(NLDO) – Investors should take advantage of the recovery to restructure their portfolios and consider buying promising stocks in the shipping, import-export, banking, etc. industries.

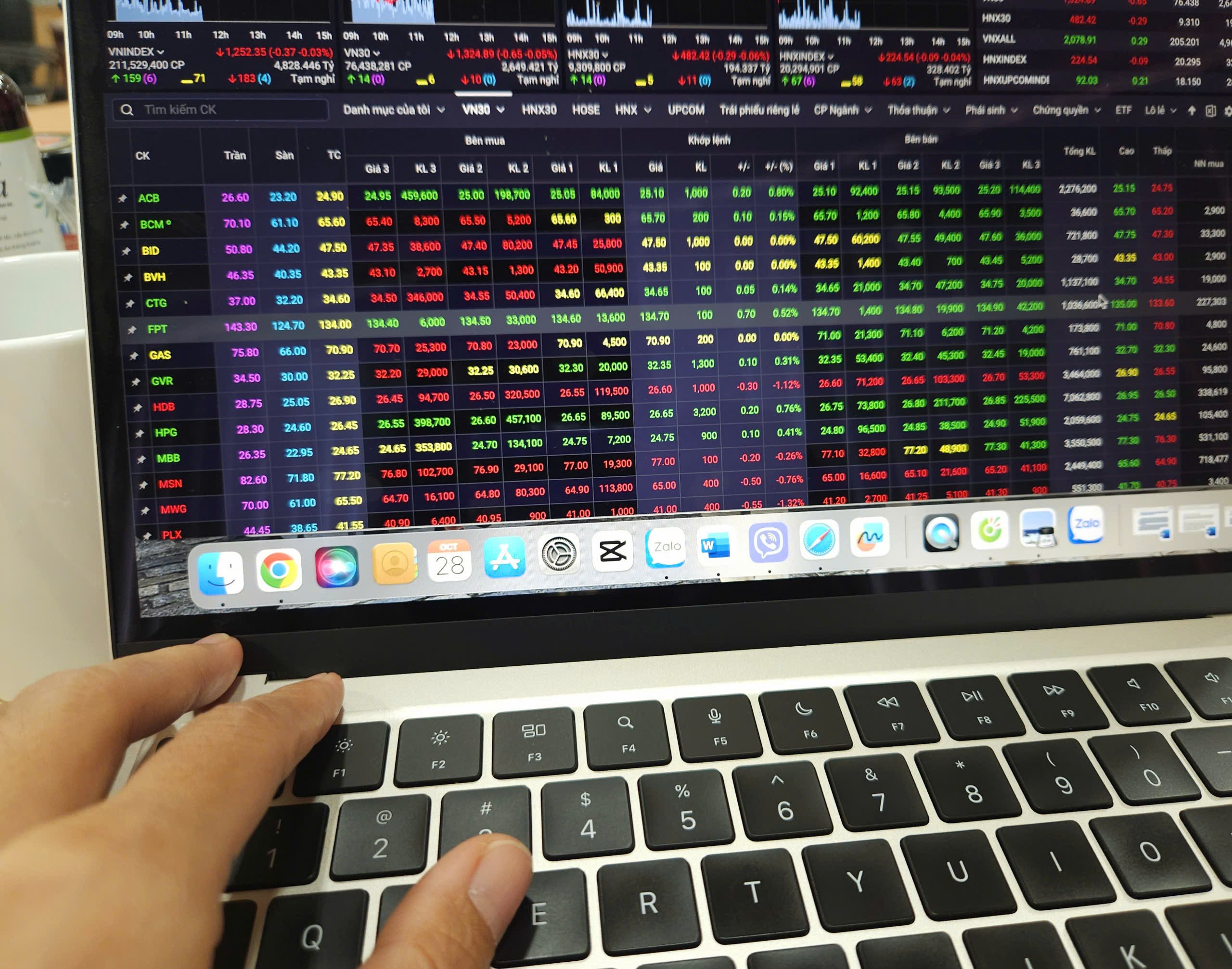

At the end of the trading week, VN-Index stopped at 1,257.5 points, down 5.07 points; HNX Index rose to 227.07 points, up 0.07 points. Tourism and entertainment stocks contributed to the market's remarkable growth, while banks caused the market to decline.

HVN, VNM, KDH, GEE, GEX increased positively, while TCB, VCB, HPG, GVR, VPB made the market less positive.

The total value of matched transactions of VN-Index decreased by 7.92% compared to last week. The next negative point is that the net selling pressure of foreign investors is still quite large, with over 1,300 billion VND on HOSE alone.

Although the VN-Index only recorded a slight decrease of 0.4% last week, the actual pressure that stock investors had to go through was much greater.

The Fed's more cautious interest rate cut roadmap next year has caused strong fluctuations in global financial markets.

US stocks were red, the USD index (DXY) soared past the 108-point mark... putting pressure on the USD/VND exchange rate and the VN-Index also fluctuated negatively.

Stocks are expected to continue to recover in the last week of the year.

Entering the next trading week, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy, VNDIRECT Securities Company, said that the international financial market could develop more positively when negative information has been largely reflected in prices. A more stable global financial market will help improve domestic investor sentiment and promote the recovery of stock indices. VN-Index could increase to around 1,270 points.

"Investors should take advantage of the recovery to restructure their investment portfolios and reduce their leverage if it is at a high level. Build their investment portfolios around industries with supportive information and improved business prospects such as maritime transport, logistics, import-export (textiles, seafood) and banking..." - Mr. Dinh Quang Hinh expressed his opinion.

Mr. Vo Kim Phung, Head of Analysis, BETA Securities Company, believes that investors should prioritize risk management strategies. Maintaining a reasonable cash ratio will help to have enough resources to buy stocks when the market has opportunities at attractive prices.

For current portfolios, investors need to review and prioritize holding stocks with good fundamentals, stable business results and long-term growth prospects. Limit increasing the proportion of stocks with high speculative nature or strong volatility.

Sharing the same positive view on the coming days, experts from Pinetree Securities Company argued that the bottom-fishing cash flow that appeared in the last session of the week helped the VN-Index not fall too deeply. It is likely that the recovery trend will continue next week, and the VN-Index may reach the 1,262 and 1,267 point levels.

Source: https://nld.com.vn/chung-khoan-tuan-toi-tu-23-den-27-12-mua-co-phieu-nao-trong-tuan-giao-dich-cuoi-nam-196241221223457707.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

Comment (0)