Gold price today August 23, 2024: At a sensitive time for the market, experts advise investors to be cautious at this time when there is still a lot of US economic and employment data to be announced, as well as before the Fed's meeting in September. Therefore, it is still advisable to keep a part of capital in gold to preserve assets.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 8/23 AND EXCHANGE RATE TODAY 8/23

| 1. SJC - Updated: 08/22/2024 08:10 - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 79,000 | 81,000 |

| SJC 5c | 79,000 | 81,020 |

| SJC 2c, 1C, 5 phan | 79,000 | 81,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,100 | 78,400 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,100 | 78,500 |

| 99.99% Jewelry | 76,950 | 77,950 |

| 99% Jewelry | 75,178 | 77,178 |

| Jewelry 68% | 50,661 | 53,161 |

| Jewelry 41.7% | 30,158 | 32,658 |

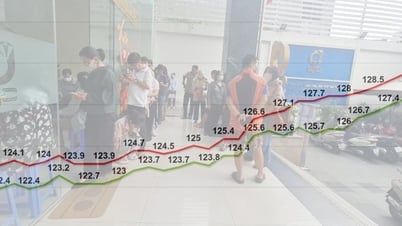

Update gold price today August 23, 2024

World gold prices plunged below the sensitive threshold of 2,500 USD/ounce, profit-taking pressure was quite large.

On Kitco , according to SP Angel, the amount of money that investors bet on the possibility of gold prices rising increased by 18%, with total new futures contracts reaching over $6.7 billion last week. Huge money is pouring into this investment channel. US investors are also buying gold ETF certificates to protect their assets against a weakening USD.

According to World & Vietnam Newspaper, at 8:30 p.m. on August 22 ( Hanoi time), the gold price traded on the Kitco electronic floor was at 2,494.50 USD/ounce, down sharply by 18.00 USD/ounce compared to the previous trading session. December gold price fell 13.40 USD to trade at 2,534.10 USD/ounce.

Gold prices are under pressure as short-term investors are keen to lock in large profits. This trend has contributed to today's decline. However, the precious metals market is largely in a pause mode ahead of a major meeting of the US central bank.

The market is in "waiting mode" for information from the US Federal Reserve's annual meeting in Jackson Hole, Wyoming, which begins late on August 22. As a tradition, US financial policy executives have often made market-moving statements at the conference in recent years. Fed Chairman Powell is expected to give an important speech on August 23 and may give some information on the scale of the US economy's expected interest rate cut in September. Previously, the FOMC meeting minutes did not contain any major surprises.

Fed officials are increasingly confident about the direction of interest rates and are ready to start easing if economic data continues to improve, as recent data show inflation is moving toward 2%. Nearly all officials said they expect inflationary pressures to continue to ease in the coming months, according to the FOMC report.

In the market, the prediction that the Fed will cut interest rates for the first time in September has reached 100%. There are 70% predicting that the Fed will cut interest rates by 0.25% for the first time and 30% predicting that the Fed will cut interest rates by 0.5% for the first time.

Meanwhile, many officials say the risks to the labor market are rising. A further deterioration in the labor market will lead to a more serious decline. Last month, the US created only 114,000 new jobs, lower than the forecast of 175,000. The unemployment rate also rose, to 4.3% - a three-year high.

Asian and European stock indexes were mixed overnight. Stock indices have not made any significant developments. Trader/investor sentiment is now more optimistic, with the S&P 500 and Nasdaq hitting four-week highs this week.

Overseas markets saw the dollar index move higher. Nymex crude oil prices edged up slightly and are trading around $72.25 a barrel. The benchmark 10-year U.S. Treasury note is currently yielding 3.792%.

Domestic gold price : SJC gold bars "unmoving", gold rings highest ever, gloomy transactions.

At the end of the trading session on August 22, Saigon Jewelry Company listed the price of SJC gold bars at 79.00 - 81.00 million VND/tael (buy - sell).

Doji Group also listed the price of SJC gold bars at 79.00 - 81.00 million VND/tael.

The price of 9999 round smooth gold rings increased to a record level - 78.4 million VND/tael.

Saigon Jewelry Company listed the price of gold rings of type 1-5 at only 77.1-78.4 million VND/tael.

Phu Nhuan Jewelry Company (PNJ) listed the price of gold rings at 77.10 - 78.35 million VND/tael.

Doji Group listed the price of 9999 round smooth gold rings at 77.15 - 78.35 million VND/tael.

|

| Gold price today August 23, 2024: Gold price 'plummeted', lost the 2,500 USD mark, gold rings are at an unprecedented high, huge cash flow is pouring into this investment channel. (Source: Bloomberg) |

Gold prices are on track for their strongest year yet.

The US is about to enter a period of monetary easing, with lower interest rates, which will weaken the USD.

Gold prices have risen more than 20% since the start of the year, and the precious metal is on track for its biggest annual gain since 2000. "Geopolitical volatility, speculative demand and increased ETF buying are all supporting gold prices," said Joseph Cavatoni, market strategist at the World Gold Council (WVG).

The main reason for the increase in gold prices is the demand for financial investment, especially from ETF funds. Investor confidence in general has also improved as they expect the Fed to cut interest rates in the September meeting," said Aakash Doshi - Director of Commodities for North America at Citi Research. He predicted that the price of gold could reach $2,600/ounce by the end of this year and reach $3,000/ounce by the middle of next year.

Holdings at SPDR Gold Trust, the world's largest gold ETF, have also just hit a seven-month high of 859 tonnes. The CME FedWatch interest rate tracker shows that the market is now betting on a 71% chance of the Fed cutting interest rates by 25 basis points (0.25%) in September.

Independent metals trader Tai Wong is cautious on the precious metal, predicting gold has room to move higher but is unlikely to accelerate sharply absent any unexpected events.

Gold is on track for its best year since 2020, rising nearly $470, or 22%, by 2024. Geopolitical tensions, uncertainty surrounding the U.S. presidential election, and the possibility of interest rate cuts are expected to continue to push the precious metal higher. Citibank experts appear confident that gold is on an upward trend over the next three to six months, with spot gold prices averaging $2,550 an ounce in the fourth quarter of 2024.

Gold is also expected to be positive due to strong demand from India, as gold purchases before the wedding season in the country of a billion people are very strong. Pre-Christmas jewelry purchases in India also tend to push prices up in the fall. In addition, the Chinese market is expected to return to net buying in the context of many private investors losing confidence in local banks and investment funds. Moreover, the Chinese government's statement that "real estate is for living, not for investment" also encourages investors to jump into other types of assets, including gold.

Source: https://baoquocte.vn/gia-vang-hom-nay-2382024-gia-vang-the-gioi-lao-doc-vang-nhan-cao-chua-tung-co-dong-tien-rat-lon-dang-do-vao-kenh-dau-tu-nay-283510.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)