Ms. Minh Hanh participated in compulsory social insurance under her labor contract for 4 years. When she was 4 months pregnant, Ms. Hanh felt unwell and could not keep up with her current job, so she quit her job.

Ms. Hanh is worried: "If I stop paying social insurance at this time, will I be entitled to maternity benefits? If so, what procedures do I need to follow and where do I submit the documents to receive maternity insurance?"

Female workers who quit their jobs before giving birth can still enjoy maternity benefits (Illustration: Tung Nguyen).

Ms. Chi is in the same situation as Ms. Hanh. Chi participates in compulsory social insurance from May 2023 to March 2024. Chi's expected date of birth is August 2024, but she had to quit her job early because the distance from home to the company is very far, and she is pregnant so she is not strong enough to go to work as before.

Ms. Chi also has the same question as Hanh: "With the above time of participating in social insurance, will I be entitled to maternity benefits? If so, how many months' salary will I receive?"

According to Vietnam Social Security, the conditions for enjoying maternity benefits for female employees giving birth are clearly stipulated in Article 31 of the 2014 Law on Social Insurance.

Specifically, there are 6 cases where employees participating in compulsory social insurance are entitled to maternity benefits.

To enjoy this regime, employees must meet the conditions on social insurance participation time before giving birth according to each specific case.

For female employees giving birth, the condition is to have paid social insurance for at least 6 months within 12 months before giving birth or adopting a child.

As for female employees who give birth and must take time off work to rest during pregnancy as prescribed by a competent medical examination and treatment facility, there are two conditions.

First is to have paid social insurance for 12 months or more.

Second, you must pay social insurance for at least 3 months in the 12 months before giving birth.

In addition, according to Clause 4, Article 31 of the Law on Social Insurance 2014, employees who are eligible for maternity benefits as above but terminate their labor contract, work contract or quit their job before giving birth are still entitled to maternity benefits.

Comparing the above regulations, if Ms. Minh Hanh has participated in compulsory social insurance for 6 months or more within 12 months before giving birth, she is still entitled to maternity benefits according to regulations.

In case Ms. Hanh has to take time off work to rest during pregnancy as prescribed by a competent medical examination and treatment facility, she only needs to have paid social insurance for at least 3 months in the 12 months before giving birth to be eligible for maternity benefits.

In Ms. Chi's case, based on the time she gave birth, if within the 12 months before giving birth she had 6 months or more of social insurance contributions, she would be entitled to maternity benefits.

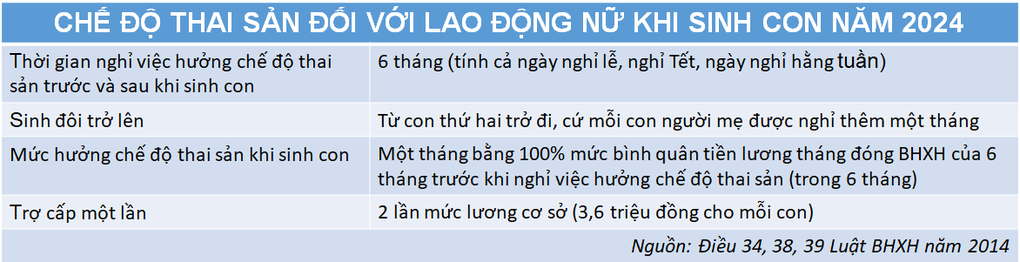

Regarding the level of maternity benefits, Vietnam Social Security said it is regulated in Article 39 of the 2014 Law on Social Insurance.

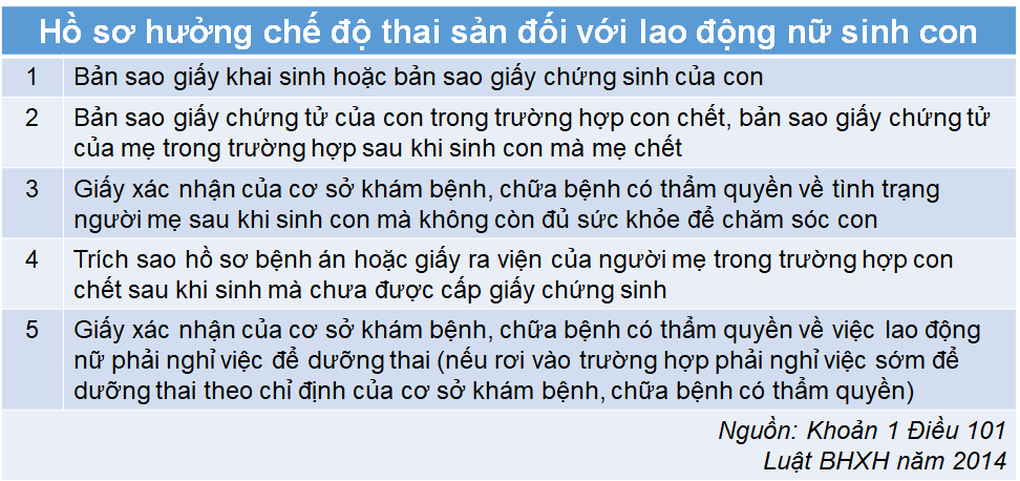

Regarding maternity benefits for female employees giving birth, Vietnam Social Security said it is regulated in detail in Clause 1, Article 101 of the Law on Social Insurance.

In case of quitting work before giving birth like Ms. Hanh and Ms. Chi, the employee must submit maternity benefits application and present the social insurance book to the social insurance agency where they reside.

Source: https://dantri.com.vn/an-sinh/nghi-viec-truoc-khi-sinh-can-lam-gi-de-duoc-huong-thai-san-20240618122827147.htm

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)