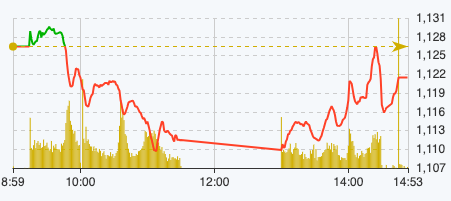

The market opened with the VN-Index slightly increasing, but before reaching 1,130 points, it was pushed back and even below the reference point when large-cap groups put pressure and the electronic board was dominated by red.

Market breadth is completely tilted towards the selling side with 540 stocks falling and 160 stocks rising. The securities group is the group being sold the most when VND, VIX, SSI, SHS, VCI all decreased by 4% or more. Trading volume in this group is leading the market.

At the end of the morning session on December 7, VN-Index decreased by 14.91 points, equivalent to 1.32% to 1,111.5 points. The entire floor had only 90 stocks increasing and 409 stocks decreasing. HNX-Index decreased by 4.13 points to 229.5 points. UPCoM-Index decreased by 1.06 points, equivalent to 1.23% to 85.26 points.

VN-Index performance on December 7 (Source: FireAnt).

In the afternoon session, the market fluctuated continuously, at one point the VN-Index reached 1,110 points. However, by the end of the session, buying pressure appeared, causing the decline to narrow.

At the end of the trading session on December 7, VN-Index decreased by 4.94 points, equivalent to 0.44% to 1,121.49 points. The entire floor had 205 stocks increasing, 289 stocks decreasing, and 95 stocks remaining unchanged.

The HNX-Index fell 1.79 points, or 0.77%, to 231.84 points. The entire floor had 75 stocks increasing, 90 stocks decreasing, and 65 stocks remaining unchanged. The UPCoM-Index fell 0.61 points to 85.71 points.

The VN30 basket recorded a divergence when 13 codes increased in price and 14 codes decreased in price. The codes that negatively affected the market were GAS, VCB, VHM, GVR, NVL, BCM, SSI, PLX, VND,FPT , taking away 5.2 points from the market. However, the whole group still increased by 2.08 points with abundant liquidity.

The stock group had the strongest decrease when 31/36 ended the session in red, cash flow concentrated in VIX with 73.8 million units matched, VND matched 67.4 million units, SHS matched 65.4 million units, SSI matched 44.2 million units, VCI matched nearly 15 million units.

Notably, since this morning on some forums, information has appeared that the KRX system may delay its operation time.

Most likely, this is the cause of negative impact on the securities stock group - which is expecting a lot from the "running" of the KRX system after the final test this December.

The highlight of today's session was the banking group when green covered most of the codes, notably BID, VPB, TCB, CTG, STB, MBB, LPB, SAB, ACB contributing 2.7 points to the general market. Cash flow also concentrated inSHB when matching orders of 35.3 million units, STB matched orders of more than 29 million units, EIB matched orders of nearly 24 million units, VPB matched orders of more than 17 million units.

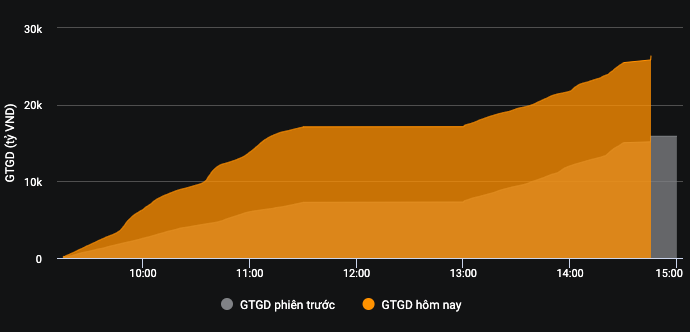

Liquidity today compared to previous session.

The total value of orders matched in today's session reached VND31,892 billion, up 54% compared to the previous session, of which the value of orders matched on the HoSE floor reached VND27,446 billion, up 52%. In the VN30 group, liquidity reached VND9,058 billion.

Foreign investors continued to be a minus point when they net sold for the 7th consecutive session with a value of more than 813.7 billion VND, of which this group disbursed 1,487 billion VND and sold 2,300 billion VND.

The codes that were sold heavily were VHM 211 billion VND, MSN 102 billion VND, STB 94 billion VND, FUEVFVND 63 billion VND, BCM 55 billion VND,... On the contrary, the codes that were mainly bought were VCB 47 billion VND, VHC 46 billion VND,OCB 29 billion VND, SSI 28 billion VND, DGC 27 billion VND,... .

Source

Comment (0)