Global fund management company AP Moller Capital (Denmark) has just announced a cooperation with VinaCapital Group to make a strategic investment in ALS Cargo Terminal Joint Stock Company (ALSC) - a large enterprise in the field of aviation logistics in Vietnam.

The capital was invested through AP Moller Capital’s Emerging Markets Infrastructure Fund II and VinaCapital’s Logistics Fund. This is the first investment by an international fund in the aviation logistics sector in Vietnam.

According to Mr. Le Viet Hai - Director of Logistics Fund (VinaCapital), Vietnam is emerging as one of the fastest growing economies in the world, thanks to the driving force of manufacturing and exports. High-value items such as electronics and consumer goods are increasingly accounting for a large proportion.

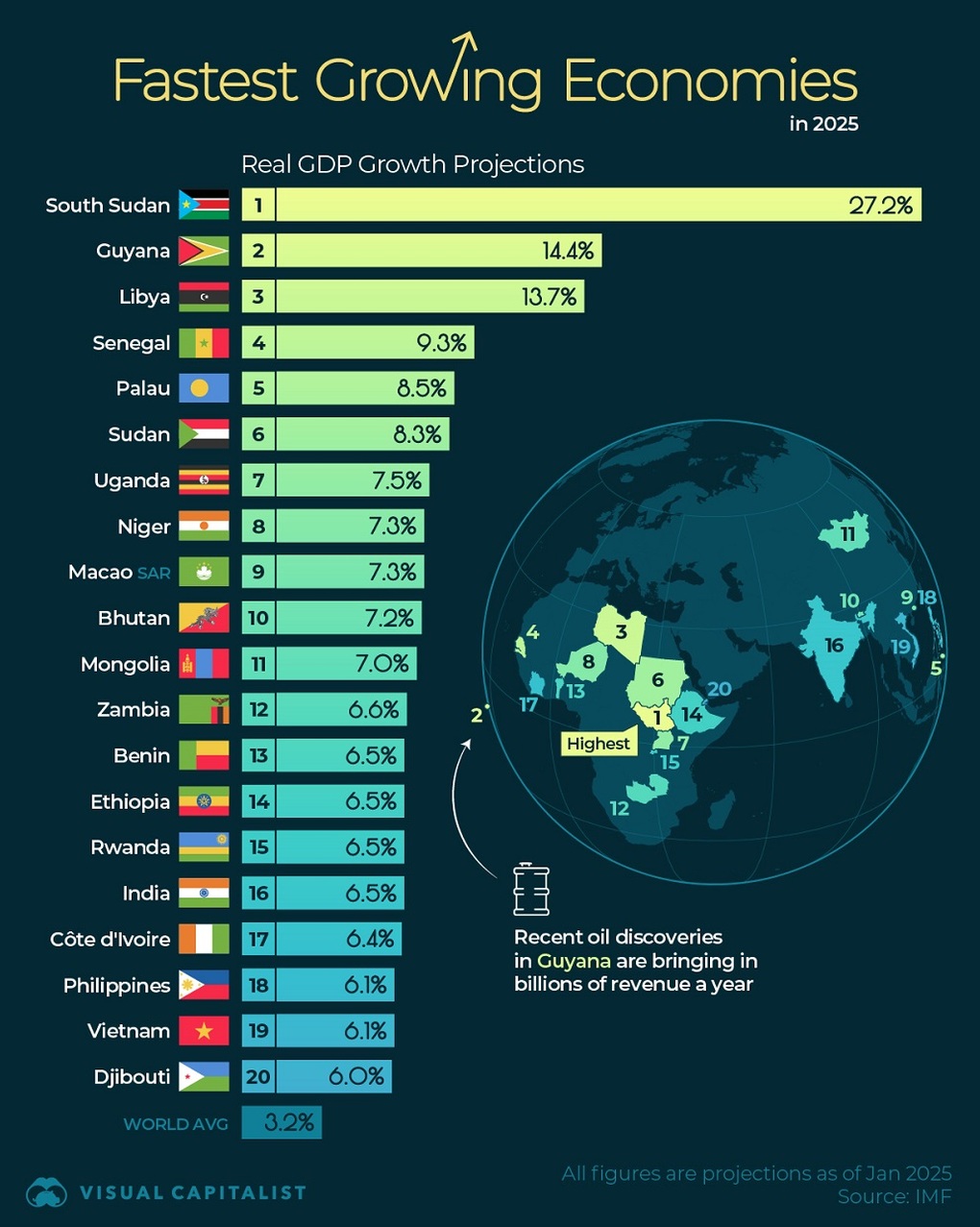

Top 20 fastest growing economies in the world (Photo: Visual Capitalist/Source: International Monetary Fund (IMF).

Data released by the International Monetary Fund (IMF) in January 2025 shows that Vietnam is among the 20 fastest growing economies in the world. Electronics exports alone grew by an average of 25% per year in the 2010-2024 period, currently accounting for 1/3 of the country's total export turnover.

However, air freight transport – an important link in the logistics chain – has not yet developed commensurately. If calculated by the average air cargo volume per capita, Vietnam is still very low compared to regional commercial centers such as Singapore, Hong Kong (China), Taiwan (China) or South Korea.

“This difference shows the huge growth potential of Vietnam's aviation logistics in the coming years,” Mr. Hai emphasized.

ALSC is currently one of the most prestigious enterprises in the field of air cargo operations at Noi Bai International Airport ( Hanoi ). The company is cooperating with many major international airlines, handling about 250,000 tons of cargo per year.

According to AP Moller Capital representative, the capital injection into ALSC is not just a financial deal but is the beginning of a long-term strategy, expanding the fund's presence in Vietnam in the field of transportation and logistics.

“The investment in ALSC demonstrates our commitment: not only to directly participate but also to act as a bridge to attract high-quality international capital flows into Vietnam. We believe that Resolution 68 will encourage healthy competition among capital providers, creating more development opportunities for businesses,” said Mr. Hai.

Three driving forces for Vietnam's logistics

Mr. Le Viet Hai pointed out three major driving forces that will accelerate the Vietnamese logistics industry:

Export-oriented economy: Total trade is now twice GDP, making logistics a key link in driving trade and production.

Shifting global supply chains: US-China trade tensions and tariff policies have led many international corporations to choose Vietnam as a production base, increasing the “Vietnamese content” in their products.

Infrastructure breakthrough: Long Thanh airport is about to come into operation, along with investment in the North-South expressway, railway, seaport and free trade zone, which will upgrade infrastructure and strengthen Vietnam's global logistics position.

In addition, Resolution 68 on private economic development is expected to unlock more investment capital flows, creating new momentum for logistics - a sector that requires long-term resources but brings stability similar to infrastructure assets in developed economies.

Source: https://dantri.com.vn/kinh-doanh/quy-toan-cau-dan-mach-rot-von-vao-logistics-hang-khong-viet-nam-20250925150523801.htm

![[Photo] Prime Minister Pham Minh Chinh receives Secretary of Shandong Provincial Party Committee (China) Lin Yu](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/26/821396f0570549d39f33cb93b2e1eaee)

![[Photo] Prime Minister Pham Minh Chinh receives Secretary of Shandong Provincial Party Committee (China) Lin Yu](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/26/821396f0570549d39f33cb93b2e1eaee)

Comment (0)