construction and Design Joint Stock Company No. 1 - DECOFI (DCF, UPCoM) implemented a plan to privately offer 10 million shares. The expected offering price is 10,000 VND/share, equivalent to a total mobilized amount of 100 billion VND. The issued shares are restricted from transfer within 1 year.

All proceeds from the issuance will be used to pay off short-term loans at Nam A Bank under the VND800 billion credit contract signed on May 16. If the issuance is successful, DECOFI's charter capital will increase from nearly VND430 billion to VND530 billion.

Binh Duong Minerals and Construction Joint Stock Company (KSB, HOSE) also approved the components of the registration dossier for public offering of shares, submitted to the State Securities Commission for approval. According to the plan, KSB will issue more than 114 million shares to existing shareholders at a ratio of 1:1, at a price of 10,000 VND/share. If the issuance is successful, KSB will collect more than 1,140 billion VND, and at the same time increase its charter capital to nearly 2,300 billion VND.

Of the expected amount of money mobilized, KSB will use 690 billion VND to pay principal and interest on short-term and long-term loans to the bank and supplement working capital including debt payment, taxes and payables to the State.

Tasco Joint Stock Company (HUT, HOSE) announced the offering of more than 178 million shares to existing shareholders. The registration period is from July 7 to August 20. If the offering is successful, HUT will increase its charter capital from more than VND 8,925 billion to more than VND 10,710 billion.

July Preferred Stocks

According to the July strategy report of An Binh Securities (ABS), the Vietnamese stock market is in a short-term and medium-term uptrend, with a positive outlook for the second half of 2025.

On the technical chart, the market recorded good demand and positive trading cash flow throughout the second quarter of 2025.

ABS assessed that Vietnam’s expected reciprocal tax rate lower than the initial 46% is a positive result in the context of trade negotiations with the US, lower than the rate currently applied to countries in the region (25-36%). This development could promote the global supply chain to shift to Vietnam, creating advantages for export industries with high localization rates.

Domestically, a series of fiscal and credit policies are being strongly implemented such as: Incentives for young people to buy houses, establishing a National Housing Fund, promoting public investment, promoting the digital asset market... while also providing additional support for market growth trends.

So, there will be 2 scenarios for the stock market:

With the main scenario (high probability) , VN-Index maintains its upward momentum to the 1,475 point area, continuing to accumulate and expand the medium-term uptrend. Investors should maintain their positions in banking, securities, real estate, technology and export stocks.

As for the secondary scenario (low probability) , the market will make a technical correction before re-establishing the trend, with a notable support zone around 1,320-1,350 points. Short-term investors are recommended to prioritize profit-taking in speculative stocks, rotating cash flow to pillar groups, leading stocks with good fundamentals, especially when the market makes a slight technical correction.

Comments and recommendations

Grandfather Bui Ngoc Trung , Mirae Asset Securities Consultant , Mirae Asset Securities (Vietnam) assessed that the Vietnamese stock market is entering a new era with greater prospects than ever before, having just closed a trading week with many positive highlights.

Strong market growth but large differentiation

In addition, foreign capital flows have returned strongly due to fundamental changes in the macroeconomic outlook and management policies. Key factors that help increase foreign investors' confidence and the market trend will continue to move towards higher milestones such as 1,500 - 1,600 points. In the medium and long term, although in the short term there may be correction factors when profit-taking activities are starting to increase, the big trend is still well maintained.

In terms of industry groups, cash flow may continue to increase and concentrate on industries with growth prospects in the second half of the year and anticipate the trend of Q2 business results in the next few days. Specifically, these include the following industry groups:

Banks play a leading role thanks to positive credit growth and well-controlled bad debt. Banking stocks directly benefit from the return of capital flow: VCB (Vietcombank, HOSE), ACB (ACB, HOSE), VPB (VPBank, HOSE).

Real estate is gradually recovering and entering a new growth trend thanks to support credit packages, promoted infrastructure and synchronous legal reforms: VHM (Vinhomes, HOSE), KDH (Nha Khang Dien, HOSE), PDR (Phat Dat, HOSE), DXG (Dat Xanh, HOSE).

Consumption - retail recovered well thanks to improved purchasing power and positive consumer sentiment, especially the continued maintenance of the 2% VAT reduction policy until the end of the year: MWG (Mobile World, HOSE), MSN (Masan, HOSE).

Public investment also promises to grow strongly with the promotion of infrastructure development and construction of key projects on schedule and the synchronous implementation and completion of key national projects such as the North-South Expressway, North-South high-speed railway, Long Thanh airport, etc.: VCG (VINACONEX, HOSE), CTD (Cotecons, HOSE), HHV (DII, HOSE), LCG (Lizen, HOSE).

In the short term, investors should continue to maintain appropriate portfolio proportions, taking advantage of technical adjustments to increase the proportion of stocks with good fundamentals, which are prioritized by foreign investors. Choosing sectors that benefit from macro and policy, especially those that are "favoring the wave" such as finance, real estate, retail, and construction, will be the key to optimizing the portfolio in the second half of 2025.

TPS Securities believes that although technically the market is entering the overbought zone, with the potential risk of correction, with strong capital flow and the upside of VN-Index still high, if a correction occurs, it will be healthy, opening up opportunities to increase positions. Investors can consider a buy and hold strategy in the medium term.

Phu Hung Securities believes that the market likely needs to consolidate around the 1,440 - 1,460 point area to regenerate more momentum. The target resistance level is the psychological threshold of 1,500 points, while short-term support is raised to the 1,400 - 1,420 point area. The general strategy is to hold, limit excitement in chasing or spreading out allocation. The midcap group can correct and open up opportunities when testing the trend successfully. Priority groups to pay attention to: Banking, Securities, Technology, Real Estate, Retail.

Dividend payment schedule this week

According to statistics, there are 35 businesses that have decided to pay dividends for the week of July 14 - July 18, of which 30 businesses pay in cash and 5 businesses pay in shares.

The highest rate is 110%, the lowest is 1.5%.

5 businesses pay by stock:

Saigon VRG Investment JSC (SIP, HOSE), ex-right trading date is July 14, rate 15%.

Long An IDICO Construction Investment JSC (LAI, HOSE), ex-right trading date is July 15, rate 60%.

FPT Digital Retail JSC (FRT, HOSE), ex-right trading date is July 16, rate 25%.

Khang Dien House Investment and Trading JSC (KDH, HOSE), ex-right trading date is July 17, rate 10%.

Deo Ca Transport Infrastructure Investment JSC (HHV, HOSE), ex-right trading date is July 18, rate 5%.

Cash dividend payment schedule

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Education Day | Day TH | Proportion |

|---|---|---|---|---|

| THW | UPCOM | July 14 | 5/8 | 6% |

| CLX | UPCOM | July 14 | July 30 | 7% |

| NS2 | UPCOM | July 14 | 6/8 | 1.7% |

| VIT | HNX | July 14 | August 15 | 10% |

| KMT | HNX | July 14 | July 29 | 8% |

| GVT | UPCOM | July 14 | July 28 | 33% |

| NUE | UPCOM | July 14 | July 31 | 8% |

| CNN | UPCOM | July 14 | 4/8 | 14.6% |

| RAT | UPCOM | July 14 | 24/7 | 6% |

| BCF | HNX | July 15 | July 28 | 8% |

| DPM | HOSE | July 15 | 3/9 | 15% |

| HLB | UPCOM | July 15 | July 25 | 110% |

| BTU | UPCOM | July 15 | 1/8 | 20% |

| XHC | UPCOM | July 15 | 1/8 | 10% |

| NBT | UPCOM | July 15 | July 29 | 11% |

| BMK | UPCOM | July 15 | July 22 | 5% |

| A32 | UPCOM | July 16 | August 12 | 12% |

| LDW | UPCOM | July 16 | July 31 | 6.1% |

| TOS | UPCOM | July 16 | August 18 | 30% |

| VLB | UPCOM | July 16 | August 14 | 15% |

| CTW | UPCOM | July 16 | December 9 | 14% |

| BHP | UPCOM | July 16 | July 28 | 1.5% |

| PIC | HNX | July 16 | August 18 | 8% |

| TV3 | HNX | July 16 | October 22 | 5% |

| CDG | UPCOM | July 17 | 5/8 | 6% |

| TMP | HOSE | July 17 | July 30 | 12% |

| OCB | HOSE | July 17 | 7/8 | 7% |

| NQB | UPCOM | July 17 | July 31 | 3.8% |

| BIO | UPCOM | July 17 | August 26 | 7% |

| DTB | UPCOM | July 18 | 5/8 | 13% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-14-18-7-vn-index-se-tang-but-pha-nhung-phan-hoa-manh-20250714090234015.htm

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

![[Photo] Prime Minister Pham Minh Chinh attends the 1st Hai Phong City Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/676f179ddf8c4b4c84b4cfc8f28a9550)

Comment (0)