At the end of yesterday's trading session, cocoa prices led the decline, losing 7%. Analysts said the main reason was profit-taking by speculators.

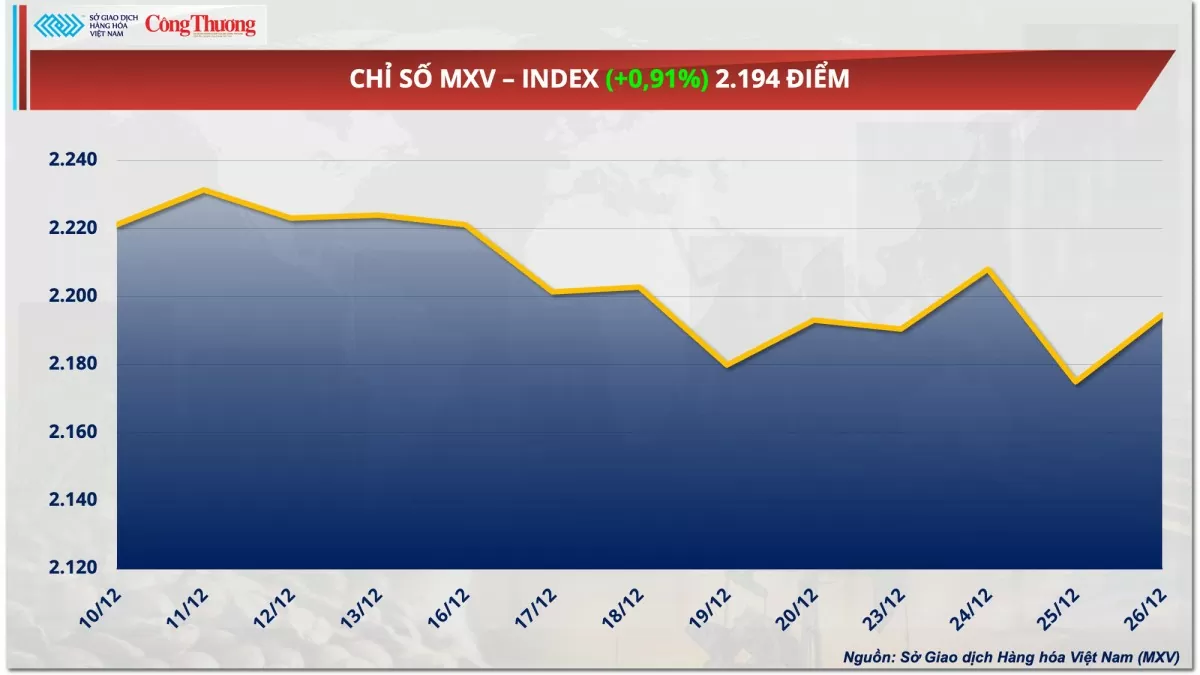

According to the Vietnam Commodity Exchange (MXV), the world raw material market was divided in the first trading session after the Christmas holiday (December 26). At the close, the MXV-Index increased by 0.91% to 2,194 points. Notably, 5 out of 7 agricultural products increased in price, notably soybean meal, soybeans and wheat. On the contrary, the prices of industrial raw materials weakened, in which cocoa recorded a sharp decline of nearly 7%.

|

| MXV-Index |

Soybean market recovers after holiday

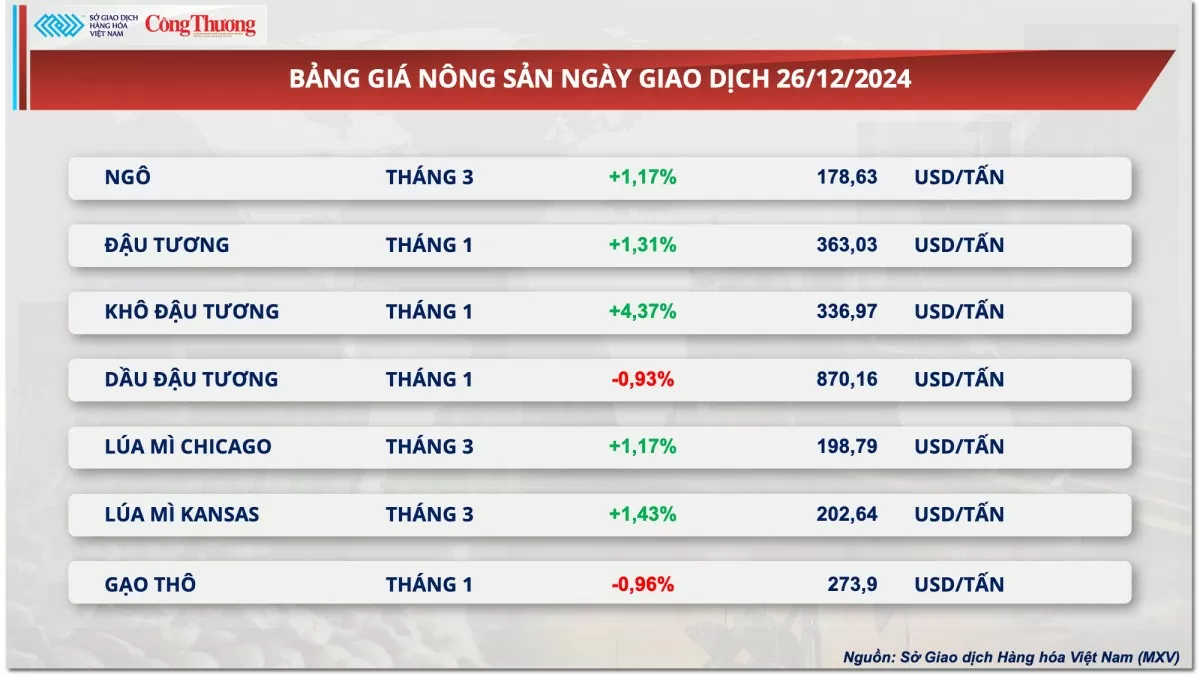

Buying pressure dominated the agricultural market after the Christmas holiday, with soybeans and soybean meal standing out on the price chart, rising 1% and 4.37%, respectively. Concerns about drought in Argentina, a fire at the Bunge soybean processing plant in Cairo (USA) and the liquidation of short positions by investment funds supported prices of these commodities in yesterday's trading session.

|

| Agricultural product price list |

According to weather forecasts in South America, the dry conditions in Argentina will continue into the new year, with limited rainfall in early January. Meanwhile, Brazil has received abundant rain, ensuring favorable conditions for the crop. This has raised concerns that the current crop year's soybean meal supply will not be as high as previously expected.

Yesterday, in Cairo, a major fire broke out at the Bunge grain mill. The fire is now under control but the resumption date is still undetermined. This factor also contributed to supporting soybean meal prices, indirectly positively affecting soybean prices.

In the domestic market, on December 26, the offer price of South American soybean meal to our country's ports was relatively stable. At Vung Tau port, the offer price of soybean meal for February 2025 delivery was VND 10,300/kg, while the March 2025 delivery also fluctuated at VND 10,300/kg. At Cai Lan port, the offer price was about VND 150/kg higher than at Vung Tau port.

Wheat also rose more than 1% after the holiday on supply concerns. Temperatures are forecast to be above normal across much of the U.S. over the next 10 days, along with heavy rainfall, which could be a concern if the ground doesn’t get a full snow cover when temperatures drop to normal and below normal.

According to the Russian Association of Grain Exporters and Producers, Russia's grain export potential in 2025 is forecast at 45 million tonnes, including 40 million tonnes of wheat. This forecast includes export volumes in the second half of the 2024-2025 season (when exports are limited by government quotas to increase domestic supply) and the first half of the 2025-2026 season, when quotas are not applied.

Cocoa prices fall 7% on profit-taking pressure

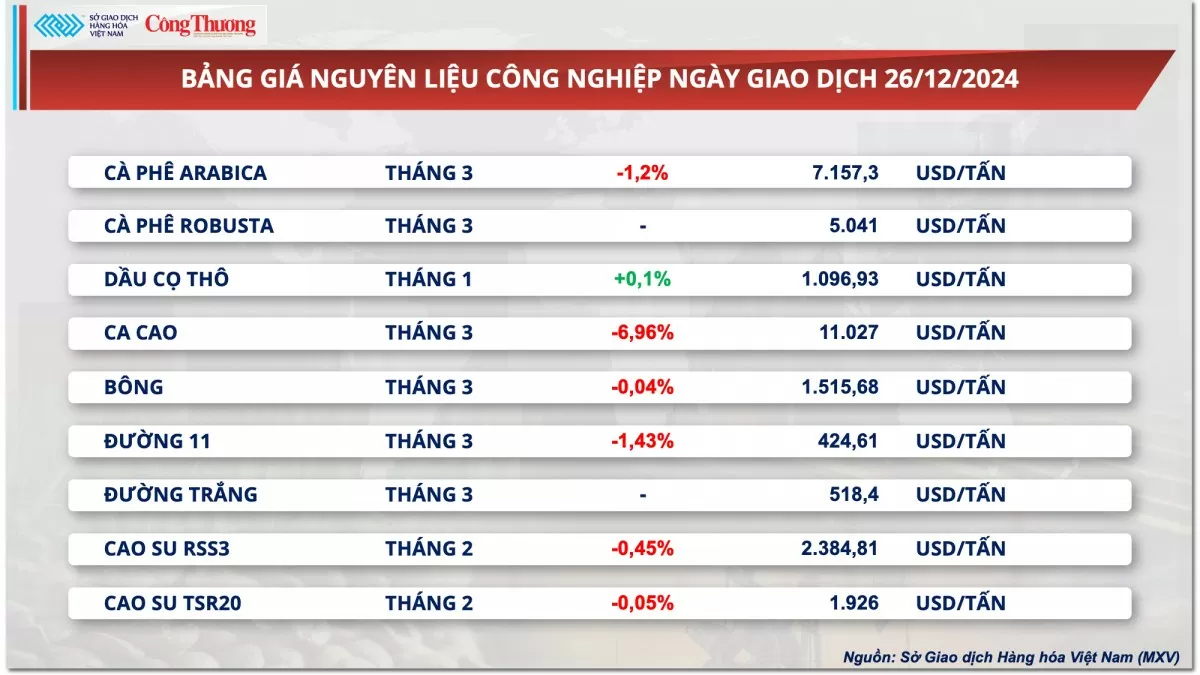

Industrial raw materials closed down across the board yesterday, while Robusta coffee and white sugar were closed. Intercontinental Exchange (ICE-US) commodities opened late.

|

| Industrial raw material price list |

Cocoa prices led the decline, falling 7% in yesterday's session. Analysts said the main reason was profit-taking by speculators after the Christmas holidays. However, the market still worries about supply in the first months of 2025.

Cocoa growers in Côte d’Ivoire are concerned about production in early 2025 due to the impact of strong dry monsoons in the main producing areas. Strong Harmattan winds combined with low rainfall have dried out cocoa leaves, weakening trees and affecting yields. The hardest hit areas are Daloa Central West, Yamoussoukro Central and Bongouanou Central, which have seen almost no rain.

Cocoa exporters in Ivory Coast reported that between October 1 and December 22, cocoa arrivals reached 972,000 tonnes, up 30% year-on-year. However, this increase is due to a sharp decline in production and exports in the previous 2023-2024 crop year. In fact, compared to normal crop seasons, cocoa arrivals are currently low.

Following cocoa, Arabica coffee prices fell 1.2% due to profit-taking pressure and the prospect of oversupply next year. According to the US Department of Agriculture (USDA), global coffee supply and demand in the 2024-2025 crop year will have a surplus of 6.78 million 60-kg bags, up 21.07% from the June forecast and the largest surplus in the past four years. USDA also estimated that global coffee trade will have a surplus of 8.26 million bags in the 2024-2025 crop year, 2.2 times higher than the previous forecast but 1.29 million bags lower than the 2023-2024 crop year. Of which, exports are expected to reach 144.9 million bags and imports 136.6 million bags.

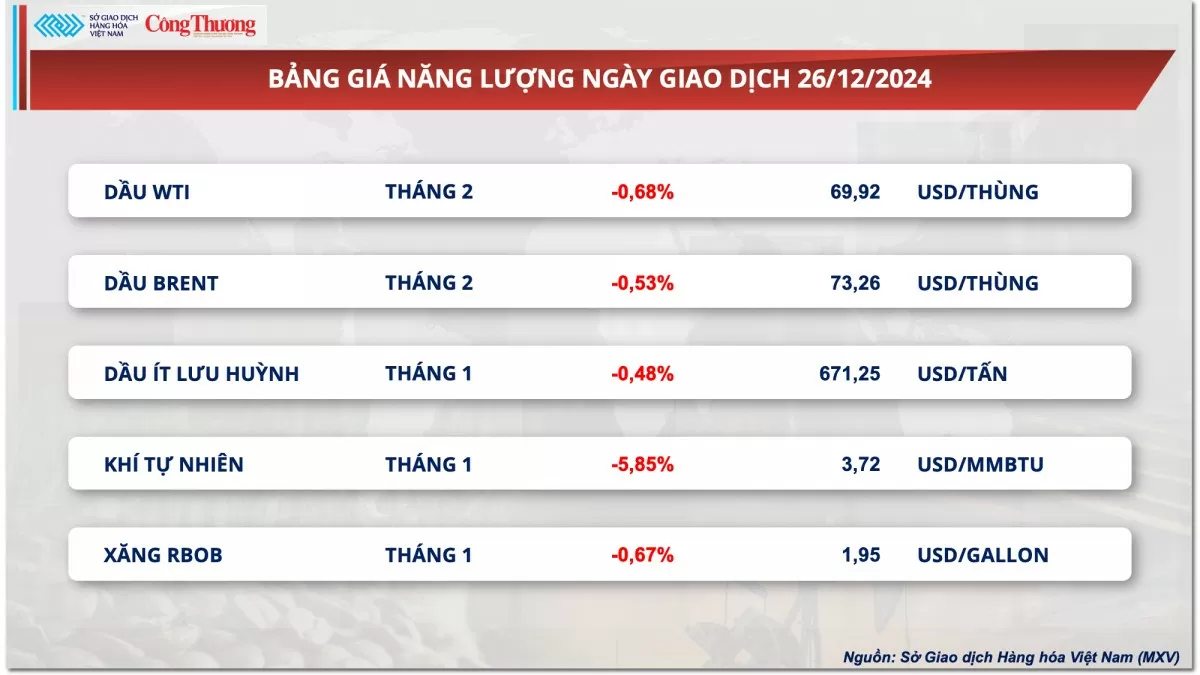

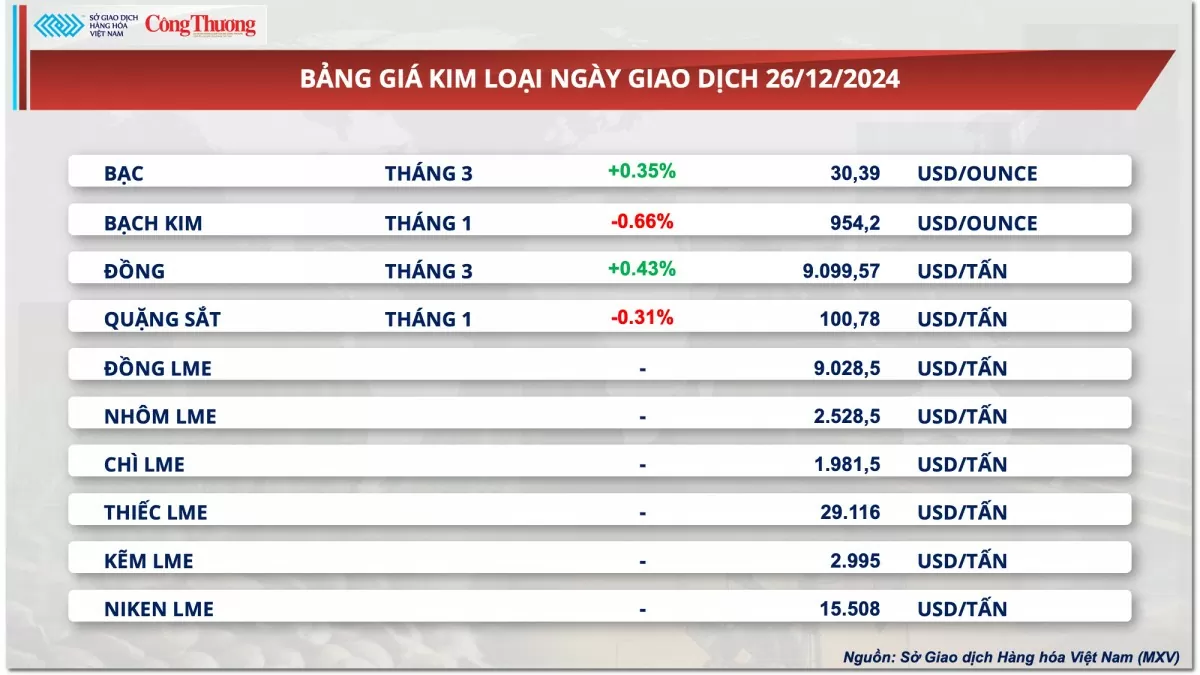

Prices of some other goods

|

| Energy price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2712-gia-ca-cao-giam-7-do-ap-luc-chot-loi-366464.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)