First of all, Decree No. 245/2025/ND-CP dated September 11, 2025 of the Government , amending and supplementing a number of articles of Decree No. 155/2020/ND-CP detailing the implementation of a number of articles of the Securities Law, helps attract the participation of foreign investors (FIIs) in securities offerings and issuances.

Decree No. 245/2025/ND-CP has supplemented regulations related to documents identifying professional securities investors compatible with foreign papers and documents, making it easier for foreign investors to participate...

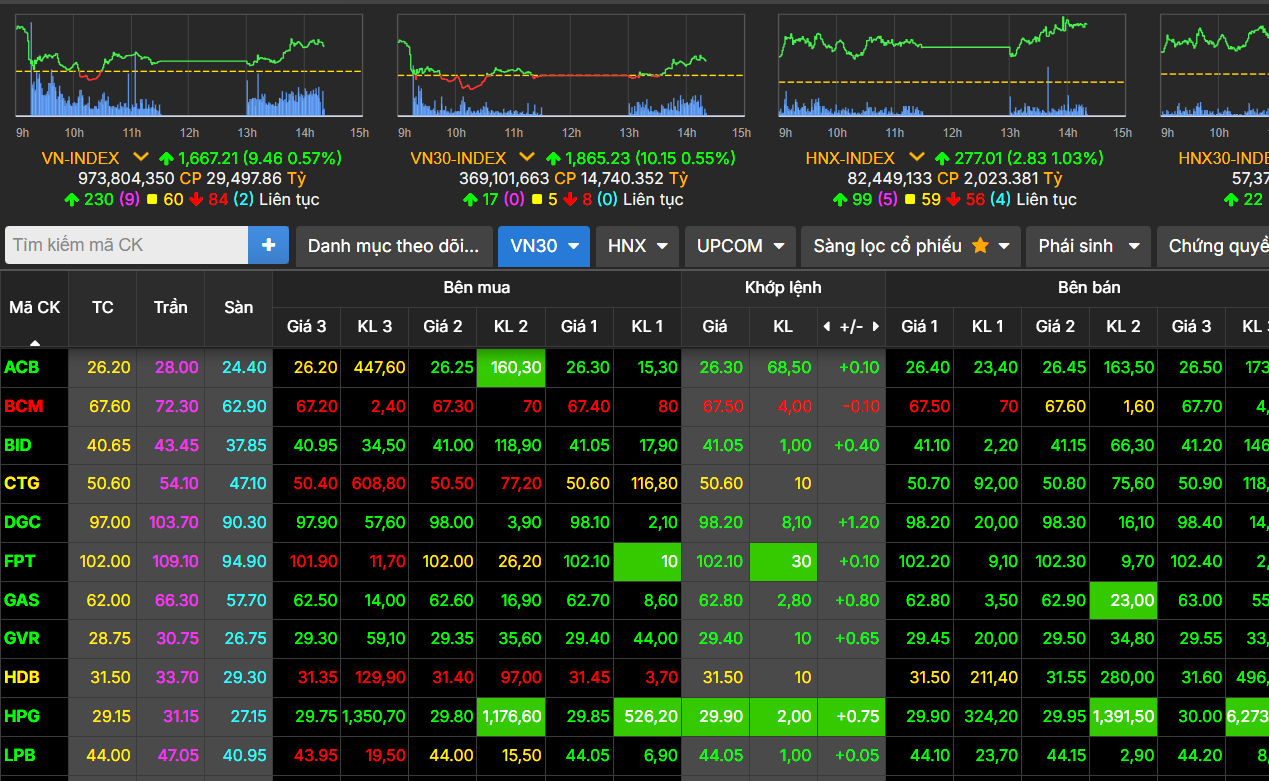

Decree 245/2025/ND-CP contributes to opening the market to foreign investors. Screenshot

In addition, the Decree shortens the time for newly offered and issued securities to be traded on the centralized market. At the same time, the time for securities to be traded on the market after the stock exchange has approved the listing is reduced from 90 days to 30 days.

These regulations are expected to help shorten the process of listing and trading securities by 3-6 months compared to present, better protect investors' rights, and increase the attractiveness of IPOs.

Decree No. 245/2025/ND-CP removes the regulation that the general meeting of shareholders and the charter of a public company decide on a maximum foreign ownership ratio lower than the level prescribed by law and international commitments.

For public companies that have announced the maximum foreign ownership ratio, it will continue to remain unchanged or this ratio will be changed in an increasing direction to gradually approach the level prescribed by law.

The Decree also adds a transitional provision stipulating the deadline for public companies to complete the procedure for notifying the maximum foreign ownership ratio (within 12 months from the effective date of Decree No. 245/2025/ND-CP), because currently many public companies have not completed this procedure, so the market has not correctly reflected the maximum foreign ownership ratio at public companies.

The amendment and supplementation of the above regulations aims to ensure the rights of foreign shareholders in buying and selling shares on the stock market; comply with the maximum level of market openness according to investment law, as well as reduce risks for foreign investors when events affecting enterprises occur.

With the new regulation, foreign investors are allowed to trade immediately after being granted ESTC and in accordance with international practices.

The Ministry of Finance has reported to the Government to supplement a number of regulations to perfect the legal basis for implementing the mechanism for clearing and settlement of securities transactions under the central clearing counterparty (CCP) mechanism, as well as establishing a subsidiary to undertake the CCP function.

Continuing the goal of making the stock market transparent, many regulations have been added in line with international practices, such as the regulation that corporate bonds offered to the public must have a credit rating (CRR), and at the same time, enterprises are allowed to use CRRs of prestigious international organizations such as Moody's, Standard & Poor, and Fitch Ratings.

In addition, the subjects eligible to act as organizations guaranteeing payment of corporate bonds offered to the public have been expanded; regulations related to the responsibility of paying dividends of public companies have been supplemented, and a number of regulations on public company governance have been amended to limit conflicts of interest...

Source: https://hanoimoi.vn/foreign-investors-are-given-conditions-to-participate-in-the-stock-market-715855.html

![[Photo] National Assembly Chairman Tran Thanh Man presided over the welcoming ceremony for Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/889b54ac5cd440099ddc618c99663612)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

Comment (0)