The United States initiated anti-dumping and anti-subsidy investigations into hard capsule shells imported from Brazil, China, India and Vietnam.

The Department of Trade Remedies, Ministry of Industry and Trade said that on November 13, 2024, the US Department of Commerce (DOC) initiated anti-dumping and countervailing duty investigations into hard capsule shells imported from Brazil, China, India and Vietnam. In this case, the above-mentioned products from all four countries were proposed for both anti-dumping and countervailing duty investigations.

|

| The United States initiated an anti-dumping investigation on hard capsule shells from Vietnam. Illustrative photo. |

Accordingly, the products under investigation are some hard capsule shell products (HS codes 9602.00.1040 and 9602.00.5010). Case codes: A-552-847 and C-552-848. The plaintiff is Lonza Greenwood Co., Ltd. The exporting enterprise accused of dumping and subsidization: The plaintiff named 02 Vietnamese companies.

CBPG investigation period: April 2024 - September 2024; CTC investigation period: 2023; Damage investigation period: January 2021 - June 2024.

According to the plaintiff, the total import turnover of goods from Vietnam in 2023 is about 26 million USD; China is 49 million USD, India is 67 million USD and Brazil is 4 million USD. According to data from the US International Trade Commission (ITC), the import volume from Vietnam accounts for about 12% of the total import volume of investigated products into the United States.

Information on alleged dumping

The alleged dumping margin against Vietnam is from 63.53% to 86.04%.

According to the Trade Remedies Authority, because the United States considers Vietnam a non-market economy , the US Department of Commerce will use the surrogate values of third countries to calculate the dumping margin for Vietnam. In this case, the plaintiff proposed to use Indonesia as a surrogate country because it believes that Indonesia has a similar level of economic development to Vietnam and has a significant number of hard capsule shell manufacturers (Indonesia is on the latest list of surrogate countries issued by the US Department of Commerce for Vietnam). The parties have a 30-day period to comment on the surrogate country before the US Department of Commerce issues its preliminary conclusions.

Information on alleged subsidies

Pursuant to the Plaintiff's allegations, after reviewing the petition, the U.S. Department of Commerce initiated an investigation into 27 government subsidy programs that allegedly benefited Vietnamese hard capsule manufacturers and exporters, causing material injury or threatening to cause material injury to the U.S. hard capsule industry. The alleged subsidy programs fall into the following categories:

Group of corporate income tax incentive programs: Including incentive programs of corporate income tax exemption and reduction for encouraged industries, for enterprises located in industrial parks, economic zones, for enterprises located in areas with difficult socio-economic conditions, for new investors and accelerated depreciation programs.

Group of loan and guarantee programs: including preferential loan programs, factoring, export guarantees with preferential interest rates and terms of 04 state-owned joint stock commercial banks (Agribank, Vietinbank, Vietcombank and BIDV) because these banks are subject to Government intervention; investment credit programs of the Vietnam Development Bank (VDB) and interest rate support programs of the State Bank.

Sponsorship program: Includes export promotion sponsorship and investment support programs.

Group of import tax exemption programs: including import tax exemption programs for imported goods used to produce export goods, import tax refunds for raw materials used to produce export goods, import tax exemption for imported goods into industrial zones, import tax exemption for foreign-invested enterprises, import tax exemption for imported raw materials for export processing enterprises located in export processing zones.

Group of land incentive programs: including programs to exempt or reduce land and water surface rent/tax or rental fees for encouraged industries, enterprises in industrial parks and economic zones, and foreign-invested enterprises.

Program to provide utilities at preferential prices in industrial parks and export processing zones: includes programs to provide electricity and water utilities to enterprises in industrial parks and export processing zones at preferential prices.

Subsidy programs from the Korean government: contract performance guarantee programs, export promotion loans, overseas business promotion loans, and the Export-Import Bank of Korea interbank revolving credit facility program. This is a program that is accused of cross-border subsidies under the new regulations that will take effect from April 24, 2024 in the United States.

Further investigation procedures:

Mandatory selection of defendant

To date, the US Department of Commerce has not issued the Quantity and Value (Q&V) Questionnaire for both anti-dumping and countervailing duty cases to collect information for mandatory respondent selection. Enterprises need to proactively register for an IA ACCESS account at the US Department of Commerce's electronic information portal (https://access.trade.gov/login.aspx) to update information on enterprises required to respond to the Q&V Questionnaire and submit relevant documents and materials to the US Investigation Agency. Note that the response deadline can be extended. Enterprises that do not receive the Q&V Questionnaire but export this item to the US during the investigation period still need to respond to be calculated separately.

Traditionally, the US Department of Commerce will base on the Q&V Questionnaire responses and US Customs data to select 2 mandatory respondents (usually the largest Vietnamese exporters according to US Customs data during the investigation period). The mandatory respondents will be investigated and their respective dumping/subsidy margins will be determined.

Register for separate tax rates (only applicable to anti-dumping cases)

In the case of anti-dumping investigation, in case of not being selected as mandatory defendant, enterprises need to submit a separate application for tax rate. Enterprises need to prove that they operate independently, not under the control of the Government in both law and practice. The separate tax rate is equal to the weighted average of the dumping margins of mandatory defendants (excluding zero margins, de minimis margins, and margins based on unfavorable available data). The deadline for submitting a separate application for tax rate is 30 days from the date of initiation.

In case an enterprise does not submit a separate application for tax rate or the enterprise has submitted it but it is not accepted, the dumping margin for the enterprises will be the common dumping margin (usually equal to the alleged margin).

Answer the survey questionnaire

Once a mandatory respondent is identified, the U.S. Department of Commerce (DOC) will issue a Questionnaire to the mandatory respondent. In countervailing duty cases, DOC will issue a supplementary Questionnaire to the Government. The response period is typically 30 days from the date of issuance of the initial questionnaire (with possible extensions). DOC may issue additional questionnaires with shorter deadlines.

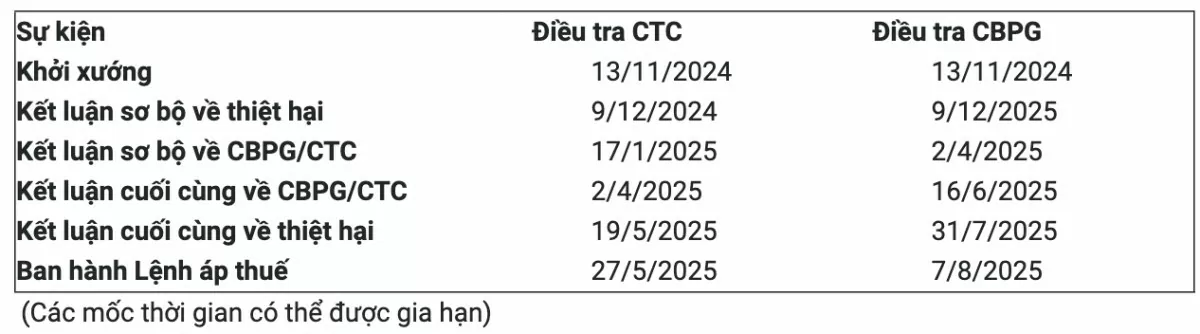

Some key timelines for the investigation are as follows:

|

The Trade Defense Department recommends that enterprises producing and exporting related products: Continue to closely monitor the developments of the case; proactively study and master the regulations, procedures, and processes of anti-dumping and anti-subsidy investigations of the United States; diversify export markets and products; fully cooperate with the US investigation agency throughout the course of the case. Any act of non-cooperation or incomplete cooperation may lead to the US investigation agency using available evidence to the disadvantage or applying the highest anti-dumping and anti-subsidy tax rate to the enterprise;

Actively register for an IA ACCESS account at the US Department of Commerce's electronic information portal (https://access.trade.gov/login.aspx) to update information and submit relevant documents and papers to the US Investigation Agency; Regularly coordinate and update information with the Trade Remedies Authority to receive timely support.

Source: https://congthuong.vn/hoa-ky-khoi-xuong-dieu-tra-chong-ban-pha-gia-chong-tro-cap-vo-vien-nhong-cung-tu-viet-nam-359921.html

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)