Attending the conference were representatives of the Cooperative Alliance, the Economic Security Department (PA04) - Provincial Police, the People's Committees and Police of communes and wards in Lam Dong and Khanh Hoa provinces, and leaders of 59 People's Defense Forces operating in the two provinces.

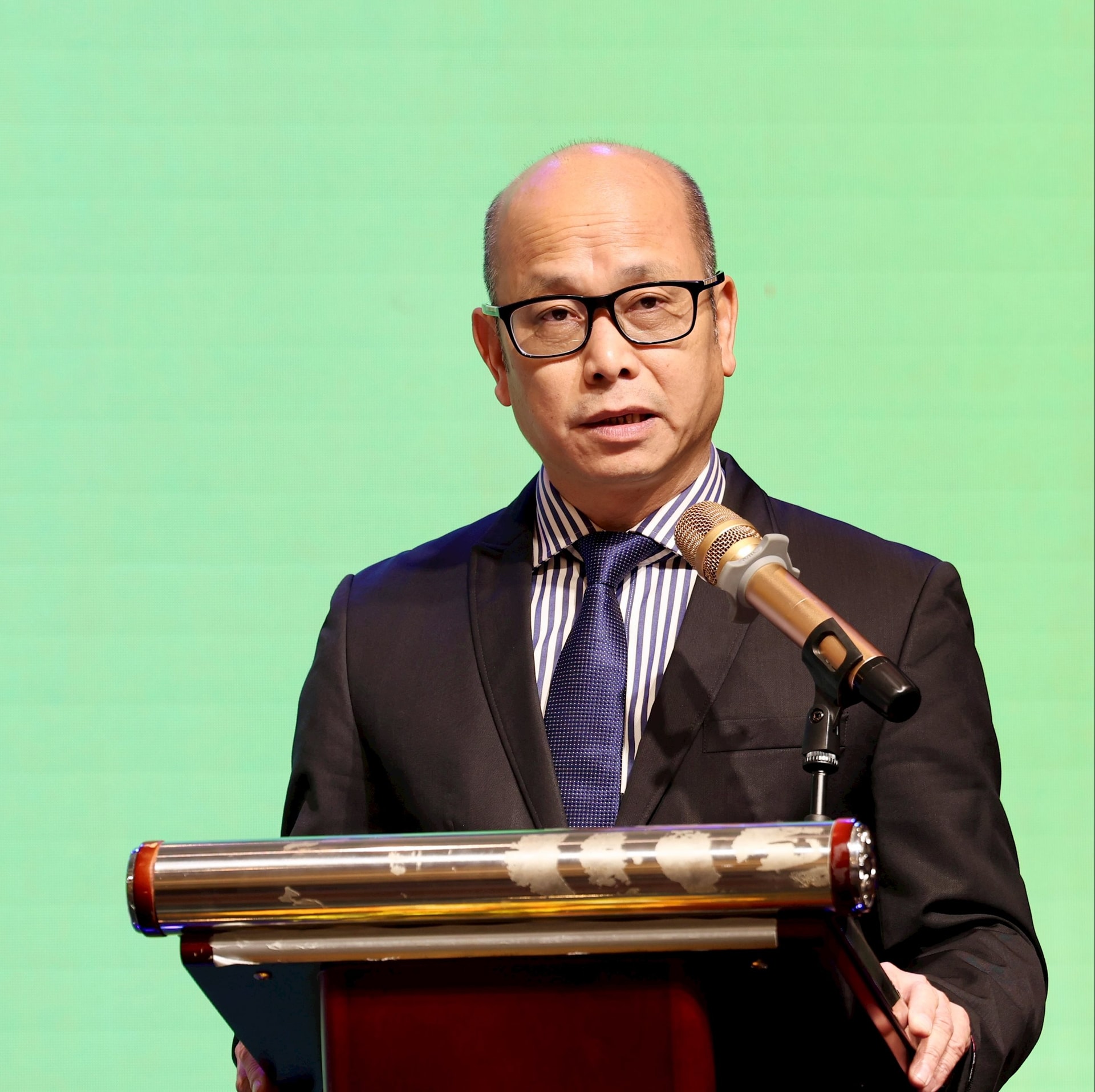

In his opening speech, Mr. Bui Huy Tho - Director of the State Bank of Vietnam Region 10 said that the merger of State Bank branches was carried out to enhance the efficiency of management and operation of the credit institution system in areas with many similarities in socio-economics. Currently, the State Bank of Vietnam Branch Region 10 performs the function of state management of currency, banking and foreign exchange activities in the two provinces of Lam Dong and Khanh Hoa .

Mr. Nguyen Van Giang - Deputy General Director of the Cooperative Bank of Vietnam provided more information on the role of capital regulation, ensuring stable operations of the People's Credit Funds, and proposed a closer coordination mechanism between the Cooperative Bank and the State Bank in supporting the People's Credit Funds system.

Currently, the State Bank of Vietnam (SBV) Region 10 is managing 59 People's Credit Funds operating in the two provinces. As of August 31, 2025, the People's Credit Fund system in Region 10 has more than 124,000 members, an increase of more than 6,000 members compared to 2024; total capital reaches VND 18,200 billion, outstanding loans of VND 13,059 billion, mainly serving the fields of agriculture , small-scale industry and consumption. The bad debt ratio is only 0.42%, reflecting well-controlled credit quality.

In 2024, the entire system will record a profit of 230 billion VND, making a positive contribution to the state budget, creating jobs for local workers, participating in social security programs and helping to limit usury. This is an important milestone, demonstrating a strong change in the management, operation and development of the QTDND system in the new period.

In addition to the achieved results, the activities of the People's Credit Fund still have some limitations that need to be overcome, such as: products and services are still monotonous; management and operation capacity has not met the requirements of innovation; internal inspection and control work is still formal; the application of technology and digital transformation is still slow; some People's Credit Funds show signs of deviating from the cooperative's principles and goals.

Delegates agreed that in the coming time, it is necessary to continue to improve governance and management capacity, and strengthen the People's Credit Fund system in a safe, sustainable, and correct direction as a cooperative credit institution.

At the Conference, delegates presented papers sharing effective operating methods of the People's Credit Funds of the Cooperative Bank; discussed contents revolving around the operational goals of the People's Credit Funds.

The conference also witnessed the signing ceremony of the cooperation program between the State Bank of Vietnam, Region 10 branch, the Co-operative Bank of Vietnam and the Deposit Insurance of the South Central and Central Highlands branches.

QTDND is a credit institution established by legal entities, individuals and households in the form of cooperatives to carry out a number of banking activities according to the provisions of the Law on People's Credit Institutions 2010 in the communes (wards). The QTDND Fund is used to contribute capital from members to lend and share profits according to the capital contribution ratio of members.

Source: https://baolamdong.vn/phoi-hop-cung-co-hoat-dong-cua-to-chuc-quy-tin-dung-nhan-dan-395372.html

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

Comment (0)