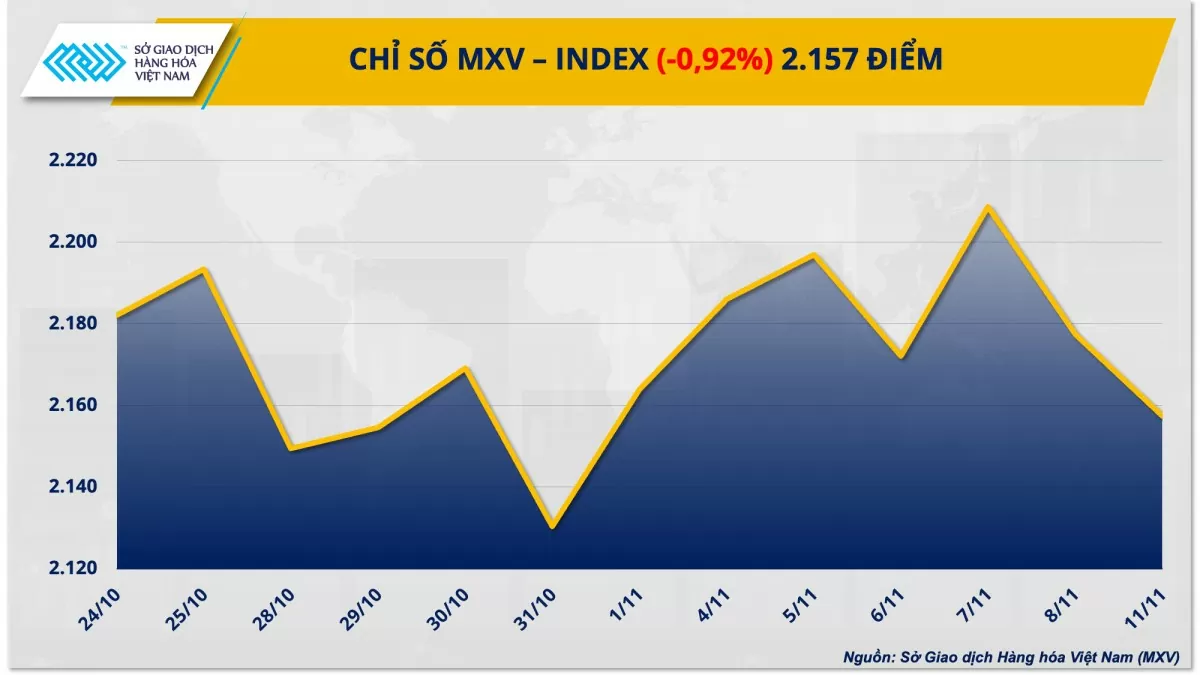

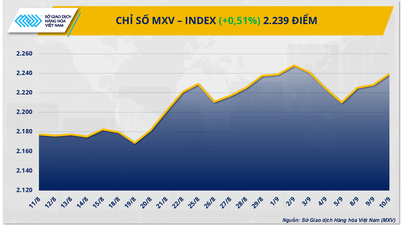

According to the Vietnam Commodity Exchange (MXV), world raw material prices fell sharply in the first trading session of the week (November 11).

At the close, the MXV-Index fell 0.92% to 2,157 points. Notably, in the metal market, all 10 commodities' prices weakened, of which silver prices fell nearly 3%. In addition, the energy market saw two commodities, WTI and Brent crude oil prices, plummeting simultaneously.

|

| MXV-Index |

Precious metal prices continue to lose momentum

The metal market started the new week with red dominating the price chart. For precious metals, silver and platinum prices continued to decline from the end of last week, falling 2.66% and 0.92%, respectively. At the end of the session, silver prices fell to 30.61 USD/ounce, while platinum prices fell to 969.5 USD/ounce.

|

| Metal Price List |

The strong increase in the USD continued to be a factor that put pressure on the price of precious metals in yesterday's trading session. The Dollar Index, a measure of the strength of the USD and 6 other major foreign currencies, closed up 0.52% to 105.54 points, the highest level in more than 4 months. The USD exchange rate continued to increase as the market remained optimistic about Donald Trump's victory in the race to the White House.

In addition, concerns about the possibility of the US Federal Reserve (FED) delaying its monetary easing cycle have also been a factor pushing the USD exchange rate up in recent sessions. Experts say that Mr. Trump's tariff and trade policies could push inflation in the US higher. This could pose many challenges for the FED as they have not yet completely won the battle to cool down inflation. The CME FedWatch interest rate tracking tool shows that traders are now betting on a 65% chance that the FED will cut interest rates by 25 basis points at its December meeting, down from the 80% rate achieved before Trump's victory.

In base metals, COMEX copper and iron ore both fell more than 1%, closing at $9,322 a tonne and $100.66 a tonne, respectively. Both commodities were under pressure yesterday as investors expressed disappointment over economic data from China, the top metal consumer.

Specifically, according to data released by the General Statistics Office of this country at the weekend, in October, China's consumer price index (CPI) increased by 0.3% compared to the same period last year, 0.1 percentage points lower than the forecast and the previous month's figure. In addition, the producer price index (PPI) continued to fall further, with a decrease of 2.9% in October, marking the 25th consecutive month of decline. This figure decreased more sharply than the market's forecast of a 2.5% decrease and the 2.8% decrease of the previous month. This is also the sharpest decline since November last year.

The data underscores the lingering fear of deflation in China’s economy and raises concerns that the country will miss its target of around 5% growth this year. It also worsens the outlook for demand for metals used in manufacturing, such as copper and iron ore, putting pressure on prices.

World oil prices fell more than 2%

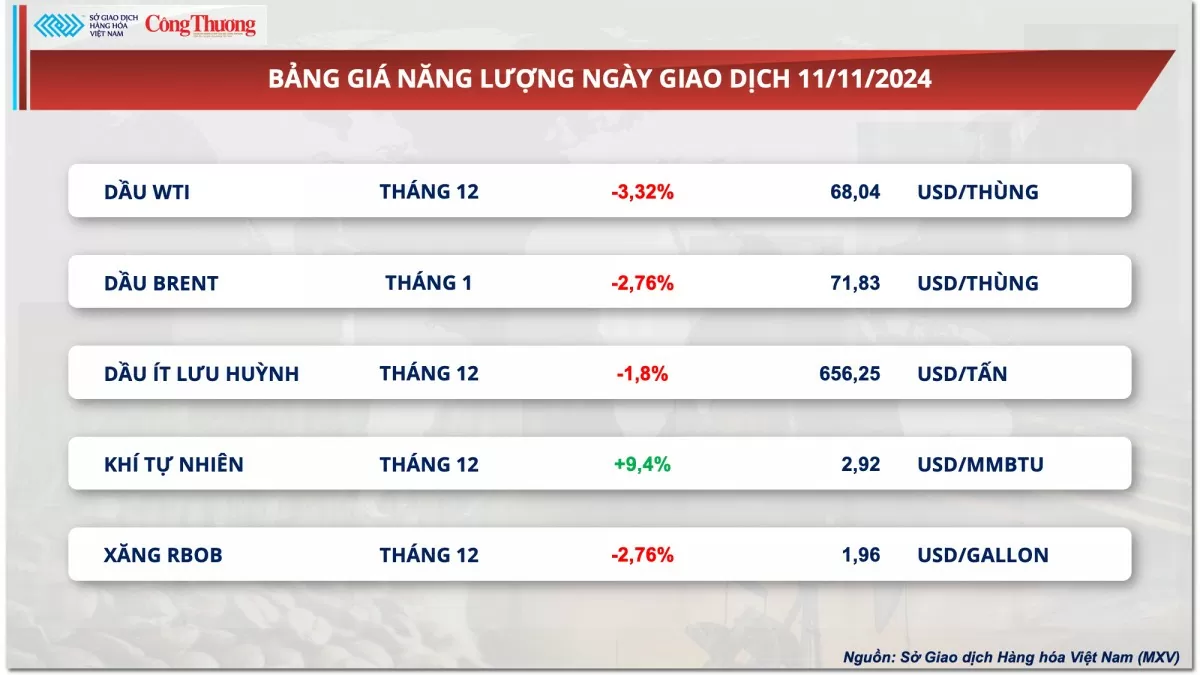

Oil prices plunged 2% in yesterday's trading session as the Chinese government 's stimulus package disappointed investors in their search for demand growth. In addition, forecasts of increased supply in 2025 put pressure on both oil prices, according to MXV.

At the end of the trading session on November 11, WTI crude oil price decreased by 3.32% to 68.04 USD/barrel. Meanwhile, Brent crude oil price decreased by 2.76% to 71.83 USD/barrel.

|

| Energy Price List |

So far, the oil consumption situation in China – the world’s largest oil importer – has not shown any signs of improvement. According to data from the National Bureau of Statistics (NBS), the consumer price index (CPI) in October increased 0.3% compared to the same period last year, slowing down from the 0.4% increase in September, marking the slowest increase since June this year.

In addition, data from the General Administration of Customs of China (GACC) showed that the country's oil imports in October reached only 10.53 million barrels per day, down 9% compared to the same period in 2023 and down 2% compared to September. In order to revive the slowing economy, the Beijing government announced a fiscal support package worth 10,000 billion yuan, equivalent to 1,400 billion USD last weekend. However, instead of focusing on the real estate sector or boosting consumption as expected by the market, this fiscal package aims to resolve the outstanding debt of local governments. The market was really disappointed by the scale and focus of this fiscal support package, adding to concerns about the oil demand outlook.

In addition, Mr. Trump's victory in the race to the White House added strength to the USD, helping the US dollar index (DXY) increase 0.52% to 105.54 USD in the trading session on November 11. The greenback's high value makes oil more expensive for importers buying with other currencies, raising concerns about declining oil demand, thereby putting more pressure on world oil prices.

On the supply side, newly elected US President Donald Trump has emphasized his support for expanding oil and gas exploitation in the US, raising concerns about future oversupply. In addition, according to Bank of America's forecast, oil supply growth from countries outside the Organization of Petroleum Exporting Countries (OPEC) will reach 1.4 million barrels/day in 2025 and 900,000 barrels/day in 2026. The bank also said that global oil inventories will increase, even if the Organization of Petroleum Exporting Countries and its allies (OPEC+) do not increase production. These data have reinforced the market's judgment of oversupply and weakened world oil prices.

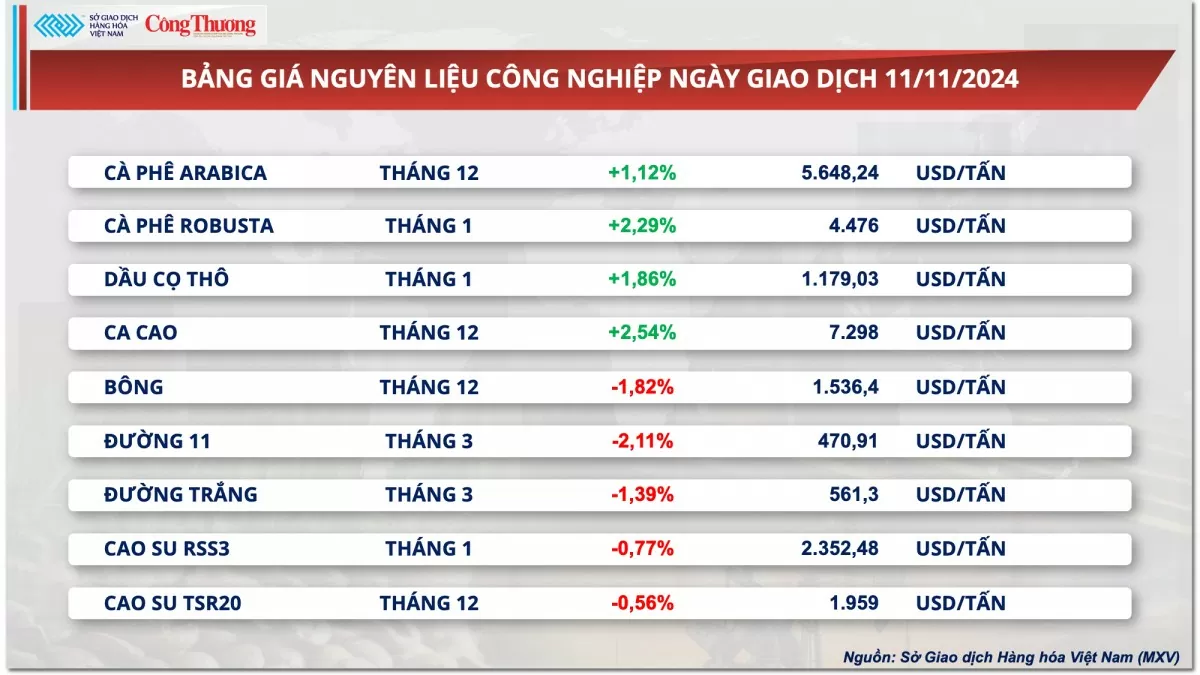

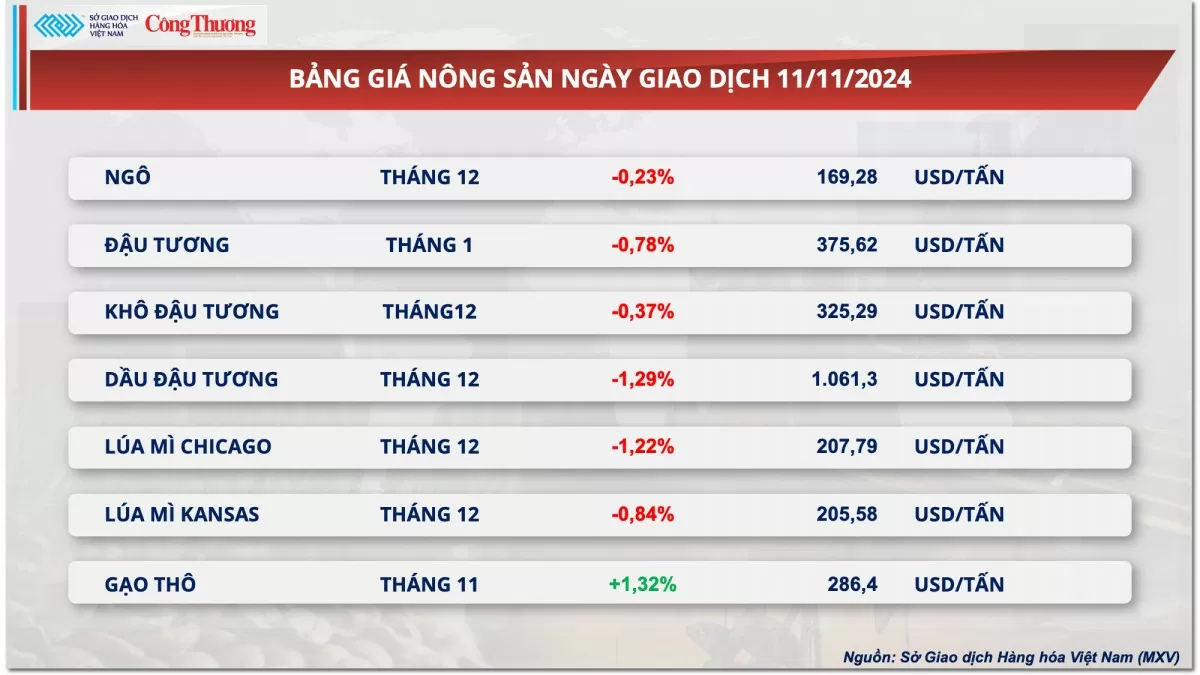

Prices of some other goods

|

| Industrial raw material price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-12112024-gia-dau-the-gioi-giam-hon-2-358262.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)