Among the typical achievements in Phu Tho - the sacred land of the nation's origin, there is the work of sustainable poverty reduction and ensuring social security with very positive and comprehensive results.

That is to focus on implementing many livelihood programs and projects, developing economic models, creating momentum to help the countryside prosper, and people improve their lives. Specifically, in 2023, the province's poverty rate will be 4.49% (down 0.7% compared to 2022), the near-poor household rate will be 3.65% (down 0.53%). A typical example is Tan Son, which has been out of the list of poor districts 30a since 2018, 2 years ahead of schedule. This year, nearly 50% of communes and villages have escaped the situation of extreme difficulty, and the poverty rate in ethnic minority areas has decreased sharply (3%/year).

According to the assessment of the representative of the Provincial Party Committee and People's Committee of Phu Tho province, the achievements in implementing the national target program for sustainable poverty reduction, in addition to the drastic participation of the entire political system from the province to the district and commune levels, and the active participation of the people, cannot fail to mention the positive and effective contributions of the Vietnam Bank for Social Policies (VBSP) in implementing Decree No. 78/2002/ND-CP of the Government on preferential credit policies for the poor and other policy subjects.

Publicize information on preferential credit at the Commune Transaction Points in the area.

For the past 22 consecutive years, with the attention and direction of the superior bank, local leaders, the close coordination of departments, organizations and the spirit of efforts to overcome difficulties of the Vietnam Bank for Social Policies, the preferential credit capital of the State has always flowed regularly throughout the area, to each village, promptly supporting poor households and ethnic minority families in difficulty to develop production and business, and improve their lives.

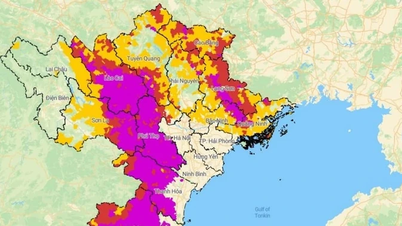

Director of the Phu Tho Provincial People's Credit Fund, Mr. Truong Viet Phuong is one of the few policy credit officers who have matured and been involved in the journey of policy credit for social security for more than two decades. He said: Right from the time of its establishment, the Phu Tho Provincial People's Credit Fund had to face many difficulties and challenges such as limited capital, lack of management and operational staff, large operating area with many communes and villages located in particularly difficult areas (region 3). "In this land, the previous difficulties have passed, and new challenges have come. Recently, storms have severely devastated the northern midland and mountainous areas, including Phu Tho province, but we, the policy credit officers, are not discouraged, we unite and join forces, proactively participate in the arduous fight against poverty, determined to develop and implement appropriate solutions; focus on mobilizing all resources, capital sources and effectively organizing policy credit programs," Mr. Phuong affirmed.

With the will not to falter in the face of difficulties caused by objective and subjective factors and never being satisfied with the results achieved, the People's Credit Fund of Phu Tho province has focused on mobilizing capital from many channels, many subjects, and many forms. By October 31, 2024, the total operating capital of the branch reached VND 6,379 billion, an increase of VND 354 billion compared to the whole year of 2023. With the capital created by the unit, including the budget source from the locality entrusted to the People's Credit Fund of VND 136.7 billion, the Party committees and authorities at all levels have thoroughly grasped and widely implemented Directive No. 40/CT-TW (Directive 40) of the Secretariat on strengthening the Party's leadership over social policy credit. All of this capital was promptly transferred from the Provincial Headquarters to the district transaction offices of the Phu Tho Social Policy Bank to 225 commune transaction points, to 3,659 Savings and Loan Groups in villages, hamlets, and residential areas, helping people have capital and conditions to intensively cultivate fields and gardens, develop livestock, and expand traditional handicrafts.

After more than 22 years of implementing Decree No. 78 of the Government, especially after 10 years of putting Directive 40 into practice, Phu Tho has increased the number of preferential credit programs from a meager 4 to 20 programs with a total outstanding debt of 6,371 billion VND, with 113,516 poor households and policy beneficiaries still in debt. Not only that, Decree No. 78 and Directive No. 40 were born and put into practice, changing the entire face of rural villages, improving the lives of ethnic minorities in remote and mountainous communes; at the same time, changing the awareness in leadership and direction of Party committees, authorities and the whole society regarding poverty reduction and ensuring social security for the disadvantaged.

One example is that in recent years, Tan Son mountainous district has had many flexible and suitable solutions to help people easily access science and technology application services, borrow favorable policy capital, use loans for production purposes... thereby contributing to increasing income and improving people's lives.

From 2020 to now, the poverty rate of Tan Son district has decreased by 1.7% each year; the poverty rate among ethnic minorities has decreased by 3% each year. Mr. Tran Minh Dien in Lien Minh area, Thu Ngac commune shared: “My family used to be a poor household. With the encouragement and guidance of the commune and residential area, we participated in classes on livestock breeding and afforestation techniques and received preferential credit loans under the poor household program and job creation of the Vietnam Bank for Social Policies, my family has more motivation to invest in developing the hill and forest economy combined with livestock breeding. Working hard and saving, by 2022, my family had escaped poverty, become a well-off household, built a solid house, and raised 2 children to study...”.

Or like the family of Mrs. Trinh Thi Tam in Zone 3, Thanh Ha Commune, Thanh Ba District, thanks to the support of policy credit capital, they escaped poverty and built a new, spacious and solid house. According to Mrs. Tam, her family was very difficult before, her husband was sick, her children were unemployed, and she was a poor household in the locality; she lacked land for production, and she herself was often sick, so all family expenses depended on the unstable income from agriculture.

Seeing the difficult situation, the People's Committee of Thanh Ha commune and the Women's Union of the commune considered and approved her family to access 30 million VND from preferential loans from the district's Social Policy Bank. From the loan, she repaired the barn, bought pigs and cows. Thanks to her diligence in learning from experience, and the commune officials regularly following up to exchange, guide, and promptly resolve difficulties, Mrs. Tam's pigs and cows have grown well. After more than 2 years of borrowing money, her family has paid off the debt, escaped poverty, built a house, and the family economy has gradually improved.

Many households in Phu Tho province have borrowed preferential loans to develop effective breeding cow models.

The effectiveness of the 22-year journey of operation of the People's Credit Fund of Phu Tho province has been increasingly affirmed. The policy credit capital flow has been unblocked and flows regularly throughout the countryside; 100% of the poor and other policy beneficiaries in need and with sufficient conditions have had access to preferential credit policies.

From gathering large capital sources to innovating the method of transmitting and disbursing policy credit capital in 2024, looking broadly at the journey of more than 22 years, the People's Credit Fund of Phu Tho province has effectively implemented poverty reduction and social security work; recognized by leaders and people.

In the coming time, Phu Tho Social Policy Bank will continue to closely follow the policies and Decrees of the Party and the State on poverty reduction, focus on mobilizing a lot of capital sources, quickly and safely transferring capital to villages to effectively serve the cause of sustainable poverty reduction and new rural construction; contributing to the effort to become the leading developed province in the Northern midland and mountainous region by 2030.

Source thoibaonganhang.vn

Source: https://baophutho.vn/phu-tho-phat-huy-hieu-qua-tin-dung-uu-dai-trong-giam-ngheo-224129.htm

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)