HSBC predicts that Vietnam's GDP growth in 2024 will reach 7% - the highest among the six largest economies in Southeast Asia.

HSBC forecasts that Vietnam's GDP in 2025 will maintain the highest level in the region. Photo: Hai Nguyen

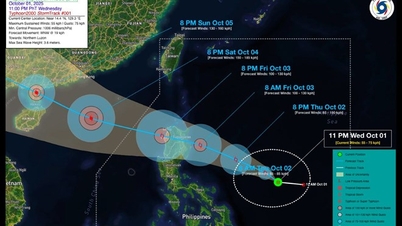

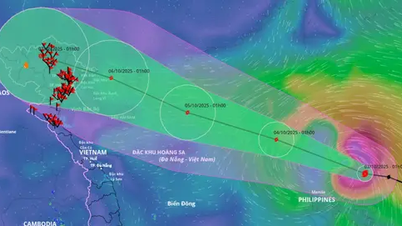

According to HSBC Vietnam's 2024 macroeconomic assessment, after a difficult first quarter, the economic picture has been mostly positive over the months. Despite Typhoon Yagi , Vietnam's economy has recovered and accelerated in the second half of the year, led by the manufacturing sector. The 11-month industrial production index (IIP) increased by 8.4% compared to the same period in 2023, contributing to strong double-digit export growth (14.4%). Encouragingly, trade was initially positive in the electronics industry and then gradually expanded, such as textile and footwear exports increasing by 16.7% in the third quarter. The manufacturing industry has strongly escaped last year's difficulties. Attracting foreign capital inflows remains fundamentally positive. FDI disbursement in 11 months is estimated at 21.68 billion USD, up 7.1% over the same period last year. This is the third consecutive year that Vietnam has achieved FDI disbursement of over 20 billion USD. After GDP unexpectedly increased by 6.9% in the second quarter and 7.4% in the third quarter, HSBC believes that Vietnam's growth in 2024 will reach 7%, the highest among the six largest economies in Southeast Asia (along with Indonesia, Malaysia, the Philippines, Singapore and Thailand). Thus, this year, Vietnam is likely to "return as a growth star", after the Philippines led the region last year. HSBC forecasts that in 2025, Vietnam's GDP will continue to maintain the highest level in the region. While the growth target for 2025 assigned by the National Assembly to the Government is 6.5-7%, striving for 7-7.5%. According to HSBC experts, there is a basis for setting this expectation in the context of favorable production and export. HSBC warns of some risks for next year. How much demand for goods improves will be the key to determining the strength of the recovery, as Western markets account for nearly half of Vietnam's exports. Therefore, it is necessary to closely monitor the trajectory and spending speed of consumers in these markets. It is too early to assess the specific impact of US trade policies in the coming time. However, any policy will have an impact on ASEAN, including Vietnam, in different forms, according to the expert group. The structure of Vietnam's garment and footwear exports to the US accounts for more than 40% and 33%, respectively. Europe is the second largest market for these products, but it is difficult to fully absorb them in the short term. However, Vietnam can hedge against potential tariff risks from the US in the medium to long term through its ownership of many free trade agreements (FTAs). In addition, the possible recurrence of exchange rates is a matter of concern. Vietnam was labeled a "currency manipulator" by the US Treasury Department in December 2020, before being removed from the list in April 2021. However, Vietnam remains on the US Treasury’s most recent monitoring list, meaning trade data needs to be closely monitored. The USD’s performance is also a factor to consider for the upcoming exchange rate trend. With an uneven recovery and a high growth target for next year, HSBC expects the State Bank to maintain a flexible monetary policy, keeping the operating interest rate unchanged at 4.5% until the end of 2025. According to VinaCapital, 2025 will be volatile for the Vietnamese economy and stock market. In the first half of 2025, the decline in exports may have a stronger impact on Vietnam’s GDP growth than many economists expect. This decline may prompt the Government to take drastic actions to support the economy, especially in the context of high GDP growth targets. In the short term, the government is likely to spend more on infrastructure development, thanks to its strong fiscal position (public debt is currently below 40% of GDP). VinaCapital expects the government to take concrete steps to support the real estate market next year. The lengthy planning and project approval process is the biggest barrier to boosting real estate development, but VinaCapital has heard on the ground that some project approvals are now being accelerated. In addition to measures to boost Vietnam’s short-term growth, the government is also taking steps to boost long-term GDP growth. These include structural reforms, some of which will take effect next year and could help cool the real estate market and improve the ease of doing business ranking.Laodong.vn

Source: https://laodong.vn/kinh-doanh/du-bao-lac-quan-ve-tang-truong-gdp-viet-nam-1439340.ldo

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)