With a loss after tax of VND 546 billion after 9 months of 2024, HAGL Agrico (code: HNG) has increased its accumulated loss to VND 8,648 billion. This loss level has also far exceeded the target of only a loss before tax of VND 120 billion in 2024 approved by the General Meeting of Shareholders.

HAGL Agrico (HNG) lost another 182 billion VND in the third quarter of 2024

Hoang Anh Gia Lai International Agriculture Joint Stock Company (HAGL Agrico, code HNG - UPCoM) has just announced its financial statements for the third quarter of 2024 with net revenue reaching VND 141 billion, down 12% over the same period last year. Due to operating below cost price (VND 187 billion), HNG suffered a gross loss of VND 47 billion, but this was a significant decrease compared to the gross loss of VND 101 billion in the same period in 2023.

In terms of expenses, except for financial expenses, which increased by 34% to VND117 billion this period, sales expenses and administrative expenses decreased by 58% and 72% to VND2.7 billion and VND5 billion, respectively. As a result, HNG reported a loss after tax of VND182 billion in the third quarter of 2024, a slight decrease compared to last year's loss of VND199 billion. This is also the 14th consecutive quarter that HAGL Agrico has recorded a loss.

At the same time, the Company had 116.4 billion VND in financial expenses incurred during the period, including: 54.2 billion VND in exchange rate loss due to revaluation of foreign currency debts and 62.2 billion VND in interest expense arising from previous loans of rubber and palm oil projects. The combination of the above factors caused the Company to continue to incur losses.

In the first 9 months of 2024, HAGL Agrico brought in VND 288 billion in net revenue, down 34%, but had a loss after tax of VND 546 billion (a loss of VND 446 billion in the same period) due to operating below cost price, thereby increasing HNG's accumulated loss to VND 8,648 billion. The loss for the first 9 months also far exceeded the target of only VND 120 billion in pre-tax loss approved by the 2024 HNG Shareholders' Meeting.

HAGL Agrico lost an additional VND 182 billion in the third quarter of 2024.

Explaining further about the poor business results, in addition to the above-mentioned exchange rate difference loss, HAGL Agrico said the cause of the loss also came from the decrease in fruit production. Compared to the same period, fruit production only reached 2,903 tons, down 56%. The suspension of production of a part of the banana growing area for care and land improvement caused the banana production to decrease during the period.

Specifically: The area of banana gardens harvested during the period decreased from 1,920 hectares to 494 hectares. Due to the area of perennial banana gardens, the quality and productivity were no longer effective, so the company had to stop taking care of them to focus on re-leveling the land and renovating the gardens to improve quality and efficiency.

At the same time, the company is implementing a factory model with investment in completing synchronous infrastructure, mechanized machinery and equipment, applying new technical processes to stabilize output, improve productivity and quality in the coming time.

Regarding rubber trees, rubber output reached 2,401 tons, equivalent to revenue of 89.8 billion VND. The area of rubber plantation has been completed to 15,192 hectares, but the company has only effectively exploited 4,932 hectares. Meanwhile, HAGL Agrico still has to calculate depreciation for the entire area of plantation, including the unexploited part, leading to increased costs.

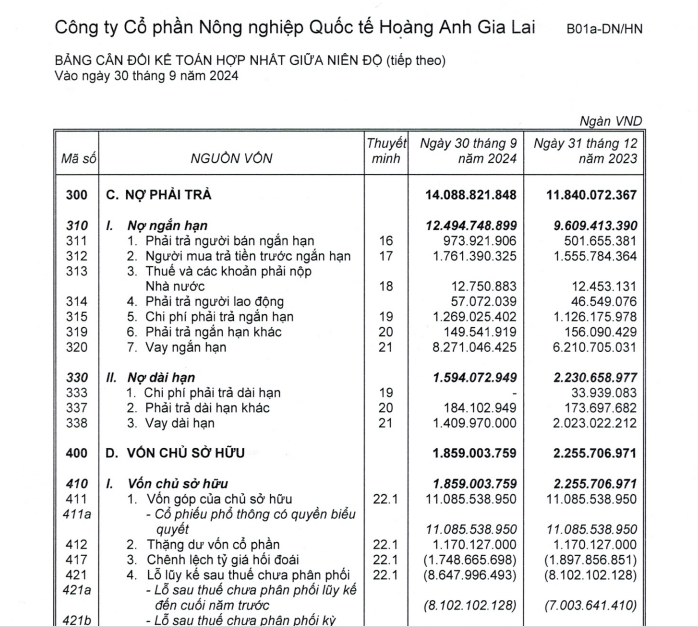

HAGL Agrico's short-term debt increased by more than 2,000 billion VND

At the end of the third quarter of 2024, HAGL Agrico's total assets increased by nearly VND 1,900 billion compared to the beginning of the year (15%), reaching VND 15,948 billion.

The majority of HAGL Agrico’s remaining assets are long-term assets, located in land plots and construction investment funds. Of which, fixed assets account for VND5,443 billion. This asset has been depreciated by VND3,223 billion. Long-term unfinished assets account for VND5,619 billion, VND1,200 billion higher than at the beginning of the year, mainly the cost of developing fruit orchards and rubber orchards.

Short-term debt during the period increased by VND 2,060 billion, accounting for VND 8,271 billion.

The capital structure in the first 9 months of the year also showed a sharp increase in short-term debt.

Specifically, total liabilities accounted for 14,089 billion VND, equivalent to 88% of the enterprise's capital. Short-term loans during the period increased by 2,060 billion VND, accounting for 8,271 billion VND.

In contrast, long-term debt decreased by more than VND600 billion, to VND1,410 billion. HAGL Agrico's total debt is VND9,681 billion, 5.2 times higher than its equity.

HNG's largest creditor is Truong Hai Agriculture Joint Stock Company with VND7,757 billion, up 42% compared to the beginning of the year, including VND272.7 billion in short-term loans and VND7,487 billion in long-term loans. Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) is also lending HNG VND1,019 billion, down nearly VND100 billion.

On the stock market, HNG shares have been delisted and traded on UPCoM since September 18. After being delisted, HNG shares will be traded on UPCoM. To be relisted on HoSE, HAGL Agrico must have profits for 2 consecutive years before it can apply for registration.

Previously, in the semi-annual report, the auditor emphasized the ability to operate continuously, the reason being that HAGL Agrico at that time had an accumulated loss of VND 8,466 billion. Short-term debt exceeded short-term assets and violated some terms of the loans.

HAGL Agrico explained: Currently, the company is continuing to implement projects to ensure cash flow for business operations, restructuring some debts and working with related parties to resolve debts and receive land use right certificates for projects in Laos and Cambodia, to implement legal procedures for project investment and mobilize capital to have cash flow for investment. On this basis, the Company has prepared and presented the 6-month financial statements of 2024 meeting the going concern assumption for the next 12 months.

A banana plantation in Laos of HAGL Agrico. Photo: Thaco

HAGL Agrico said it is trying to improve its business operations. This year, HAGL Agrico plans to plant 1,533 hectares of new bananas, care for and exploit 6,328 hectares of rubber; invest in barns, pastures and import 5,800 cows.

In addition, HAGL Agrico has been approved to invest in a large-scale fruit tree planting and cattle breeding project in Attapeu and Sekong provinces (Laos). The project covers 27,384 hectares of land, with a total investment of VND 18,090 billion, and is scheduled to be completed between 2024 and 2028. Estimated revenue in 2028 is VND 13,500 billion, with expected profit of VND 2,450 billion.

Currently, the company implements a large-scale agricultural production strategy, industrial management throughout the value chain, applying mechanization, biotechnology and digitalization according to a suitable roadmap.

“With this strategy, the company hopes to generate profits in the near future. From there, it will gradually reduce accumulated losses on the financial statements,” HAGL Agrico emphasized.

Reporting on the large-scale agricultural investment project for the 2024-2028 period, HAGL Agrico leaders want to plan a specialized fruit tree growing area of up to 10,000 hectares (including 8,000 hectares of bananas and 2,000 hectares of pineapples).

Planning area for cattle breeding combined with fruit tree planting up to 14,000 hectares (including 5,000 hectares of fruit trees including mango, grapefruit, durian and herd size of 210,000 cows).

Total investment capital is 18,090 billion VND (about 750 million USD). Investment progress from 2024 to 2028.

Accordingly, by 2025-2028, the company plans to export 624,000 tons of fresh fruit per year, 25,000 tons of processed fruit per year, 12,000 breeding cattle per year and 17,000 tons of commercial beef per year.

The expected efficiency by 2025-2028 will reach revenue of 13,500 billion VND (equivalent to 550 million USD) and will have profit of 2,450 billion VND (about 100 million USD).

Source: https://danviet.vn/hagl-agrico-bao-lo-quy-thu-14-lien-tiep-no-vay-ngan-han-tang-them-hon-2000-ty-dong-20241030140932025.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)