More than a decade of "mentioning" - the upgrade target is very close

From the policy determination, the goal of upgrading the Vietnamese stock market has been transformed by the whole system into a strategy and a tight line, based on three main pillars: first is institutional reform; reform of technical infrastructure; third is being proactive in exchanging and connecting with market rating organizations.

Accordingly, Ms. Dang Nguyet Minh, Director of Dragon Capital's research division, believes that the upgrade according to FTSE Russell standards will be achieved next September. Even the Vietnamese stock market can achieve the goal of upgrading according to MSCI standards within the next 18 - 24 months. In particular, the stock market is having an important catalyst as many large enterprises are planning to IPO in the period of 2026 - 2027.

Ms. Nguyen Hoai Thu - Deputy General Director of VinaCapital Fund Management Company also said that we are quite close to the decision to upgrade from FTSE Russell. The remaining issue is that FTSE Russell will need to get opinions from foreign institutional investors trading in Vietnam. If investors see no major obstacles to trading, especially the fact that there is no need to deposit cash before buying securities, the Vietnamese stock market will be upgraded.

VinaCapital experts also believe that upgrading the market also has the meaning of increasing the depth of the Vietnamese stock market, overcoming the situation where individual investors currently account for about 90% of the total market's transactions, through increasing the attraction of foreign capital flows, with high stability, into the market.

Through research on other markets in the Asian region, Dragon found that, in periods when these countries are experiencing double-digit GDP growth and investment levels on GDP at around 30 - 40%, equivalent to the current action plan of the Vietnamese Government , the stock market is the most attractive asset channel, with the highest investment efficiency, which can be up to 5 - 10 times, even up to 12 times.

As those countries' stock markets developed, their valuations also reached very high levels, from 25 times to even 50 times, supported by profit growth potential in the range of 25 - 30%.

In the current stock market context, Vietnam's tariff agreement with the US has removed the biggest risk to Vietnam's economy at the present time, thereby paving the way for growth in the next 3-5 years and the next 10 years.

Dragon Capital's vision for 2030 is that Vietnam will become a modern, innovative nation supported by a streamlined, consensual, and highly consistent political system.

“When the economy takes off, stocks will be the asset channel with the highest investment performance,” said Ms. Minh.

|

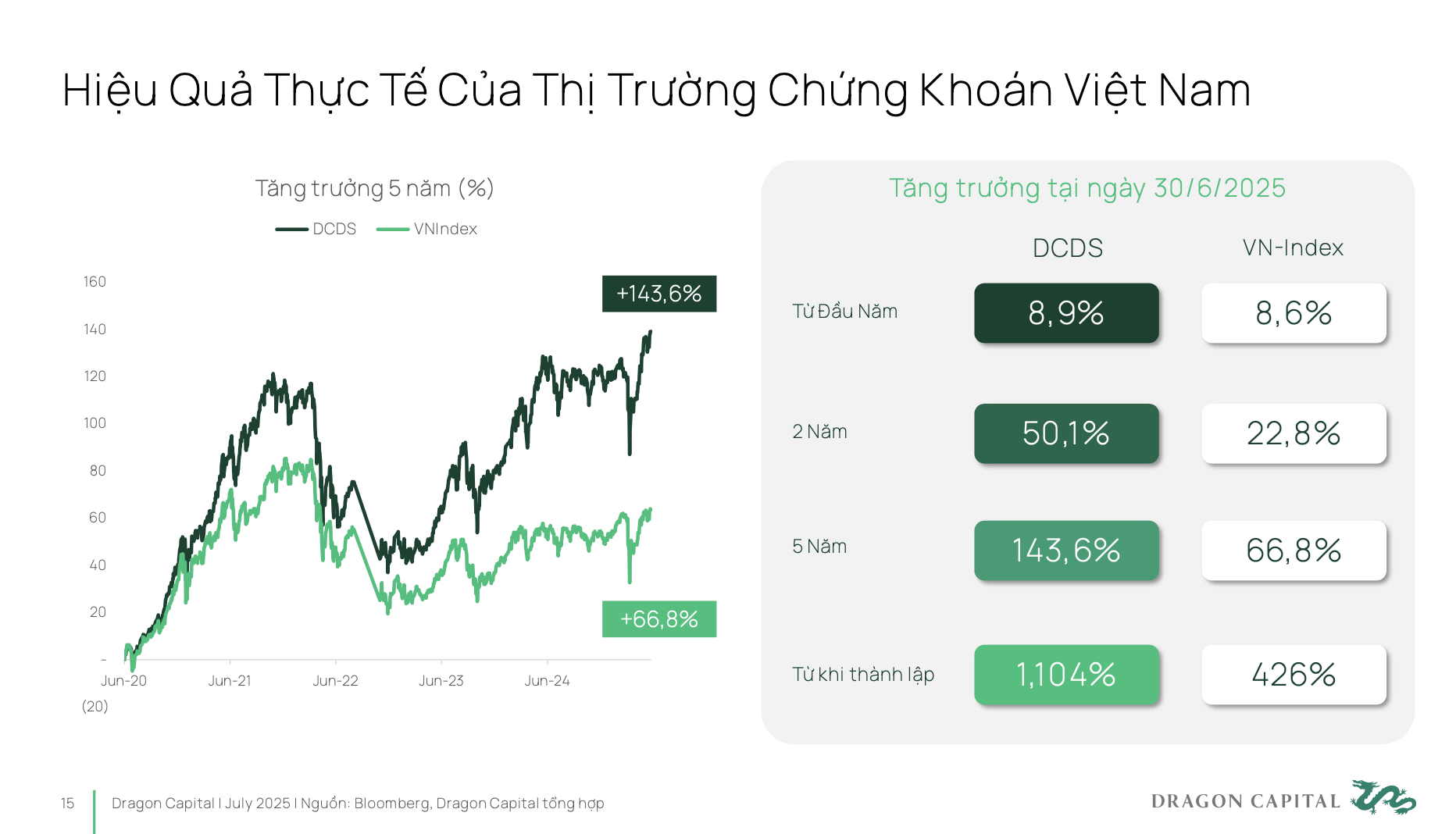

In the past 5 years, the Vietnamese market has actually grown by nearly 70%. If investors go through professional investment funds, they can even achieve higher investment performance.

Typically, Dragon Capital's DCDS fund, established in 2004, has gone through three very large economic cycles of the Vietnamese market as well as the international market, and has achieved a 12-fold increase in performance since its inception.

Thus, Vietnamese securities are a very effective investment channel, but are currently still not being properly evaluated for their potential and inherent position.

From that reality, it is necessary to discuss policy levers as well as development orientations in the coming time. Resolution 68 is a very clear step in empowering and supporting the private economic sector, so that businesses can develop, break through and create a foundation for double-digit GDP growth. However, to achieve that, private businesses need long-term, stable sources of capital, and less dependence on banking channels.

The stock market will be the most effective tool to unlock this capital flow. Compared to the Government’s target by 2030, the size of the stock market needs to reach 120% of GDP, while it is currently only at around 50-55%. This means that within the next 5 years, the market size needs to double compared to the present. And to achieve that goal, Vietnam’s position on the global investment map needs to be improved.

There are two very important factors. First is upgrading the market to the emerging market group - there is a very clear strategic action plan. Second, Vietnam needs to achieve a national credit rating at investment grade. Only when both of these factors are achieved simultaneously, Vietnam can attract capital flows from the world's leading large investment funds. Thereby, the stock market will play a key role in realizing the goal of making the private enterprise sector become the leading force as set out in Resolution 68.

|

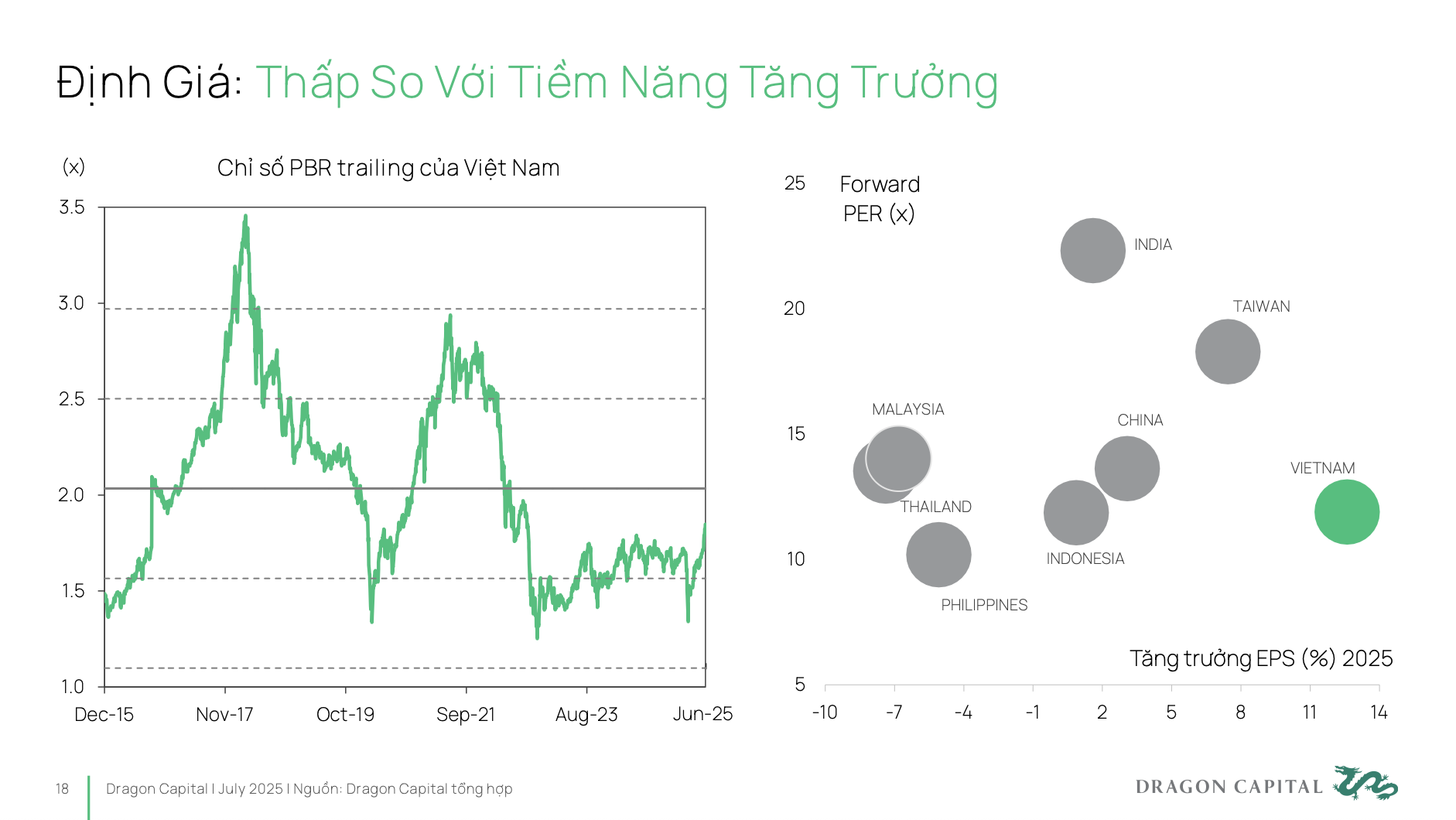

The reality is that the valuation of the Vietnamese stock market is still very low. Because low P/E means that businesses are having to bear a higher cost of capital than their real potential . Meanwhile, to mobilize capital effectively, businesses need to have an appropriate valuation that accurately and fully reflects long-term development potential.

So Dragon Capital’s hope is not for Vietnam to continue to grow at high rates with low P/Es, but to move closer to markets like India. Currently, India’s EPS growth rate is only in the single digits, but their market is still trading at P/Es of 20–25 times. That means businesses in India are raising capital at a very cost-effective rate.

For a sustainable and efficient market: Diversify investor structure

Many experts agree that for the market to develop sustainably and effectively, it needs to develop in both directions: attracting large, global, long-term institutional investors, and transforming the perception of "surfing" into long-term investment of individual investors.

For large global institutional investors, there are three key issues that need to be addressed to attract larger-scale capital. (1) Upgrading the market - this is a prerequisite; (2) After upgrading, foreign room is an issue of access for investors, how to get goods to buy, so that they can enter the Vietnamese market in the simplest and most convenient way; (3) The market needs new products as well as newly listed businesses such as IPOs.

More specifically, the accessibility of foreign investors, especially new investors, is currently quite limited due to the 49% ownership ceiling in many industries. Many good businesses have full room for foreign investors. If they want to inject capital into the Vietnamese market, they will also face many difficulties. Continuing to find solutions to expand the room for foreign investors to increase the accessibility and attractiveness of the market to foreign capital is very necessary, and in fact, one of the most urgent issues today.

In addition, for the market to attract large-scale investment funds, depth is needed. Depth includes: A diverse product system, suitable for many different investment subjects; improved quality of listed enterprises in terms of transparency and information disclosure; larger enterprise scale, with breakthrough growth points to attract investors. In addition, it is necessary to standardize issuance information, ensure transparency and encourage the participation of long-term investment funds.

On the domestic investor side, most individual investors in Vietnam still have a surfing mentality, and often call it "playing stocks" instead of "investing stocks" with the mindset of long-term, periodic accumulation.

It can be seen that individual investors are currently viewing stocks similarly to channels such as savings, gold, real estate, with a short-term vision. Investment thinking still tends to "timing the market", that is, trying to choose the perfect buying and selling point, instead of "timing the market", that is, maintaining long-term investment according to habit and long-term vision.

In terms of supply, how can we shift investors from short-term to long-term? This requires the strong participation of voluntary pension funds and long-term investment funds. To create such a supply, specific solutions and mechanisms are needed for these funds to increase their presence and contribution to the market.

On the demand side, how do individual investors feel they want to invest money in long-term investments in the stock market? In fact, in many large enterprises (mostly in VN30) and when it comes to developing pension funds and long-term assets, there are still huge barriers, which are psychological thresholds. Therefore, there should be preferential tax policies for professional financial products, and at the same time, investment in financial education to form sustainable trust in the long-term stock market.

Some issues that exist in the market today are worth noting, that is, liquidity in the market is still mainly concentrated on the VN30 group of stocks, while most of the remaining codes have not reached the minimum liquidity threshold (1 million USD/session) to meet the requirements of large funds.

The structure of listed industries on the market is still unbalanced when the banking and real estate groups account for more than 50% of the total market capitalization . Meanwhile, industries with sustainable growth potential such as technology, healthcare, and renewable energy account for a very low proportion.

This makes it difficult for large capital flows to diversify their portfolios, limiting the attractiveness of the Vietnamese market to strategic investors.

Regarding transparency and corporate governance standards, there is a need for improvement. Currently, only about 26% of listed companies have ESG-related reports and Vietnam's corporate governance index is still low when compared to markets in the same group or preparing to upgrade.

Market infrastructure is also a bottleneck, especially the central counterparty (CCP) model, which is still in the process of being implemented. The CCP model is an international standard in securities trading, applied in most stock markets in the world.

According to VinaCapital experts, the implementation of this model will help improve the market participation ability of foreign investors, who value high operating standards and require synchronization of transaction processes between the markets in which they invest, as well as minimize risks arising during transactions.

Source: https://baodautu.vn/chung-khoan-viet-nam-vuon-minh-sau-25-nam-nang-hang-va-huy-dong-von-hieu-qua-cho-doanh-nghiep-d342209.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)