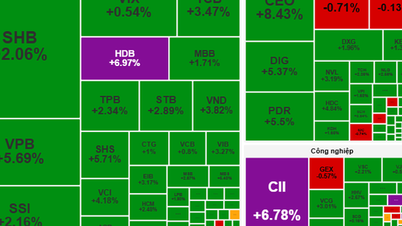

CII plans to pay dividends quarterly to attract shareholders

Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII), a well-known company in the construction sector, once struggled to invite shareholders to attend its General Meeting of Shareholders. Recently, CII continued to attract investors' attention when it introduced a strange policy to attract shareholders.

Specifically, CII plans to pay 2024 cash dividends to shareholders on the first day of each quarter. The expected payout ratio will be 4%/quarter, equivalent to about 16%/year.

CII plans to pay quarterly cash dividends (Photo TL)

On December 29, 2023, CII transferred nearly VND 100 billion to Vietnam Securities Depository and Clearing Corporation (VSDC) to pay dividends in 2024 to existing shareholders. Shares will be paid according to the shareholder list closed on October 16, 2023. This is also the first time in 3 years that CII has paid cash dividends to shareholders.

This can be considered one of the "strange" methods to attract shareholders that CII has come up with when this unit had to give gifts to "invite" shareholders but still could not summon enough people to attend the General Meeting of Shareholders.

Difficulty in organizing the General Meeting of Shareholders due to the large number of small shareholders

In 2023, CII failed to hold its General Meeting of Shareholders twice, both times due to the failure to convene enough shareholders to hold the meeting. Despite CII's previous announcement that it would give gifts to shareholders attending the meeting, it still did not receive any attention.

Specifically, the company promised to give money to shareholders attending the extraordinary general meeting on September 19, 2023, but did not convene enough shareholders to hold the meeting. The number of shareholders attending was only more than 200 people, equivalent to 31% of the voting shares.

Previously, in April 2023, CII also held the 2023 Annual General Meeting of Shareholders and promised to give money to shareholders attending but still failed to hold the meeting. This time, only 45.76% of the total voting shares participated.

In both cases, CII explained that the number of small shareholders was too large, causing the shares to be dispersed and difficult to convene.

Restructuring capital sources, revenue decreased by 65%

The notable point in CII's business activities in 2023 lies in the plan to issue convertible bonds, restructure capital sources, and reduce the debt ratio. According to the announcement at the extraordinary shareholders' meeting, CII plans to issue an additional VND7,000 billion in convertible bonds to balance financial leverage.

Also during this period, CII's business results recorded significant setbacks. In the third quarter of 2023, CII achieved revenue of VND 761.2 billion, down 65.5% over the same period. Cost of goods sold accounted for VND 466.3 billion, gross profit was only VND 265.7 billion, down 19.2% over the same period.

During the period, financial revenue increased by 83.5% to VND270.6 billion. In contrast, financial expenses also increased by 15.1% to VND371.8 billion. Of which, interest expenses alone accounted for VND267.9 billion, putting great pressure on revenue. Business management expenses and sales expenses accounted for VND12.9 billion and VND68.1 billion, respectively. Profit after tax in the third quarter reached VND107.3 billion, up 9.7% over the same period.

In CII's capital structure, total capital at the end of the third quarter reached VND26,080.6 billion, a slight decrease compared to the beginning of the year. Total liabilities decreased from VND20,258.5 billion to VND10,022.6 billion. Long-term debt decreased from VND9,415.9 billion to VND7,791.1 billion. Owner's equity was recorded at VND8,058 billion with accumulated undistributed profit after tax at VND2,441.5 billion.

Source

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)