Despite facing many challenges due to the complex and unpredictable fluctuations of the world and domestic economic situation, closely following the direction and management of the Government, the Prime Minister, the Governor of the State Bank, the Provincial Party Committee, the People's Council, the Provincial People's Committee, the State Bank - Thanh Hoa Provincial Branch has proactively grasped the macroeconomic and monetary developments, continued to synchronously and optimally implement mechanisms, policies and management solutions. Thereby, it has affirmed its position and role as the "bloodline" leading the economy, contributing to stabilizing the macro economy, controlling inflation, supporting economic growth recovery and ensuring the safe development of the system of credit institutions in the area, actively supporting capital sources, helping businesses and people to restore production and business.

Comrade Nguyen Van Thi, Permanent Vice Chairman of the Provincial People's Committee inspected the use of policy credit capital in Luan Khe commune (Thuong Xuan).

There are currently 119 credit institutions in the province, including: 35 branches of Commercial Banks, 1 branch of the Social Policy Bank, 1 branch of the Development Bank, 1 branch of the Cooperative Bank, 1 microfinance institution, 2 branches of the Tinh Thuong microfinance institution, 67 People's Credit Funds and 11 financial companies. With the drastic participation of the entire political system; the direction and administration of Party committees and authorities at all levels; the determination of the business community and the people, in the first 10 months of 2024, Thanh Hoa will continue to make a strong mark in socio-economic development, in which, Thanh Hoa is expected to return to the "VND 50,000 billion club" and create a new milestone of the highest budget revenue ever.

Agriculture and rural areas are among the areas that credit institutions prioritize for capital investment.

In that result, there is a great contribution of the banking sector. Specifically, in recent times, the banking sector in the province has performed well the task of stabilizing the monetary market, credit and banking activities in the area; improving credit quality; focusing capital on priority areas, production and business areas, national target programs. Proactively grasping, forecasting the situation and proactively and flexibly operating monetary policy; effectively and promptly implementing the Government's fiscal policies to facilitate access to capital, remove difficulties, accompany and support people and businesses to recover and develop production and business. The system of credit institutions in the area has promoted the role of "blood vessels" of the economy; is the main capital channel, serving production and business, effectively supporting the promotion of economic restructuring, improving the quality of people's lives.

People come to transact at Agribank Nam Thanh Hoa.

To ensure capital sources and meet the demand for loans for investment and development, from the beginning of the year, banks and credit institutions have focused on mobilizing capital from organizations and individuals for investment and lending. The amount of money deposited in banks has increased sharply thanks to diverse, convenient and safe forms of capital mobilization, helping people feel secure in depositing money in the banking system, creating conditions for credit institutions to be proactive in capital sources, promptly meet lending needs and ensure liquidity. As of mid-November 2024, the total capital mobilized in the area was nearly 185,000 billion VND. The capital mobilized during the year had a fairly good growth rate, helping banks and credit institutions balance capital sources, improve liquidity and effectively implement solutions to ensure capital for the economy.

Under the close direction of the State Bank, the Provincial Party Committee and the Provincial People's Committee, activities to support economic recovery and development continue to be implemented resolutely and effectively by the banking sector.

The State Bank of Thanh Hoa has closely monitored credit institutions in implementing regulations on interest rates and cost reduction to reduce lending rates, especially for existing outstanding loans; maintained operating interest rates to create conditions for credit institutions to access capital sources at low costs to contribute to supporting the economy. The lending interest rate level in the area as of November 2024 continues to be maintained stably, commonly at 4% - 11%/year for each term and borrower. Credit institutions have announced information on average lending interest rates, creating more opportunities for customers to access credit and choose banks to borrow capital. At the same time, continue to implement many loan interest rate reductions, apply preferential interest rate credit programs and packages under the direction of the State Bank of Vietnam to support businesses and people to restore production and business, and promote economic development.

Total outstanding loans in the province as of mid-November 2024 reached more than VND 215,000 billion. The State Bank of Thanh Hoa has focused on directing credit institutions to invest capital in production and business sectors, priority sectors and key economic growth sectors of the province. Strictly control credit in potentially risky sectors. The credit investment structure has shifted strongly to lending to priority sectors such as agricultural and rural development; production and export business; small and medium enterprises; supporting industries, and high-tech enterprises.

Customers come to transact at Bac A Bank - Thanh Hoa branch.

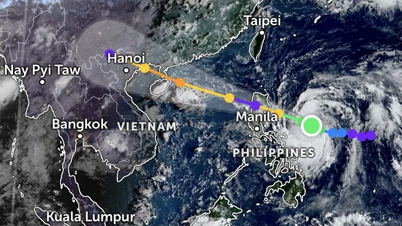

In addition, Thanh Hoa Banking sector also synchronously implemented solutions to facilitate customers' access to capital with a variety of products and services, simplify lending procedures; improve the efficiency of appraisal and assessment of customer creditworthiness to increase unsecured lending... In the face of the impact of storm No. 3, the Banking sector has proactively and regularly grasped the production and business situation and debt repayment capacity of customers affected by storms and floods to consider applying appropriate solutions to overcome difficulties for customers, in accordance with legal regulations, ensuring that the State's policies reach people and businesses in a timely and appropriate manner. At the same time, calculate support plans, restructure debt repayment terms, maintain debt groups, consider exempting and reducing loan interest for affected customers, develop new programs with appropriate preferential interest rates; continue to provide new loans to customers to restore production and business.

The credit investment structure of credit institutions has shifted strongly to lending to priority areas such as agricultural and rural development; production and export business; small and medium enterprises; supporting industries, and high-tech enterprises.

Closely following the orientation and Master Plan for socio-economic development of Thanh Hoa province to 2020, with a vision to 2030, Thanh Hoa banking sector always prioritizes capital investment for regional economic development, breakthrough areas, key economic sectors, large projects, key infrastructure, such as: Nghi Son Refinery and Petrochemical Complex Project, Nghi Son Thermal Power Plant, key traffic projects... At the same time, the credit investment structure has shifted strongly to lending to priority areas such as agricultural and rural development; production and export business; small and medium enterprises; supporting industries, high-tech enterprises. Along with the effective implementation of monetary policy management solutions, promptly meeting capital needs, the Bank - Enterprise connection activities continue to be proactively and actively implemented by the State Bank of Thanh Hoa, bringing practical results, contributing to grasping and promptly resolving recommendations for banking activities.

Along with effectively implementing monetary policy management solutions and promptly meeting capital needs, the Bank - Enterprise connection activities continue to be proactively and actively implemented by the State Bank of Thanh Hoa.

At the same time, in addition to its role as a capital supply channel for restructuring and local economic development, the banking sector has also promoted digital transformation, contributing to improving the operational efficiency and competitiveness of credit institutions; actively bringing preferential credit policies of the Party and State to poor households, policy households, remote and isolated areas, gradually reducing income gaps between regions. At the same time, strengthen connections and exchange of data information with local agencies, such as: State Treasury, Provincial Tax Department, Customs, Social Insurance... to promote electronic payments. Currently, 100% of commercial bank branches have provided electronic banking services such as: Internet Banking, SMS Banking, banking applications on App...

Credit institutions in the area actively bring preferential credit policies of the Party and State to poor households, policy households, remote and isolated areas, gradually reducing income gaps between regions.

However, in addition to the solutions of the banking industry, there still needs to be synchronous implementation of solutions from departments, branches, localities, the participation of Associations, and the efforts of enterprises in restructuring and improving operational efficiency...

Mr. Tong Van Anh, Director of the State Bank of Thanh Hoa affirmed: With the Government's proactive and flexible direction and management of monetary and credit policies, the drastic participation of the State Bank and the province, and the continuous efforts of banks and credit institutions in the area, the Thanh Hoa banking sector has always maintained its role as the "bloodline" of the economy with increasingly improved efficiency in transmitting monetary policy. Promoting its role as the "bloodline" leading the economy, the State Bank of Thanh Hoa continues to closely follow the direction of the central State Bank in implementing the tasks of the entire sector, contributing to stabilizing the macro-economy and controlling inflation. Actively and proactively grasp and identify risks to do a good job of advising and effectively implementing monetary policies, supporting people and businesses to access preferential credit sources, promoting production and business recovery, economic growth associated with ensuring the safety of business operations of credit institutions.

Article and photos: Linh Phuong

Source: https://baothanhhoa.vn/phat-huy-vai-tro-huyet-mach-dan-dat-nen-kinh-te-229882.htm

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)