How much is 1 USD in VND today?

State Bank USD exchange rate is at 24,004 VND.

Vietcombank USD exchange rate is currently at 24,430 VND - 24,800 VND (buy - sell).

Euro exchange rate is currently at 25,959 VND - 27,383 VND (buy - sell).

The current Japanese Yen exchange rate is 158.81 VND - 168.09 VND (buy - sell).

The current British Pound exchange rate is 30,396 VND - 31,690 VND (buy - sell).

Today's Yuan exchange rate is at 3,352 VND - 3,495 VND (buy - sell).

USD price today

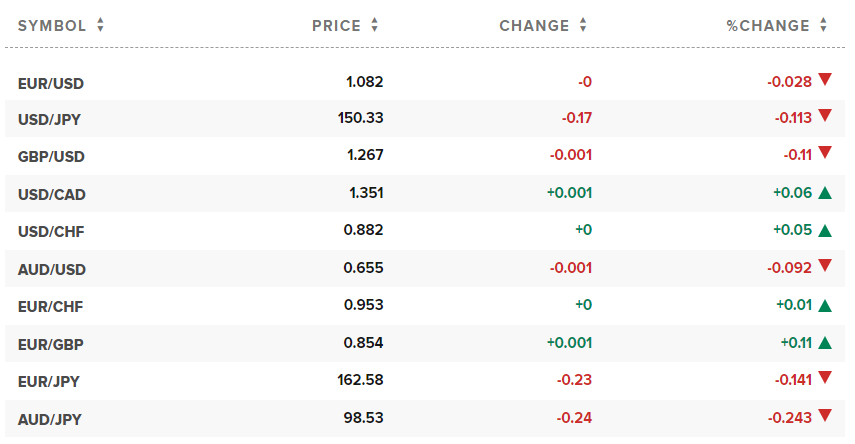

The US Dollar Index (DXY) measures the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recording at 104.01 points.

The dollar rose on Monday, preparing for a busy week of economic data that will provide further clues on the outlook for global interest rates, with U.S. inflation the biggest focus.

The core personal consumption expenditures (PCE) price index - the US Federal Reserve's preferred inflation measure - will be released on Thursday with expectations for a 0.4% monthly increase.

Inflation figures from the euro zone, Japan and Australia are also due this week, along with the Reserve Bank of New Zealand (RBNZ) interest rate decision and China PMI readings.

In the first session of the week, the greenback increased in price, pushing the Euro exchange rate up 0.04% to 1.0817 EUR/USD.

The British pound was steady at 1.2671 GBP/USD, while the Australian dollar fell 0.07% to 0.6559 AUD/USD.

Japan's consumer price data, due on Tuesday, is expected to show a 1.8% annual decline in January - the lowest since March 2022.

This will complicate the Bank of Japan’s (BOJ) plans to end negative interest rates in the coming months, putting further pressure on the yen. The yen is currently trading slightly lower at 150.40 yen per dollar, but remains high. The yen has fallen 6% since the start of the year due to the interest rate differential between the US and Japan.

“Since late last year, the market has been focused on the BOJ’s policy meetings in March or April as there is a possibility of an end to negative interest rates,” said Jane Foley, FX strategist at Rabobank. “The news that Japan is in recession in the first half of 2023 will dampen market enthusiasm for the pace of monetary tightening from the Bank of Japan.”

The latest data from the US Commodity Futures Trading Commission shows that, by the end of last week, the amount of Yen shorted in the foreign exchange market increased to about 10 billion USD - the largest level since November.

In contrast, higher-than-expected U.S. producer and consumer prices recently led to a rise in the PCE index, further pushing back expectations for a series of Fed cuts this year.

According to the CME FedWatch tool, there is now just over a 20% chance the Fed will begin easing interest rates in May. Last month, that rate was 90%.

“If there is any stronger-than-expected data, the dollar will be boosted. However, the dollar will still rise modestly. Personally, I don’t think the market will expect higher US interest rates,” said CBA expert Kong.

The USD Index was up 0.04% at 104.01.

Source

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)