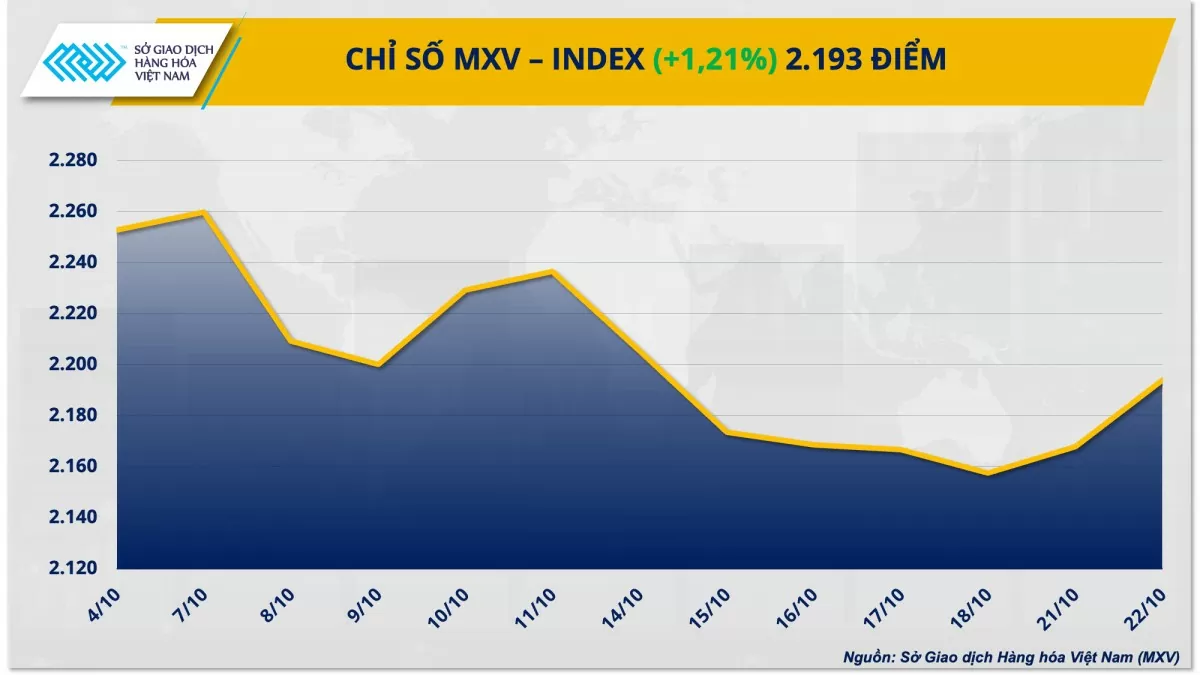

At the close, the MXV-Index increased by 1.21% to 2,193 points. Notably, green dominated the metal market, in which silver prices reached a 12-year high thanks to increased demand for safe havens. Meanwhile, the industrial raw materials market went against the general trend of the whole market when many items simultaneously decreased in price.

|

| MXV-Index |

Buying power returns to the metals market

Closing yesterday's trading day, buying power returned to the metal market, supporting the price increase of most items in the group. For precious metals, silver prices continued to fluctuate around the highest price in 12 years thanks to an increase of 2.83% to 35.04 USD/ounce. This was also the third consecutive increase in silver prices. Platinum prices also recovered when they jumped 2.42% to 1,041.4 USD/ounce. Precious metal prices continued to benefit from the increased demand for safe-haven assets amid the uncertainty surrounding the US election and escalating tensions in the Middle East.

|

| Metal price list |

Silver and platinum buying also picked up following Citigroup’s recent forecasts. The bank revised its silver price forecast for the next six to 12 months to $40 an ounce, up from $38 an ounce previously. For platinum, Citi forecasts a three-month price target of $1,025 an ounce and a six-to-12-month price target of $1,100 an ounce.

Moreover, silver prices, which are more macro-sensitive than platinum, continued to be supported as the market reacted positively to the recent interest rate cut by China, the world's largest consumer of metals. Specifically, on the morning of October 21, Chinese banks cut the loan prime rate (LPR) by 25 basis points for both one-year and five-year tenors, now anchored at 3.1% and 3.6%, respectively.

In base metals, LME aluminum extended its gain of 1.46% to $2,633.50 a tonne, its highest in more than two weeks. Aluminum has been seeing strong buying interest recently, largely due to concerns over tight raw material supplies.

According to industry sources, the supply of alumina, the raw material for primary aluminum production, is shrinking significantly due to a shortage of bauxite ore, especially the disruption of supply in Australia and Guinea. This has pushed the price of raw materials to continuously increase sharply, while also leading to expectations of a sharp increase in aluminum prices in the coming time.

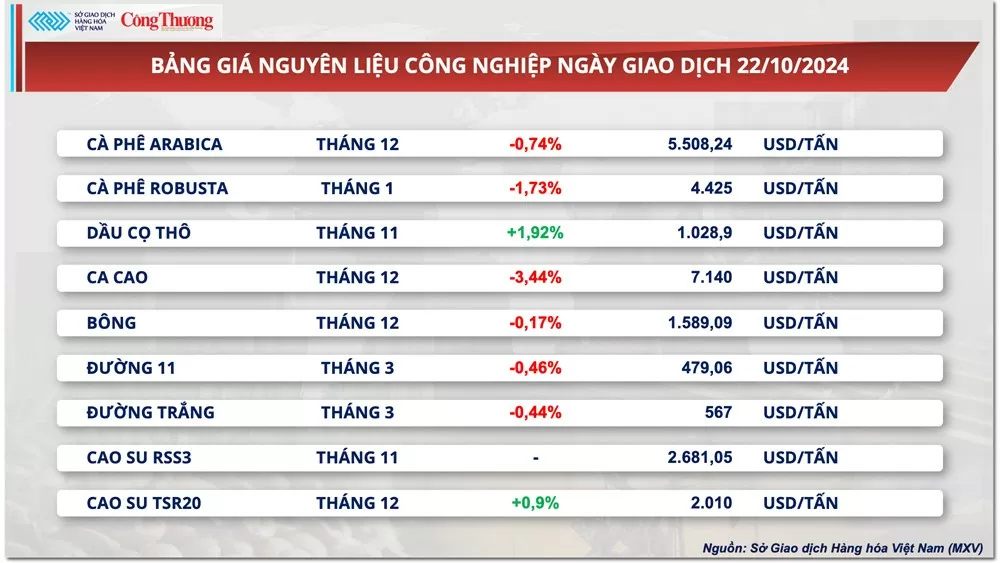

Cocoa prices lead the decline

In the industrial raw materials market, cocoa prices led the decline yesterday with a decrease of 3.44% compared to the reference. The reason came from positive signals about the crop and supply in Ivory Coast - the world's largest cocoa producer and exporter.

|

| Industrial raw material price list |

According to cocoa growers in the West African country, abundant rains fell in most of the major cocoa growing regions last week, supporting the outlook for the new crop from October to March next year. Local cocoa exporters said that in the first 20 days of the 2024-2025 crop year, cocoa arrivals reached 193,000 tonnes, up 13.5% from the same period last season.

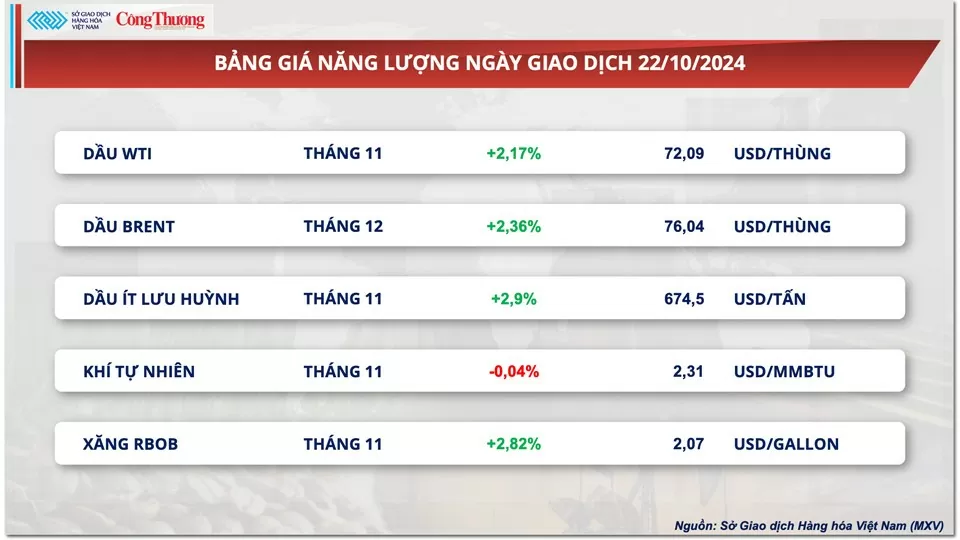

Prices of some other goods

|

| Energy price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2310-gia-bac-len-muc-cao-nhat-trong-12-nam-354182.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)