(NLDO) - Immediately after the news that Dat Xanh Group was approved to issue an additional 150 million shares, investors rushed to sell off DXG.

In the trading session this morning, December 24, the code DXG of Dat Xanh Group Joint Stock Company (Dat Xanh Group) dropped to the floor price, down to 16,450 VND after the information that the group was granted a certificate by the State Securities Commission to offer more than 150 million shares to existing shareholders.

Accordingly, Dat Xanh Group will offer shares to existing shareholders at 12,000 VND/share. The exercise ratio is 24:5, meaning that shareholders owning 24 DXG shares will have the right to buy 5 new shares at 12,000 VND. In the past few sessions, DXG shares' price exceeded 18,000 VND but this morning it dropped to 16,450 VND.

According to the announcement, after the issuance, Dat Xanh Group expects to collect more than 1,800 billion VND. The amount mobilized will be allocated 1,559 billion VND to contribute to Ha An Real Estate Investment and Trading Joint Stock Company, the rest will be used to pay off bonds and partners. Ha An Real Estate is currently a subsidiary of Dat Xanh Group with a controlling ratio of 99.99% of charter capital.

In this morning's trading session, in some stock groups (rooms), many investors commented: "DXG announced the news of the stock split and immediately fell sharply... Risks for investors if they do not carefully evaluate the business".

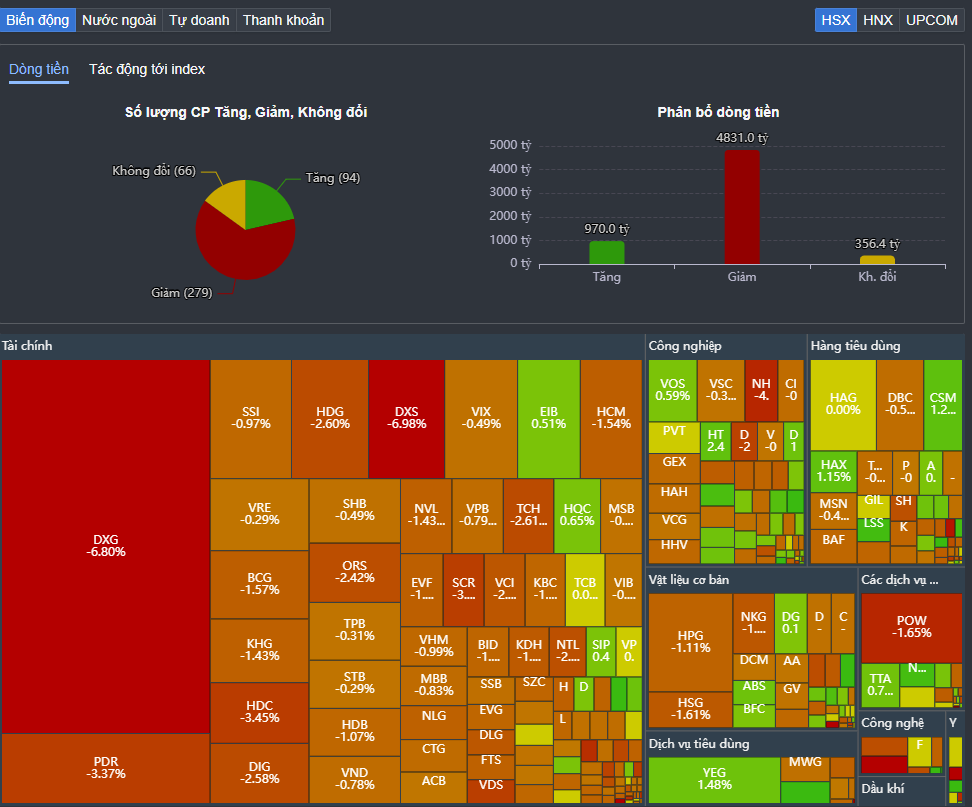

DXG stock hit the floor, greatly affecting the general market.

Previously, the shares of some securities companies also fell to rock bottom when issuing more shares. Recently, DIG (Construction Development Investment Joint Stock Corporation) also postponed issuing shares so the share price is still temporarily stable.

According to the investment director of a securities company, the sharp drop in DXG shares affected and spread to real estate stocks in the early morning session of December 24, causing the VN-Index to drop 5 points, filling the "GAP" (price gap) created yesterday. Filling the "GAP" is a necessary movement of the market. After that, the market began to balance more and recover, but there was a clear differentiation.

Only businesses with good fundamentals, reputation, health, and effective business operations will be directed to by cash flow. On the contrary, businesses with poor reputation and continuous paper distribution will have increasingly difficult times and break the "bottom". The stocks with good fundamentals in the current group are still performing well, recovering and diversifying according to the market. Investors can continue to hold these stocks.

Source: https://nld.com.vn/co-phieu-dat-xanh-bi-ban-thao-sau-tin-phat-hanh-them-196241224115134215.htm

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)